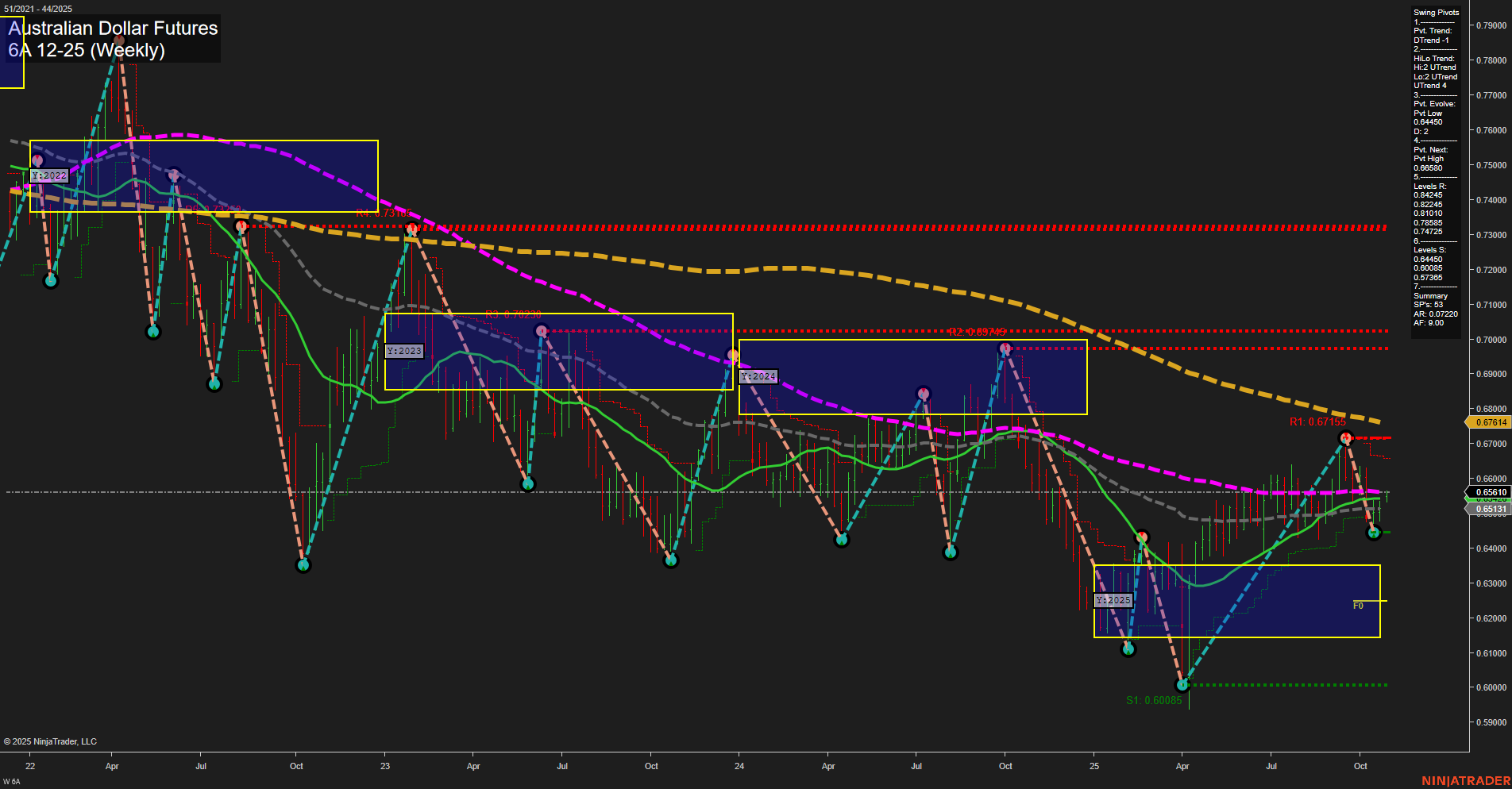

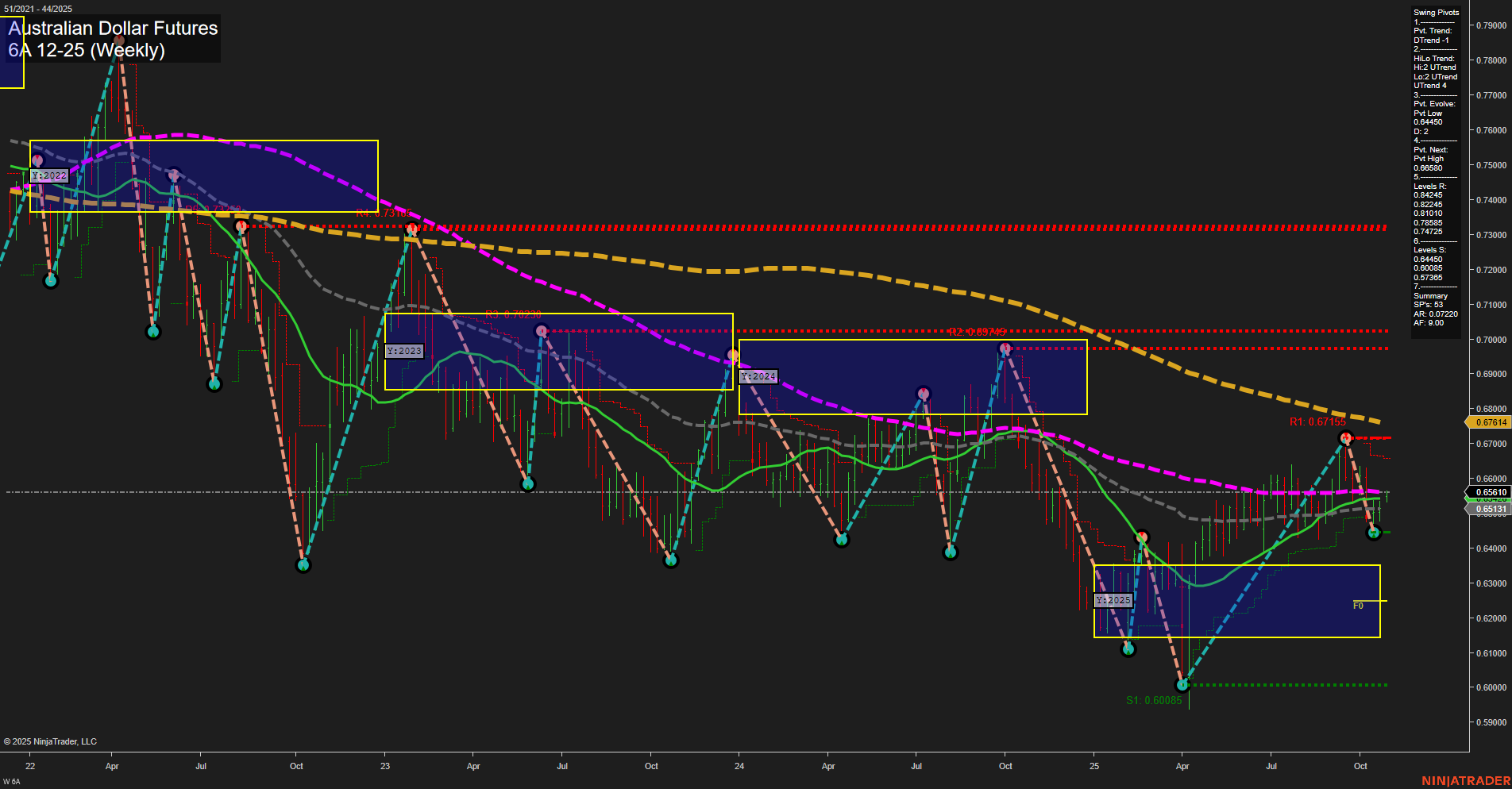

6A Australian Dollar Futures Weekly Chart Analysis: 2025-Oct-27 07:00 CT

Price Action

- Last: 0.65511,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 0.65311,

- 4. Pvt. Next: Pvt high 0.67165,

- 5. Levels R: 0.67165, 0.68949, 0.70381, 0.72845,

- 6. Levels S: 0.65311, 0.60085.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 0.66164 Down Trend,

- (Intermediate-Term) 10 Week: 0.66116 Down Trend,

- (Long-Term) 20 Week: 0.65353 Up Trend,

- (Long-Term) 55 Week: 0.67016 Down Trend,

- (Long-Term) 100 Week: 0.68949 Down Trend,

- (Long-Term) 200 Week: 0.70381 Down Trend.

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Neutral,

- Long-Term: Bearish.

Key Insights Summary

The 6A Australian Dollar Futures weekly chart shows a market in transition, with recent price action reflecting a medium bar size and average momentum. The short-term swing pivot trend has shifted to the downside, confirmed by the most recent pivot low at 0.65311, while the next resistance is set at 0.67165. Intermediate-term HiLo trend remains upward, suggesting some underlying support, but the overall structure is mixed. All major moving averages except the 20-week are trending down, reinforcing a bearish long-term outlook. The price is currently consolidating near the lower end of the yearly session fib grid, with no clear breakout or breakdown, and the neutral bias across all session fib grids highlights indecision. The market is likely digesting prior moves, with volatility compressing after a significant rally off the 2025 lows. Swing traders should note the presence of strong resistance overhead and a lack of bullish momentum, indicating that rallies may face selling pressure unless a decisive breakout occurs above key resistance levels.

Chart Analysis ATS AI Generated: 2025-10-27 07:01 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.