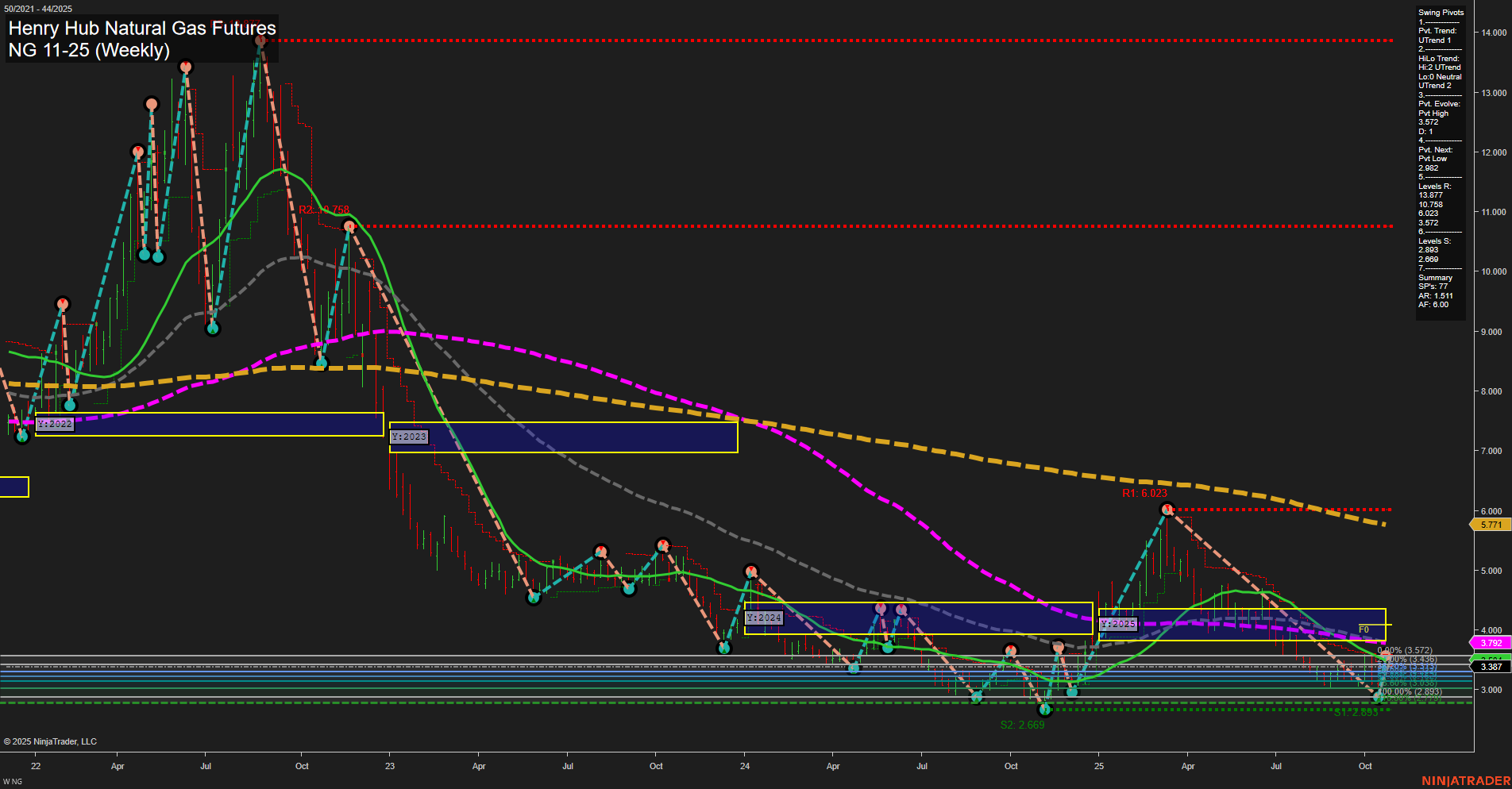

The weekly chart for NG Henry Hub Natural Gas Futures as of late October 2025 shows a market in consolidation after a prolonged downtrend. Price action is subdued, with medium-sized bars and slow momentum, reflecting indecision and a lack of strong directional conviction. The swing pivot structure is currently in an uptrend for both short- and intermediate-term metrics, but the next anticipated pivot is a potential retest of lower support near 2.882, with major resistance overhead at 3.572 and 6.023. All major long-term moving averages (20, 55, 100 week) remain in a downtrend, confirming that the broader trend is still bearish despite recent attempts at a bounce. The price is currently below these key benchmarks, indicating persistent overhead pressure. The Fib grid analysis across weekly, monthly, and yearly sessions is neutral, suggesting a lack of clear bias and a market that is likely to remain range-bound in the near term. Recent trade signals have been mixed, with both short and long entries triggered within a tight range, further highlighting the choppy and indecisive nature of the current environment. The market is testing key support levels, and while there is some evidence of attempted recovery, the overall structure remains vulnerable to further downside unless a sustained move above resistance levels is achieved. The technical landscape suggests a period of consolidation, with the potential for volatility should price break out of the current range.