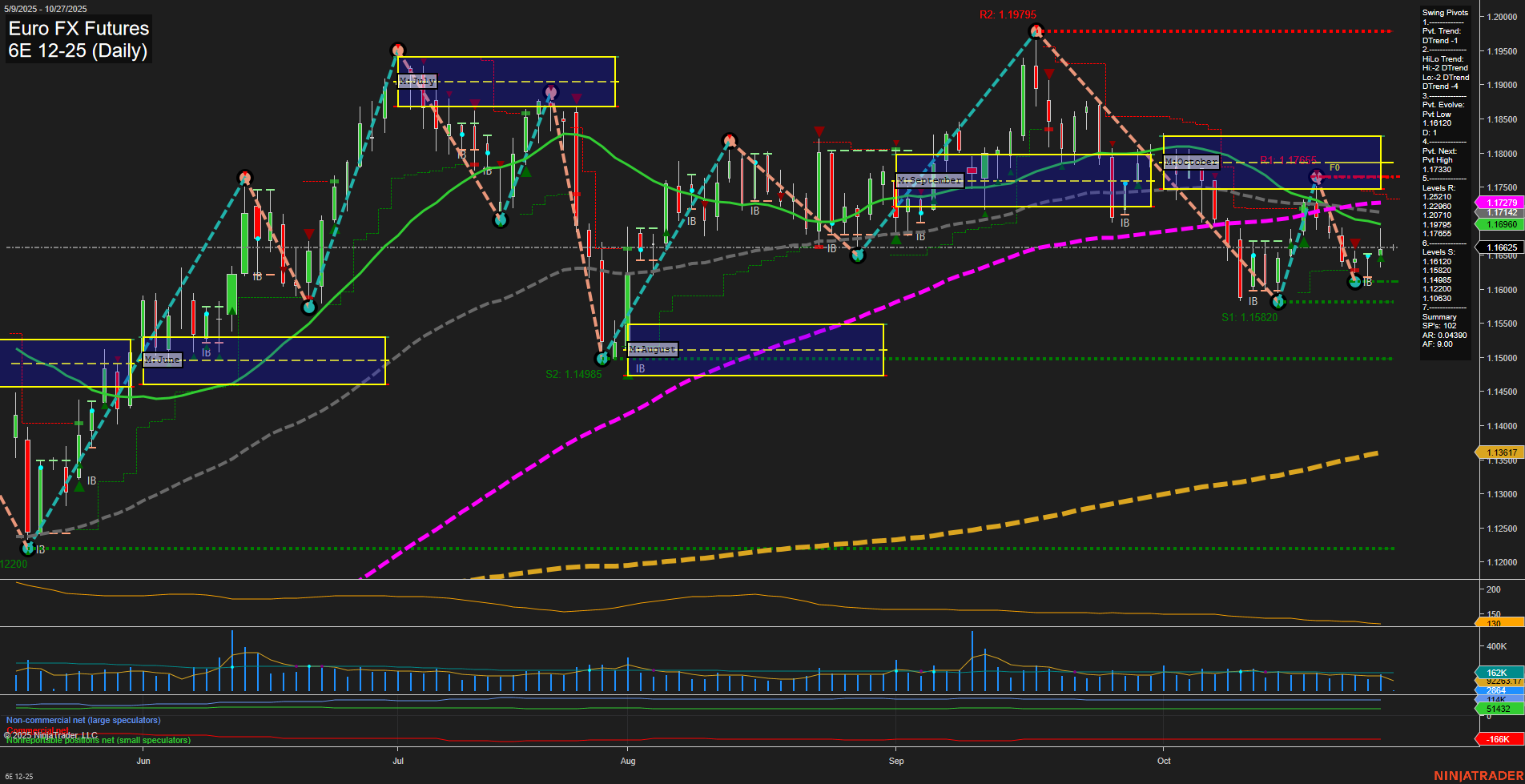

The 6E Euro FX Futures daily chart shows a market in transition. Price action is currently subdued with medium-sized bars and slow momentum, reflecting a period of indecision or consolidation after recent volatility. The short-term and intermediate-term trends, as indicated by both swing pivots and moving averages, are bearish—price is below key monthly session fib grid levels and all short/intermediate benchmarks are trending down. However, the long-term trend remains bullish, supported by the yearly session fib grid and the 200-day moving average, both of which are still pointing up. Recent trade signals show mixed short-term activity, with both long and short entries triggered in the last week, highlighting the choppy and potentially range-bound nature of the current environment. Resistance is clustered between 1.1696 and 1.1979, while support is found at 1.1582 and lower at 1.1498 and 1.1220, suggesting the market is testing lower boundaries but has not yet broken down decisively. Overall, the market is in a corrective phase within a larger bullish context, with short-term and intermediate-term pressures to the downside. Volatility (ATR) and volume (VOLMA) are moderate, indicating neither a panic sell-off nor a strong rally. Swing traders should note the potential for further downside tests before any significant reversal, but the long-term uptrend remains intact unless key support levels are breached.