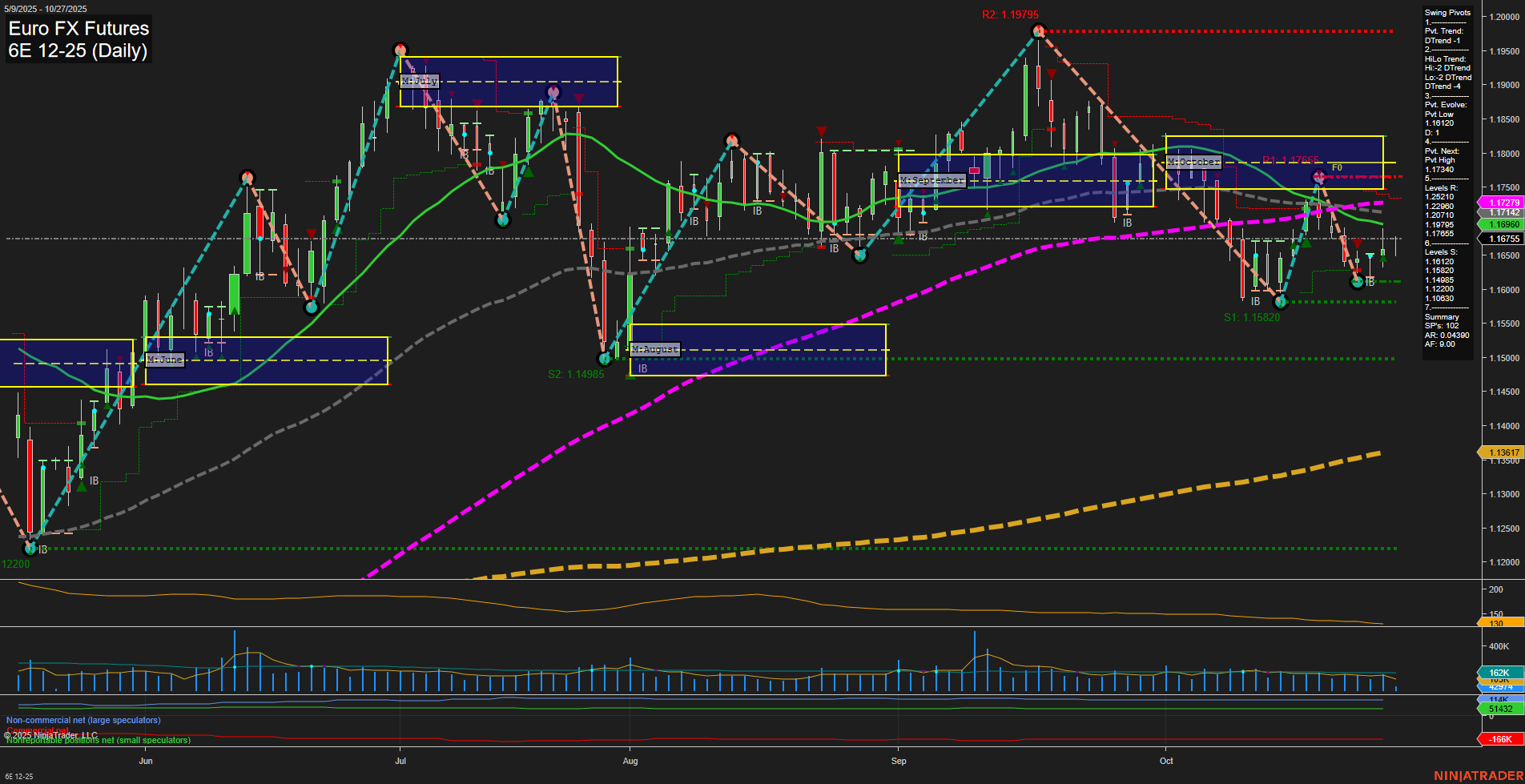

The Euro FX futures daily chart is currently showing a mixed environment for swing traders. Short-term price action is consolidating with slow momentum and medium-sized bars, reflecting indecision after a recent bounce from support at 1.1582. The weekly session fib grid (WSFG) trend is up, but the monthly session fib grid (MSFG) remains in a downtrend, indicating that the intermediate-term bias is still bearish. All key short- and intermediate-term moving averages are trending down, reinforcing the prevailing downward pressure, while the long-term 200-day MA remains in an uptrend, suggesting underlying bullish structure on a larger time frame. Swing pivot analysis highlights a short-term and intermediate-term downtrend, with the next significant resistance at 1.1734 and support at 1.1582. The recent long trade signals suggest attempts to catch a reversal or bounce, but the overall technical structure points to a market in transition, with potential for further consolidation or a test of resistance before a clearer directional move emerges. Volatility (ATR) and volume (VOLMA) are moderate, supporting the view of a market in a holding pattern. In summary, the Euro FX is at a crossroads, with short-term neutrality, intermediate-term bearishness, and long-term bullishness, making it a key area to watch for confirmation of either a sustained reversal or continuation of the broader trend.