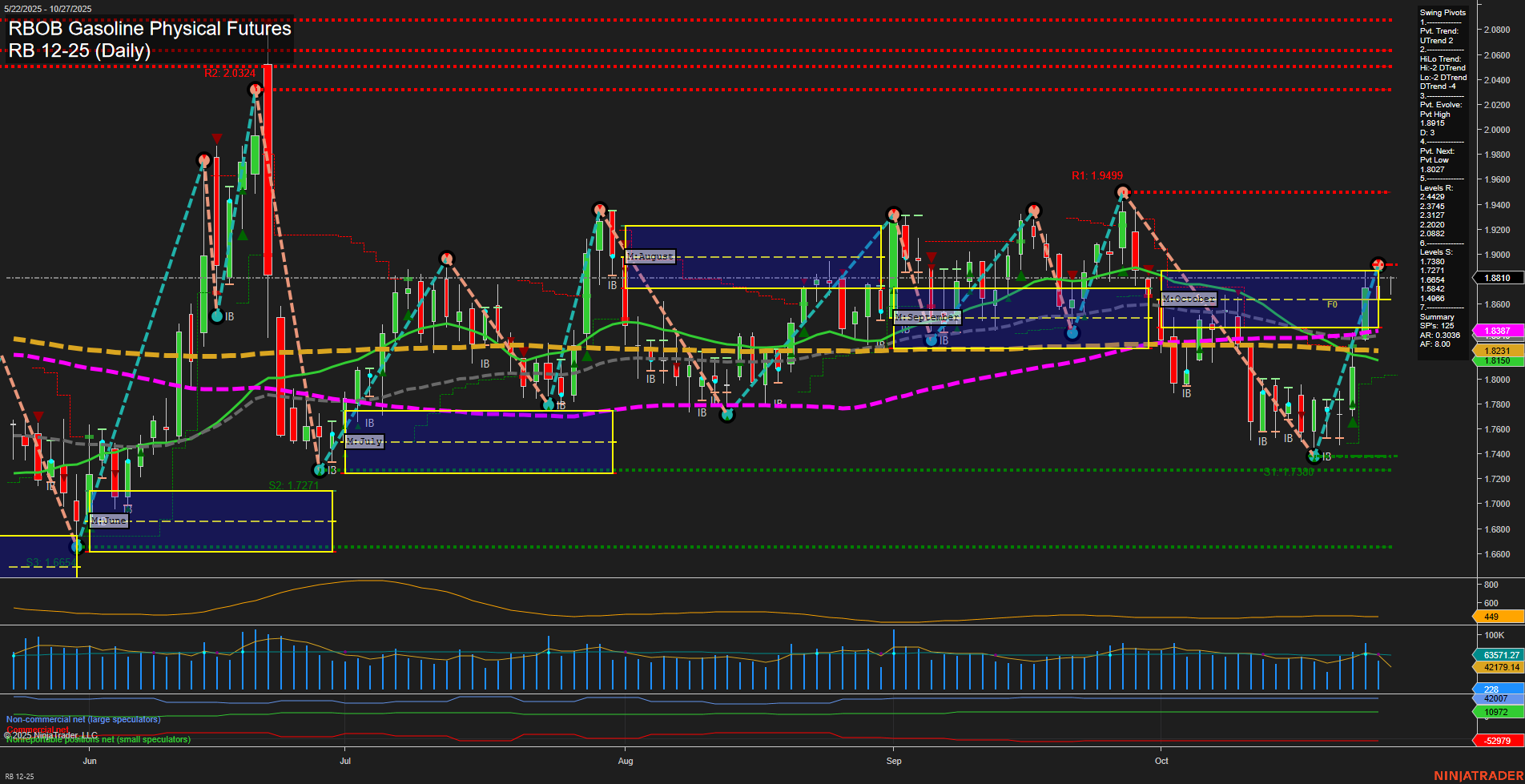

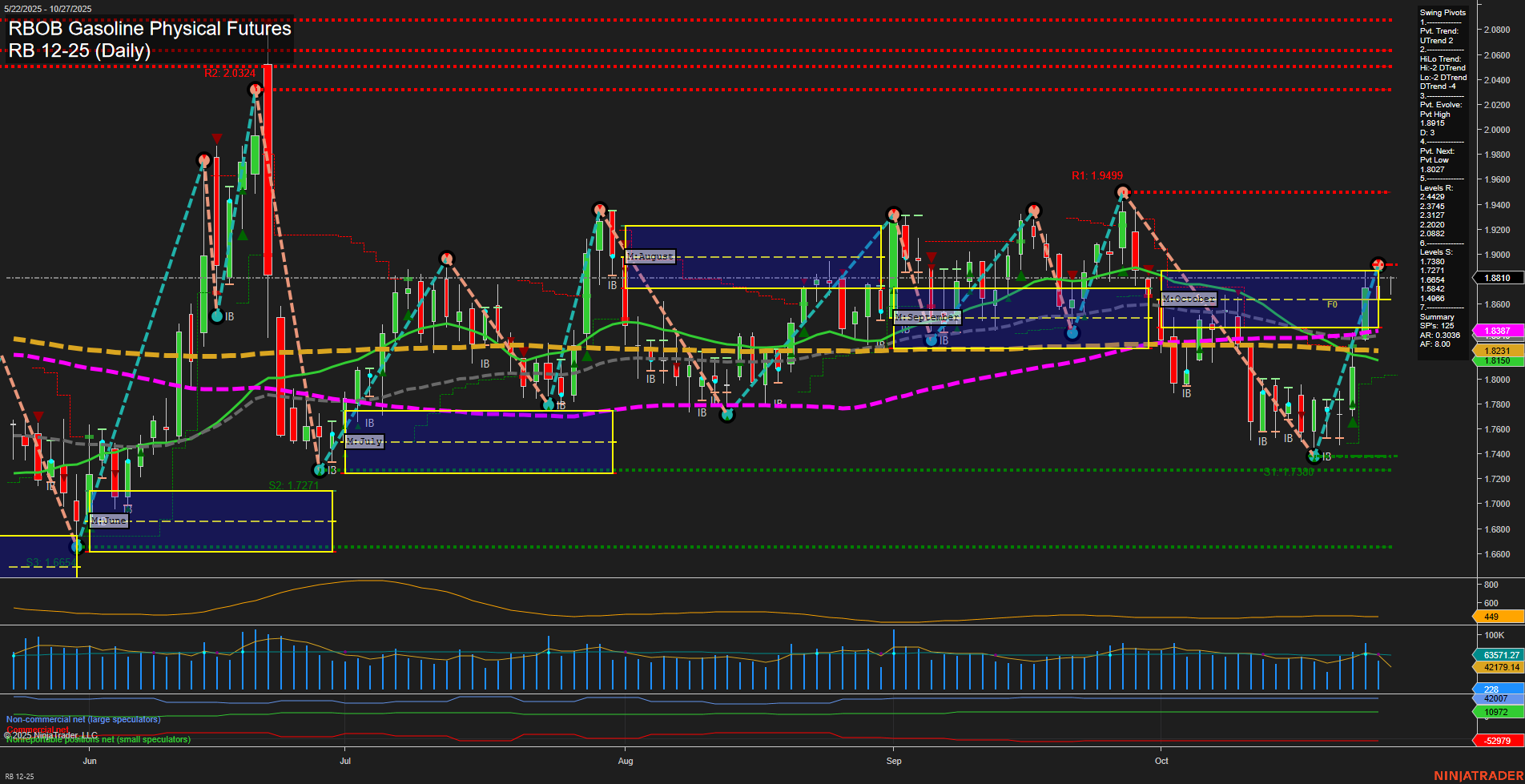

RB RBOB Gasoline Physical Futures Daily Chart Analysis: 2025-Oct-26 18:15 CT

Price Action

- Last: 1.8810,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: 17%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: 14%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 4%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt high 1.8815,

- 4. Pvt. Next: Pvt low 1.8231,

- 5. Levels R: 1.9499, 1.9027, 1.8972, 1.8854, 1.8027,

- 6. Levels S: 1.8231, 1.7721, 1.7500.

Daily Benchmarks

- (Short-Term) 5 Day: 1.8231 Up Trend,

- (Short-Term) 10 Day: 1.8150 Up Trend,

- (Intermediate-Term) 20 Day: 1.8387 Up Trend,

- (Intermediate-Term) 55 Day: 1.8231 Up Trend,

- (Long-Term) 100 Day: 1.8510 Down Trend,

- (Long-Term) 200 Day: 1.8837 Down Trend.

Additional Metrics

Recent Trade Signals

- 24 Oct 2025: Long RB 12-25 @ 1.89 Signals.USAR-MSFG

- 23 Oct 2025: Long RB 12-25 @ 1.8816 Signals.USAR.TR720

- 22 Oct 2025: Long RB 11-25 @ 1.8445 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Neutral.

Key Insights Summary

The RBOB Gasoline futures chart is showing a strong short-term and intermediate-term bullish structure, with price action breaking above key NTZ/F0% levels on both the weekly and monthly session fib grids. The recent large, fast-momentum bars indicate a sharp rally off the October lows, supported by a series of higher lows and a new swing high pivot at 1.8815. All short- and intermediate-term moving averages are trending up, confirming the bullish momentum, while the long-term 100 and 200-day MAs remain in a downtrend, suggesting the longer-term trend is still neutral and in transition. Resistance levels are clustered above at 1.8854, 1.8972, and 1.9027, with support at 1.8231 and 1.7721. The ATR and volume metrics reflect increased volatility and participation, typical of a breakout or trend acceleration phase. Recent trade signals have all been to the long side, aligning with the prevailing uptrend. Overall, the market is in a bullish swing phase with potential for further upside, but long-term trend confirmation is still pending.

Chart Analysis ATS AI Generated: 2025-10-26 18:15 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.