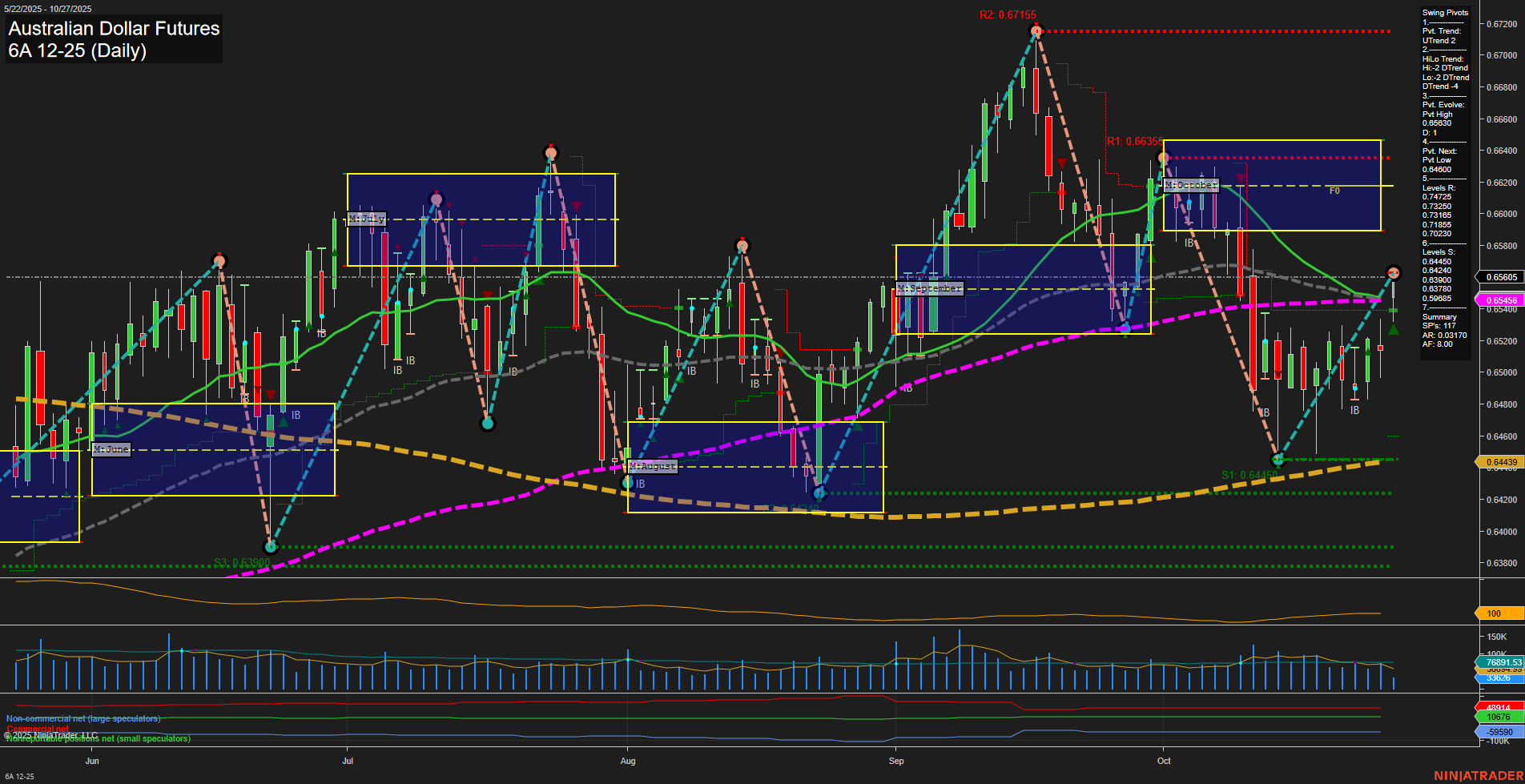

The 6A Australian Dollar Futures daily chart as of late October 2025 shows a market in transition. Short-term momentum has shifted bullish, with the most recent swing pivot marking a higher low at 0.64439 and price currently pushing above both the 5- and 10-day moving averages, both of which are trending up. However, intermediate-term signals remain bearish, as the 20-, 55-, and 100-day moving averages are all trending down, and the HiLo trend is still in a downtrend. The long-term 200-day moving average is flat to slightly up, suggesting a neutral to stabilizing backdrop. Swing structure highlights a recent recovery from support at 0.64439, with resistance levels at 0.66356 and 0.67155 overhead. The market is currently trading within a neutral Monthly Session Fib Grid, indicating a lack of strong directional conviction at the moment. Volatility (ATR) is moderate, and volume is steady, suggesting neither panic nor exuberance. Overall, the chart reflects a short-term bounce within a broader corrective or consolidative phase. The market is testing the boundaries between recovery and further downside, with key resistance and support levels clearly defined. Swing traders should note the potential for continued choppy price action as the market digests recent moves and awaits a clearer trend resolution.