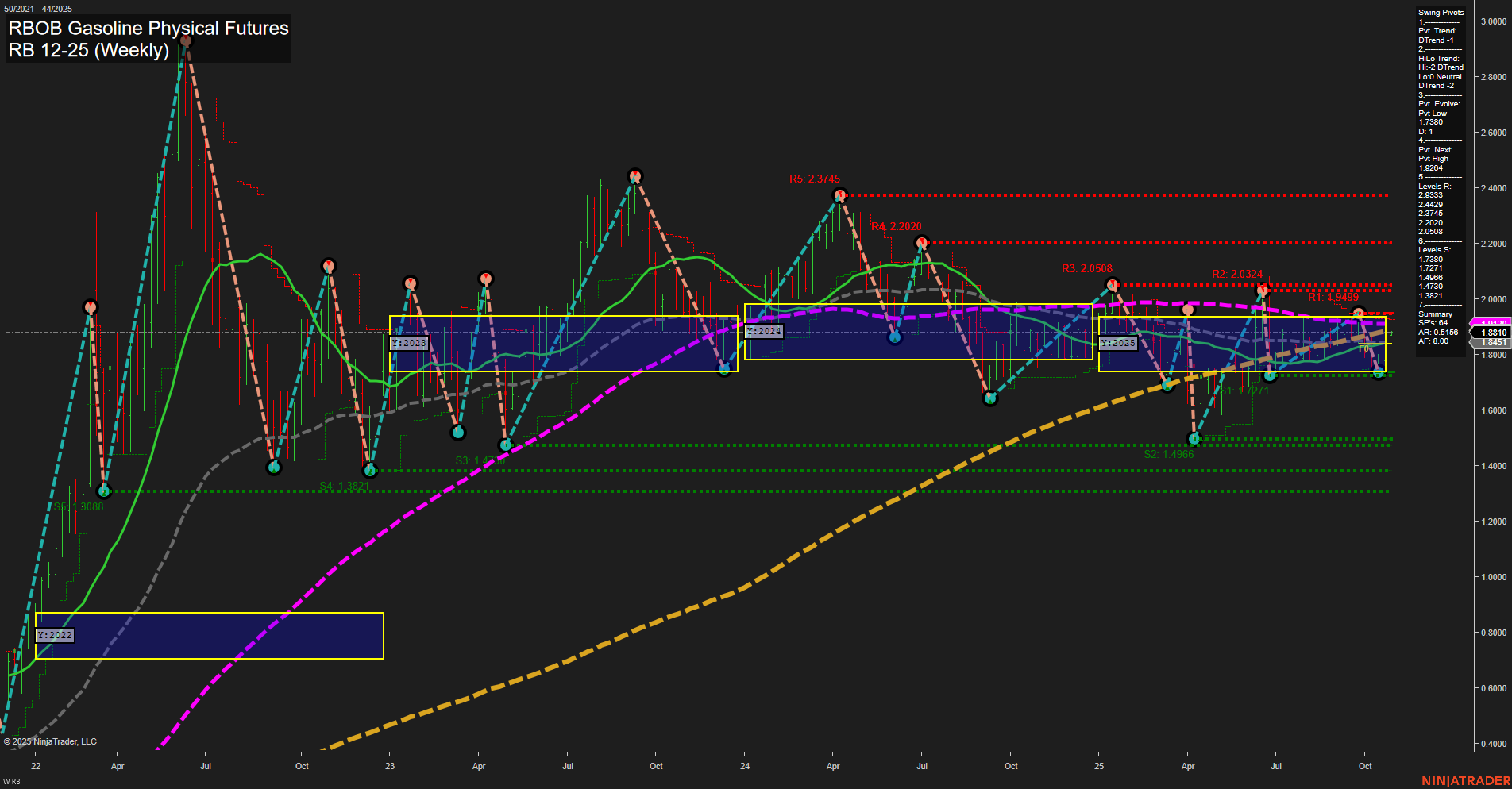

The RBOB Gasoline futures market is currently exhibiting a mixed technical structure. Price action is consolidating with medium-sized bars and slow momentum, suggesting a lack of strong directional conviction in the short term. All three session Fib grid trends (weekly, monthly, yearly) are up, with price holding above the NTZ center lines, indicating underlying bullish structure. However, both short-term and intermediate-term swing pivot trends are down, and the most recent pivots show a lower high and a lower low, reflecting a corrective or consolidative phase within the broader uptrend. Weekly benchmarks (5, 10, 20, 55 week MAs) are all in downtrends, reinforcing the current corrective tone, but the 100 and 200 week MAs remain in uptrends, supporting a longer-term bullish bias. Resistance levels are clustered above at 1.9264 and higher, while support is established at 1.7380 and below. Recent trade signals have triggered new long entries, suggesting that the market may be attempting to base and resume higher, but confirmation is still needed. Overall, the market is in a transition phase: short- and intermediate-term trends are neutral as the market digests recent declines, while the long-term structure remains bullish, supported by higher timeframe moving averages and Fib grid trends. Swing traders should be attentive to potential breakout or reversal signals as the market tests key support and resistance levels.