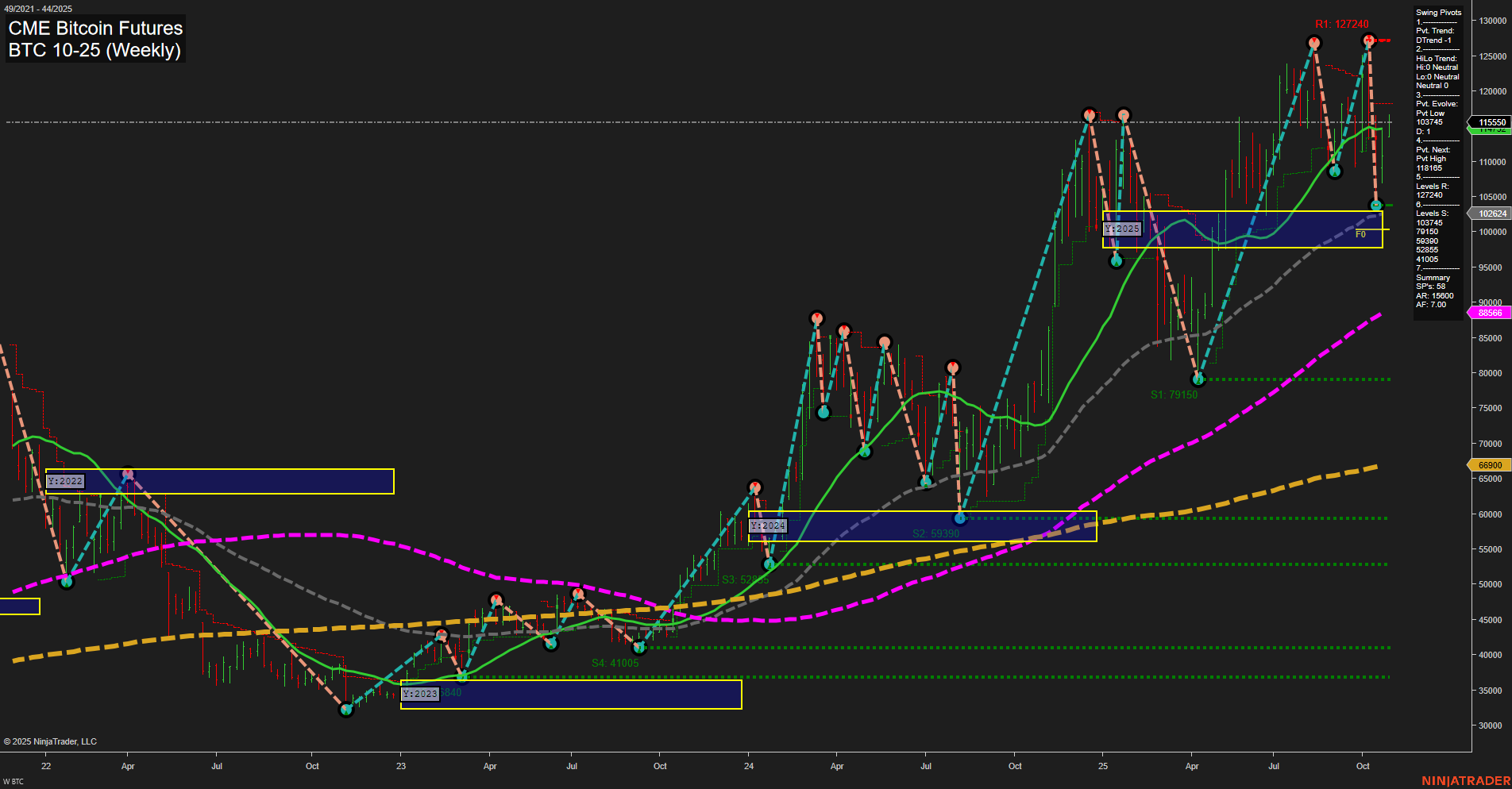

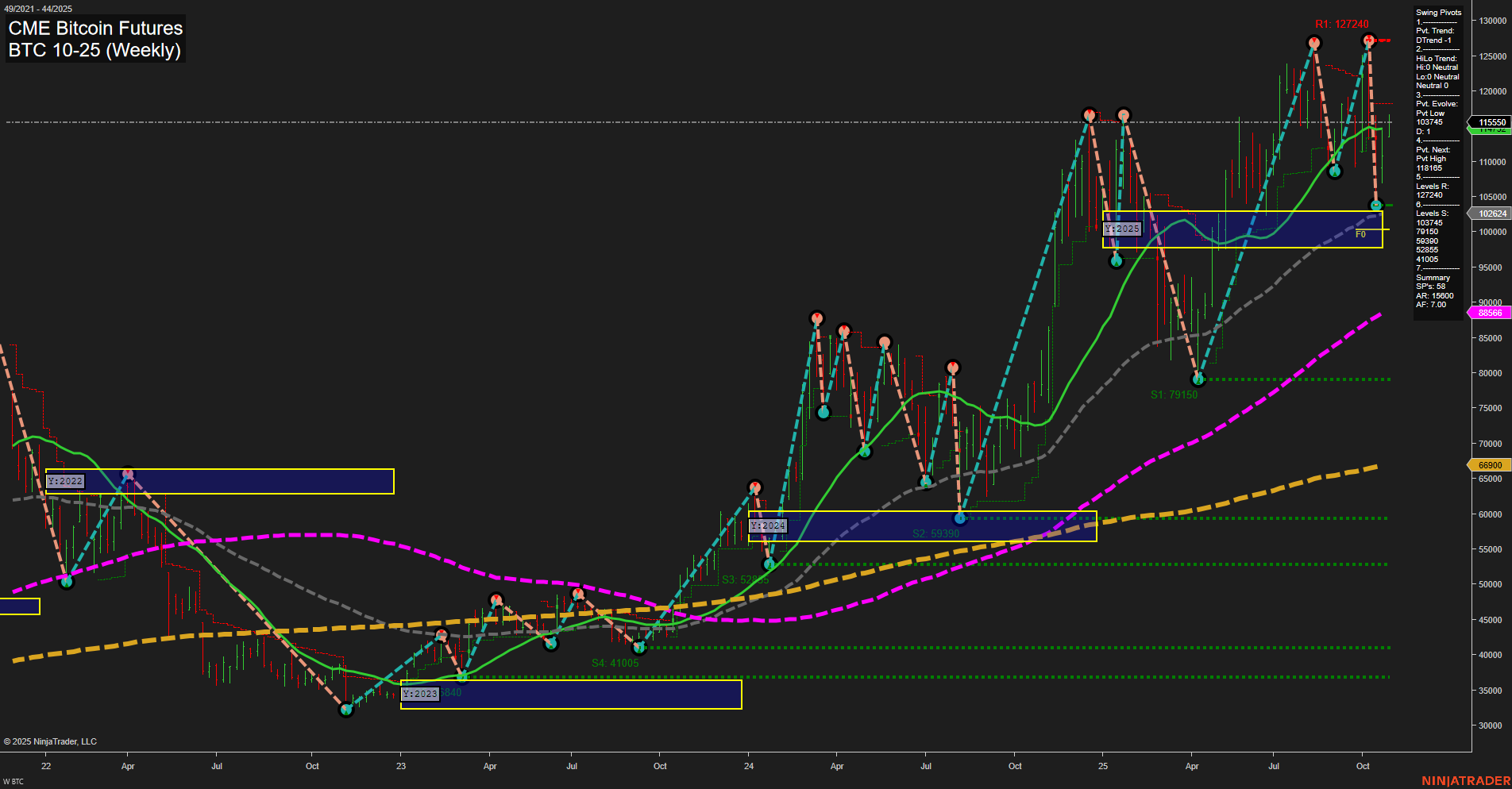

BTC CME Bitcoin Futures Weekly Chart Analysis: 2025-Oct-27 07:04 CT

Price Action

- Last: 115550,

- Bars: Medium,

- Mom: Average.

WSFG Weekly

- Short-Term

- WSFG Current: 17%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: 4%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 57%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: Neutral,

- 3. Pvt. Evolve: Pvt low 103475,

- 4. Pvt. Next: Pvt high 118145,

- 5. Levels R: 127240, 118145,

- 6. Levels S: 102624, 95300, 79150, 59390, 52310, 41005.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 113015 Up Trend,

- (Intermediate-Term) 10 Week: 110315 Up Trend,

- (Long-Term) 20 Week: 105375 Up Trend,

- (Long-Term) 55 Week: 88566 Up Trend,

- (Long-Term) 100 Week: 85656 Up Trend,

- (Long-Term) 200 Week: 69900 Up Trend.

Recent Trade Signals

- 23 Oct 2025: Long BTC 10-25 @ 109710 Signals.USAR-WSFG

- 22 Oct 2025: Short BTC 10-25 @ 108170 Signals.USAR.TR120

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The BTC CME Bitcoin Futures weekly chart shows a market in a strong long-term uptrend, supported by all major moving averages trending higher and price action consistently above key Fibonacci grid levels. The short-term swing pivot trend has shifted to a downtrend, indicating a possible pause or minor retracement within the broader bullish structure, while the intermediate-term HiLo trend remains neutral, suggesting consolidation or a transition phase. Recent trade signals reflect mixed short-term momentum, with both long and short entries triggered in close succession, highlighting choppy or indecisive price action at current levels. Resistance is clearly defined at 118145 and 127240, with support levels layered below at 102624 and 95300, providing a well-structured environment for swing traders to monitor for potential breakout or reversal setups. Overall, the technical landscape favors the bulls on higher timeframes, but short-term traders should be attentive to evolving pivots and potential volatility as price approaches resistance or tests support.

Chart Analysis ATS AI Generated: 2025-10-27 07:05 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.