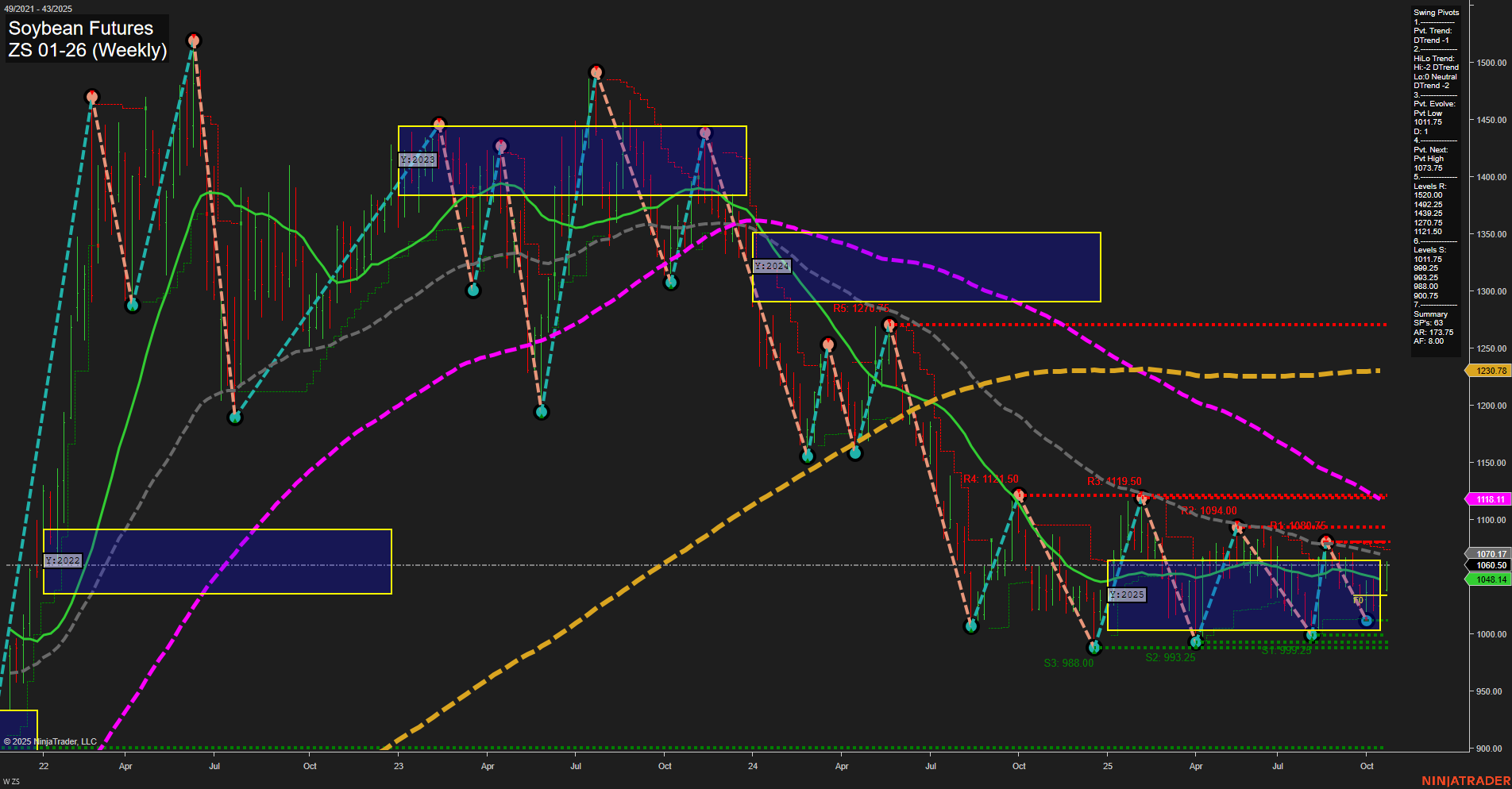

Soybean futures are currently trading at 1063.50, with medium-sized weekly bars and slow momentum, indicating a lack of strong directional conviction. The Weekly and Monthly Session Fib Grids (WSFG, MSFG) both show price above their respective NTZ/F0% levels, suggesting a short-term and intermediate-term upward bias, but the prevailing swing pivot trends (both short and intermediate) remain down, reflecting persistent selling pressure and lower highs/lows. The most recent swing low is at 1011.75, with the next resistance pivot at 1073.75, and significant resistance levels overhead at 1094.00 and 1191.50. Support is clustered near 993.25 and 988.00, highlighting a well-defined trading range. All visible benchmark moving averages (5, 10, 20, 55 week) are trending down, reinforcing the broader bearish structure despite the recent bounce. The latest trade signal (Long ZS 11-25 @ 1023.5) aligns with a short-term attempt to capture a reversal or range low, but the overall technical landscape remains pressured by longer-term downtrends. The market is consolidating within a broad range, with volatility compressing and price action choppy, as evidenced by repeated tests and rejections at both support and resistance. This environment favors mean-reversion and range-bound strategies, with no clear breakout or trend continuation yet established. The overall rating reflects a neutral short-term outlook, but bearish intermediate and long-term trends dominate until a decisive move above key resistance levels occurs.