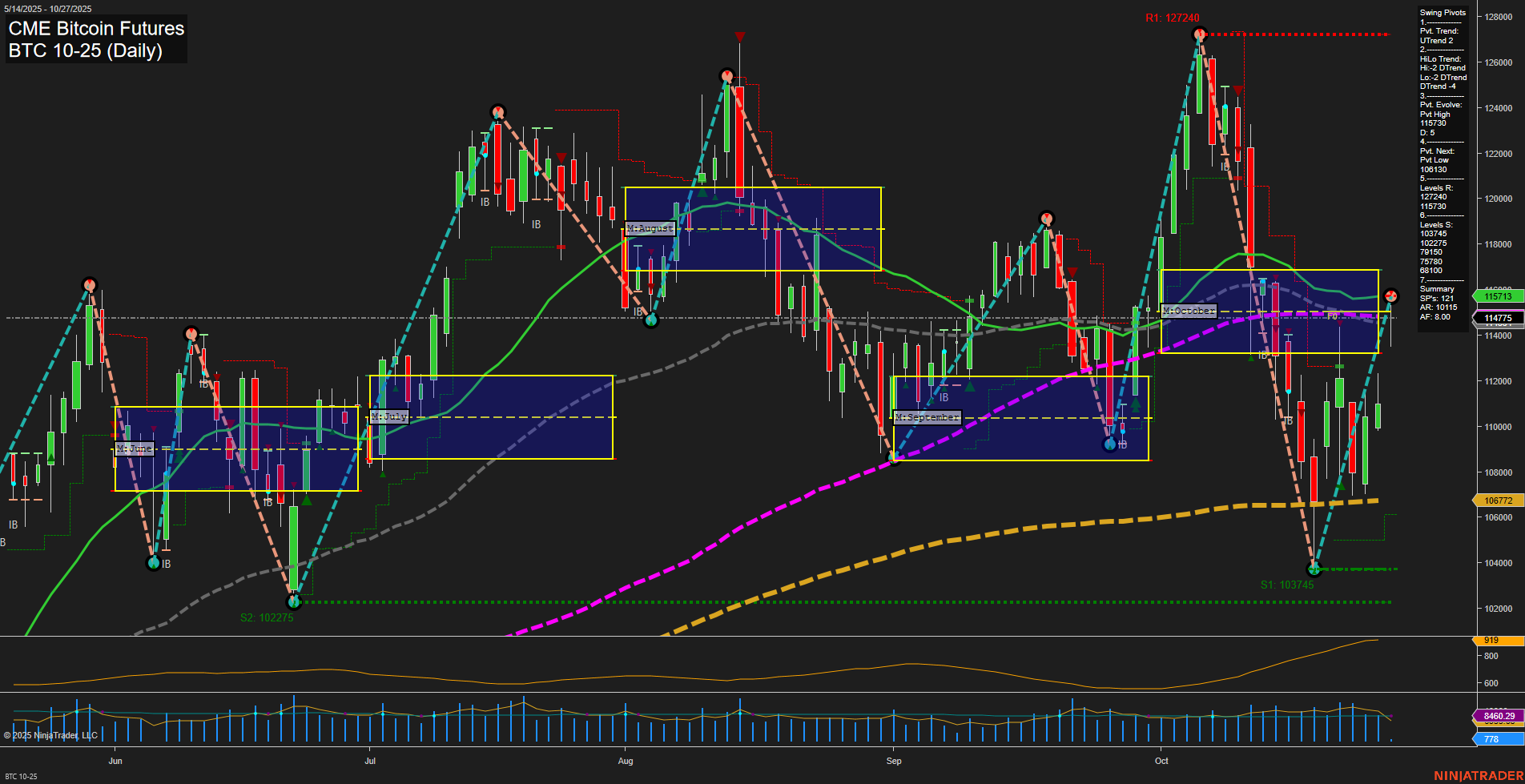

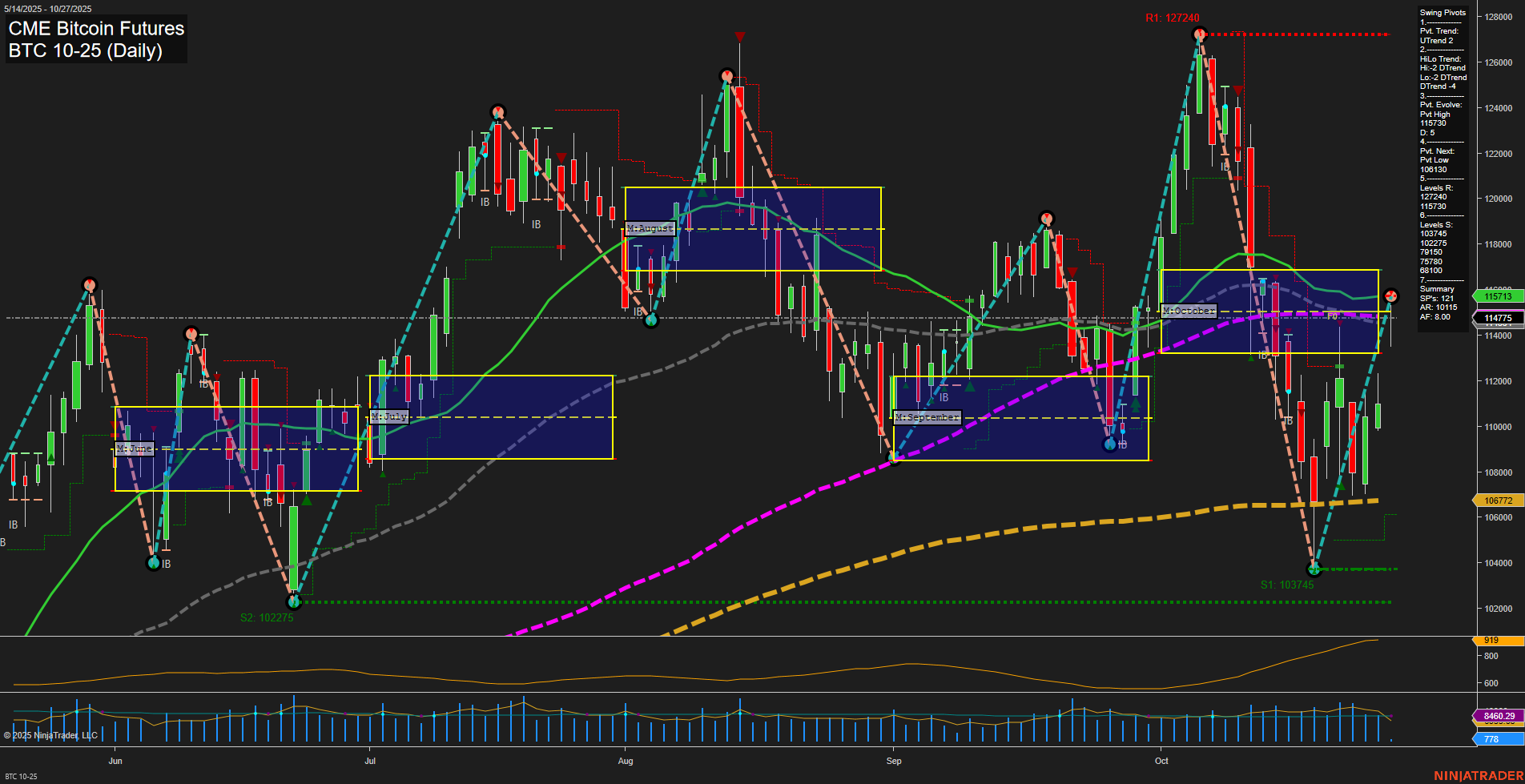

BTC CME Bitcoin Futures Daily Chart Analysis: 2025-Oct-26 18:03 CT

Price Action

- Last: 114775,

- Bars: Medium,

- Mom: Average.

WSFG Weekly

- Short-Term

- WSFG Current: 39%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: -2%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 55%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt High 115713,

- 4. Pvt. Next: Pvt Low 106130,

- 5. Levels R: 127240, 124240, 117570, 115713,

- 6. Levels S: 106130, 103745, 102275, 98780, 88100.

Daily Benchmarks

- (Short-Term) 5 Day: 112915 Up Trend,

- (Short-Term) 10 Day: 112175 Up Trend,

- (Intermediate-Term) 20 Day: 115713 Down Trend,

- (Intermediate-Term) 55 Day: 114775 Down Trend,

- (Long-Term) 100 Day: 106772 Up Trend,

- (Long-Term) 200 Day: 91900 Up Trend.

Additional Metrics

Recent Trade Signals

- 23 Oct 2025: Long BTC 10-25 @ 109710 Signals.USAR-WSFG

- 22 Oct 2025: Short BTC 10-25 @ 108170 Signals.USAR.TR120

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bearish,

- Long-Term: Bullish.

Key Insights Summary

The current BTC CME Bitcoin Futures daily chart reflects a market in transition, with mixed signals across timeframes. Short-term momentum has shifted bullish, supported by an uptrend in both the 5-day and 10-day moving averages, and a recent swing pivot high. The price is trading above the weekly session fib grid (WSFG) neutral zone, reinforcing short-term strength. However, the intermediate-term picture is less constructive: the monthly session fib grid (MSFG) trend is down, and the HiLo swing pivot trend remains bearish, indicating that the recent rally is still within a broader corrective phase. Long-term structure remains positive, with price above the yearly fib grid and all major long-term moving averages trending up, suggesting the larger bull cycle is intact. Volatility (ATR) is moderate, and volume remains healthy. The market recently generated both long and short signals, highlighting the choppy, two-way action typical of a market searching for direction after a sharp pullback and bounce. Key resistance sits at 117570 and 124240, while support is layered at 106130 and 103745. Overall, the market is in a consolidation phase with a bullish short-term bias, but intermediate-term caution persists until a clear breakout above resistance or breakdown below support confirms the next directional move.

Chart Analysis ATS AI Generated: 2025-10-26 18:04 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.