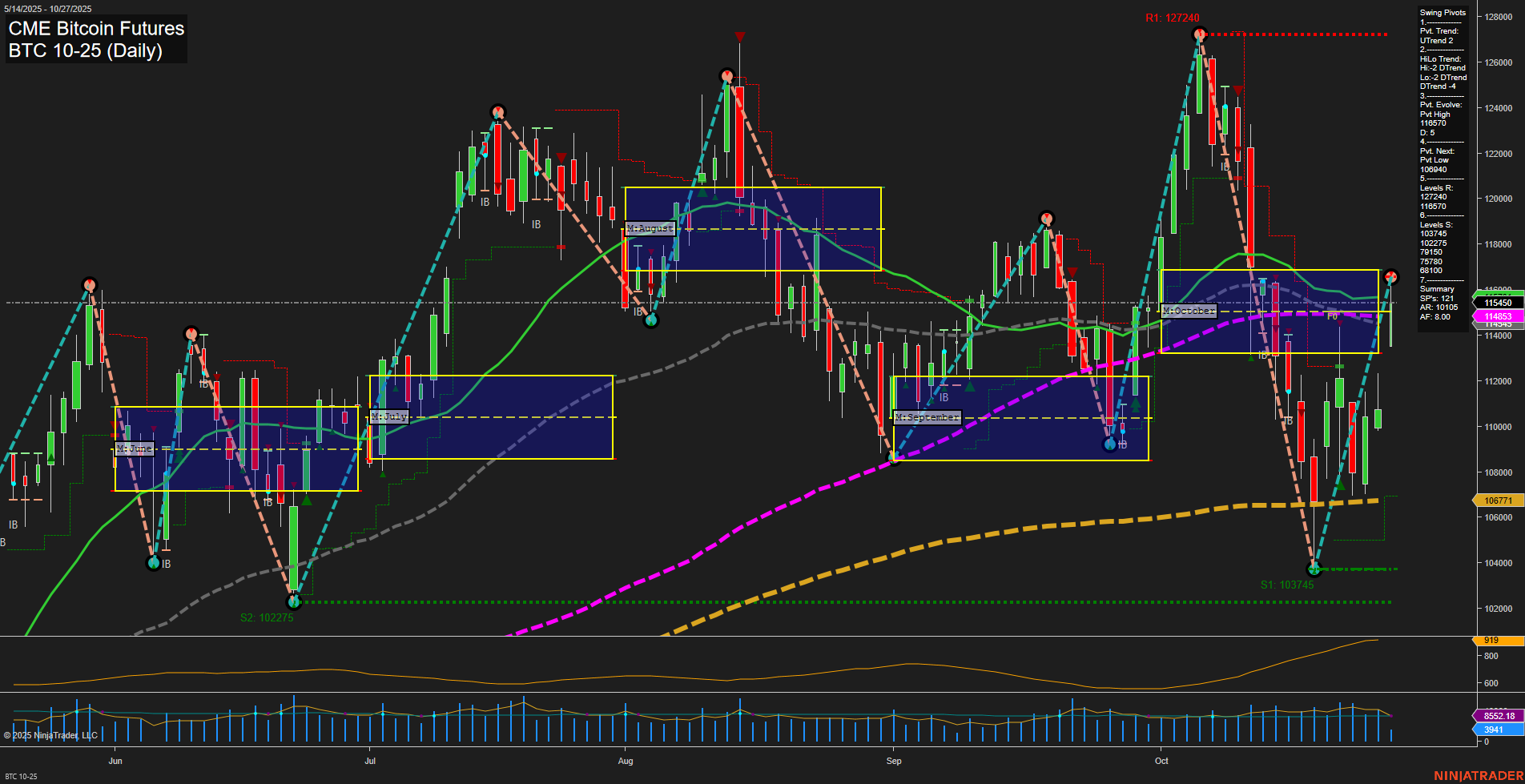

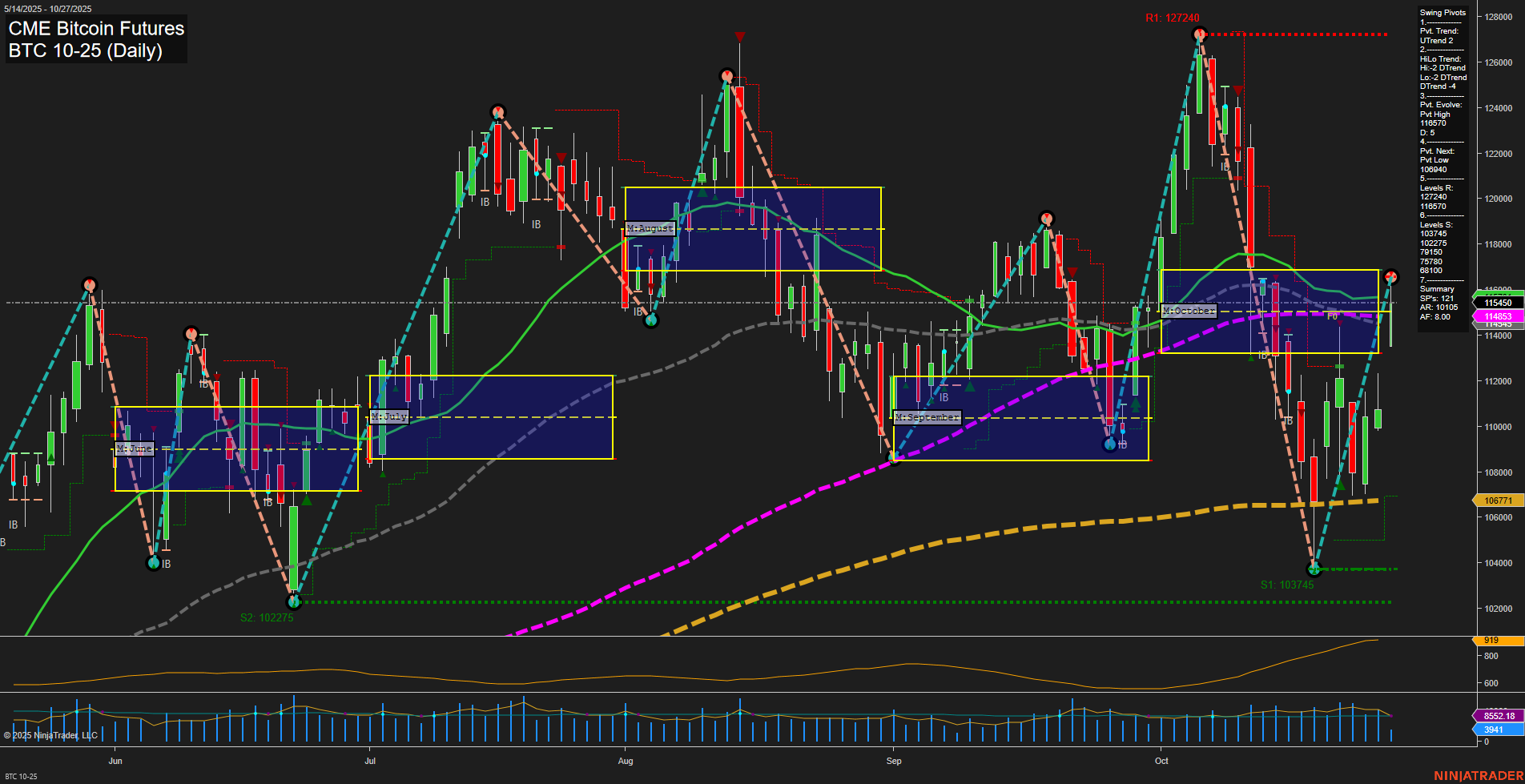

BTC CME Bitcoin Futures Daily Chart Analysis: 2025-Oct-27 07:04 CT

Price Action

- Last: 114853,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 17%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: 4%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 57%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt High 115070,

- 4. Pvt. Next: Pvt Low 109604,

- 5. Levels R: 127240, 116570, 115070,

- 6. Levels S: 103745, 102775, 98710, 87100.

Daily Benchmarks

- (Short-Term) 5 Day: 114550 Up Trend,

- (Short-Term) 10 Day: 114635 Up Trend,

- (Intermediate-Term) 20 Day: 115450 Up Trend,

- (Intermediate-Term) 55 Day: 110105 Up Trend,

- (Long-Term) 100 Day: 106771 Up Trend,

- (Long-Term) 200 Day: 91900 Up Trend.

Additional Metrics

Recent Trade Signals

- 23 Oct 2025: Long BTC 10-25 @ 109710 Signals.USAR-WSFG

- 22 Oct 2025: Short BTC 10-25 @ 108170 Signals.USAR.TR120

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Neutral,

- Long-Term: Bullish.

Key Insights Summary

BTC CME Bitcoin Futures are showing a strong recovery from recent lows, with price action now above all key moving averages and the monthly/weekly session fib grids, indicating a broad uptrend across timeframes. The short-term swing pivot trend has shifted to an uptrend, supported by recent long trade signals and a series of higher lows. However, the intermediate-term HiLo trend remains in a downtrend, suggesting that while the immediate momentum is bullish, the market is still digesting the prior selloff and could face resistance at previous highs (notably 115070 and 116570). Volatility remains moderate, and volume is supportive of the current move. The long-term structure is robustly bullish, with price well above the 100- and 200-day benchmarks, reflecting sustained institutional interest. Overall, the market is in a transition phase, with short-term bullish momentum potentially leading to a retest of resistance levels, while the intermediate-term trend awaits confirmation of a full reversal.

Chart Analysis ATS AI Generated: 2025-10-27 07:04 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.