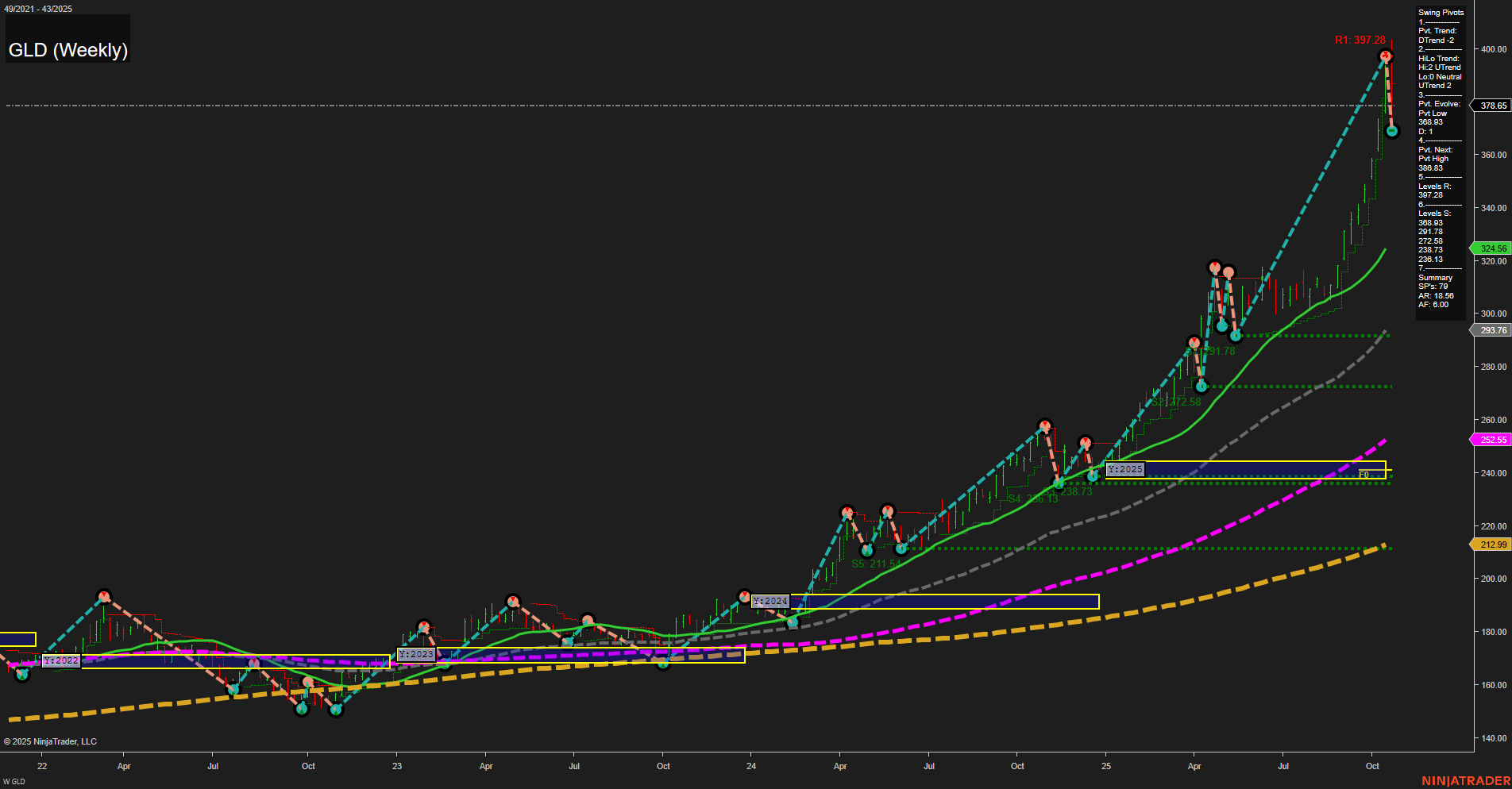

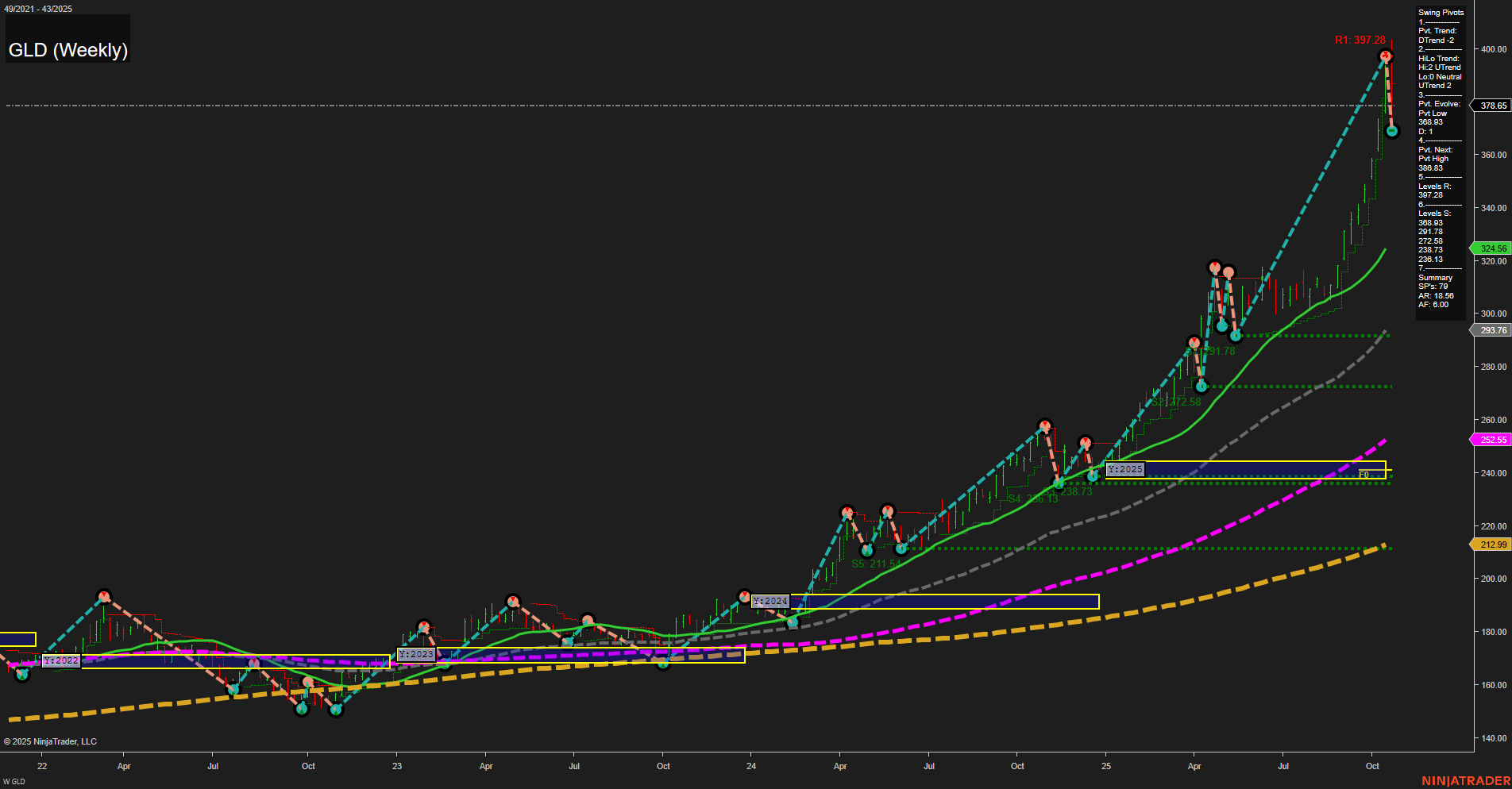

GLD SPDR Gold Shares Weekly Chart Analysis: 2025-Oct-26 18:10 CT

Price Action

- Last: 378.65,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 348.03,

- 4. Pvt. Next: Pvt high 397.28,

- 5. Levels R: 397.28,

- 6. Levels S: 348.03, 299.98, 278.73, 211.54.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 324.56 Up Trend,

- (Intermediate-Term) 10 Week: 293.76 Up Trend,

- (Long-Term) 20 Week: 252.55 Up Trend,

- (Long-Term) 55 Week: 212.99 Up Trend,

- (Long-Term) 100 Week: NA,

- (Long-Term) 200 Week: NA.

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

GLD has experienced a strong and rapid rally, as evidenced by large weekly bars and fast momentum, pushing price to new highs near 378.65. The short-term swing pivot trend has shifted to a developing downtrend, suggesting a potential pause or retracement after the recent surge, while the intermediate-term HiLo trend remains firmly up, reflecting underlying strength. The next key resistance is at 397.28, with immediate support at 348.03 and further levels down to 211.54, indicating a wide range for potential pullbacks. All visible weekly benchmarks (5, 10, 20, 55 week MAs) are trending up, confirming a robust bullish structure in the intermediate and long-term timeframes. The neutral bias in the session fib grids (WSFG, MSFG, YSFG) suggests price is consolidating after a strong move, possibly digesting gains before the next directional push. Overall, the chart reflects a market in a strong uptrend with short-term consolidation or corrective risk, but with bullish momentum intact on higher timeframes.

Chart Analysis ATS AI Generated: 2025-10-26 18:11 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.