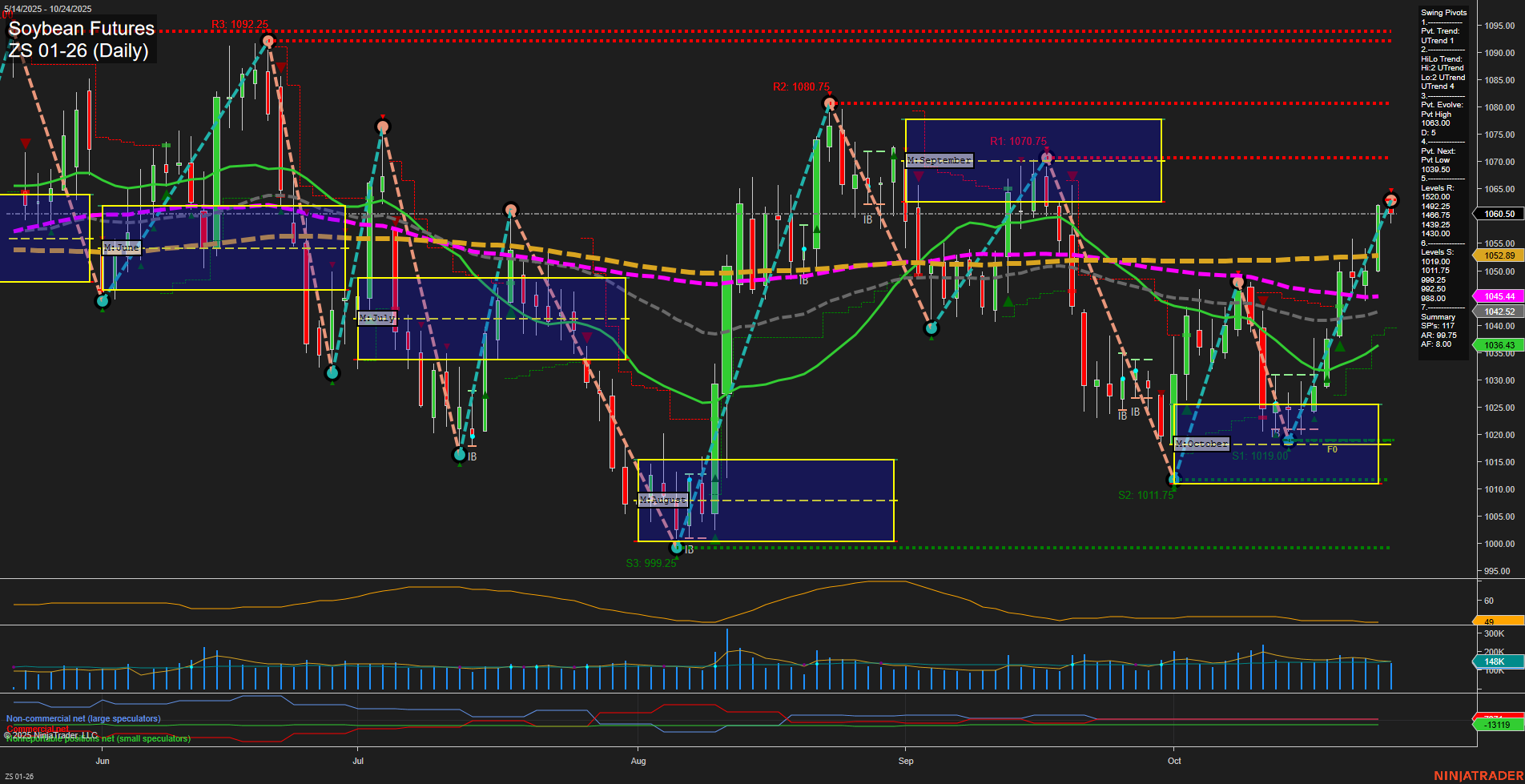

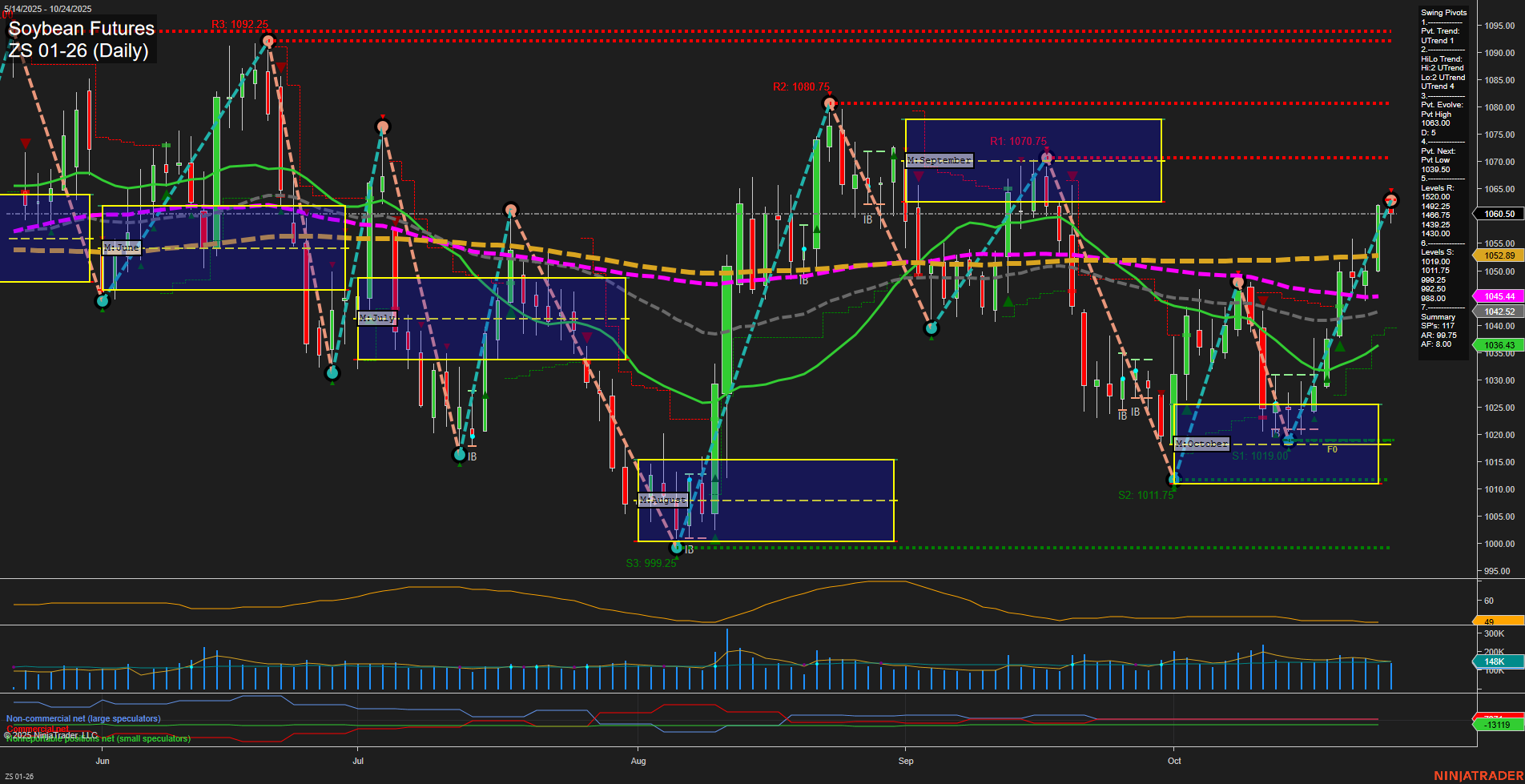

ZS Soybean Futures Daily Chart Analysis: 2025-Oct-26 18:22 CT

Price Action

- Last: 1069.50,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: 92%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: 81%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 9%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt High 1069.03,

- 4. Pvt. Next: Pvt Low 1038.50,

- 5. Levels R: 1092.25, 1080.75, 1070.75, 1069.03,

- 6. Levels S: 1040.00, 1038.50, 1019.00, 1011.75, 999.25.

Daily Benchmarks

- (Short-Term) 5 Day: 1045.44 Up Trend,

- (Short-Term) 10 Day: 1040.52 Up Trend,

- (Intermediate-Term) 20 Day: 1035.43 Up Trend,

- (Intermediate-Term) 55 Day: 1044.54 Up Trend,

- (Long-Term) 100 Day: 1045.44 Up Trend,

- (Long-Term) 200 Day: 1050.00 Down Trend.

Additional Metrics

Recent Trade Signals

- 20 Oct 2025: Long ZS 11-25 @ 1023.5 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

Soybean futures have staged a strong rally, with price action breaking decisively above key resistance levels and all major moving averages except the 200-day, which is now being tested from below. The current swing structure is in a clear uptrend, with both short-term and intermediate-term pivot trends confirming upward momentum. The fast momentum and large bar size reflect strong buying interest, likely fueled by a combination of technical breakout and possible seasonal or fundamental drivers. The ATR and volume metrics indicate heightened volatility and participation, supporting the move. With price above the NTZ/F0% levels on all session fib grids (weekly, monthly, yearly), the market is in a confirmed bullish phase across all timeframes. The most recent trade signal aligns with this trend, and the next key resistance levels are clustered just above, while support is well-defined below. The overall structure suggests a trend continuation environment, with the potential for further upside if the 200-day moving average is decisively reclaimed.

Chart Analysis ATS AI Generated: 2025-10-26 18:23 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.