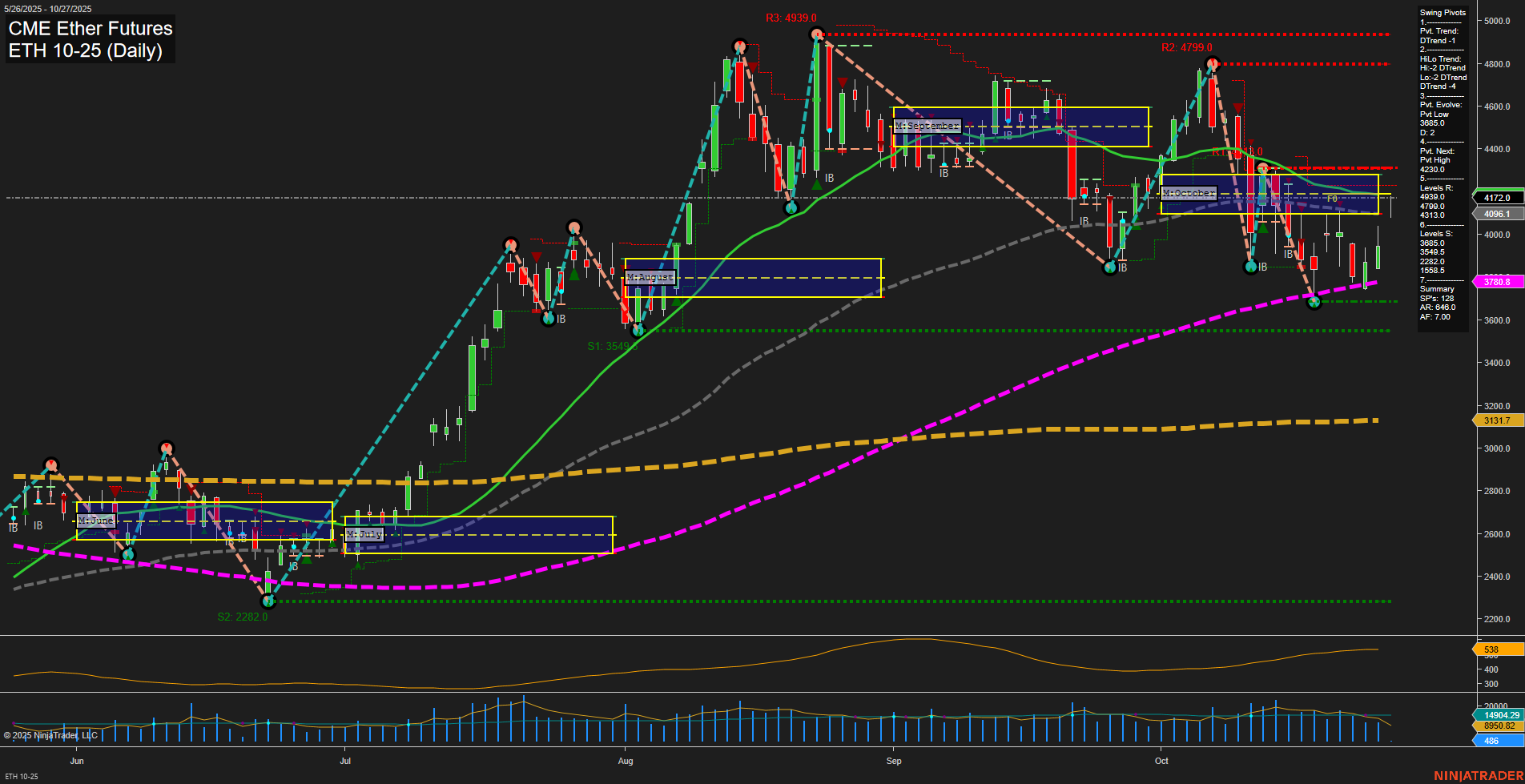

The ETH CME Ether Futures daily chart shows a market in transition. Price action is currently consolidating above key moving averages, with medium-sized bars and average momentum, suggesting a pause after recent volatility. The short-term swing pivot trend is down, and both short-term and intermediate-term pivot trends are in a corrective phase, with the most recent pivot low at 3865.0 and resistance at 4230.0. However, all major session fib grid trends (weekly, monthly, yearly) remain up, and price is holding above the NTZ center lines, indicating underlying bullish structure on higher timeframes. Daily benchmarks show short-term moving averages trending down, while intermediate and long-term averages remain in strong uptrends, highlighting a potential pullback within a broader uptrend. ATR and volume metrics suggest moderate volatility and healthy participation. Recent trade signals reflect mixed short-term direction, with both long and short entries triggered in the past week, consistent with a choppy, range-bound environment. Overall, the market is in a consolidation phase with a neutral short-term outlook, a bearish intermediate-term swing pivot structure, but a bullish long-term trend. This setup often precedes a decisive move as the market digests recent gains and tests support levels. Key levels to watch are the 3865.0 support and 4230.0 resistance, with a break of either likely to set the next directional move.