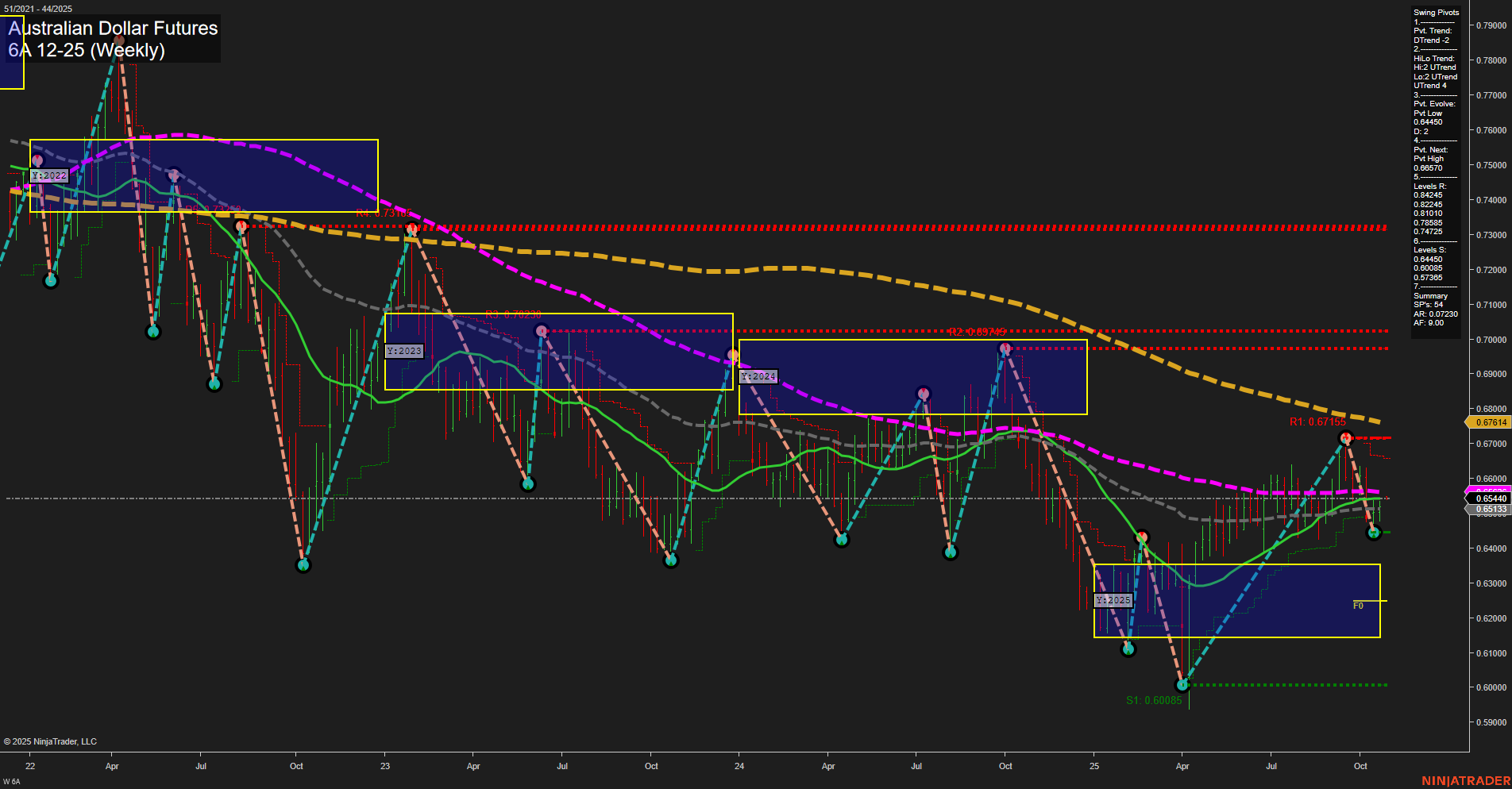

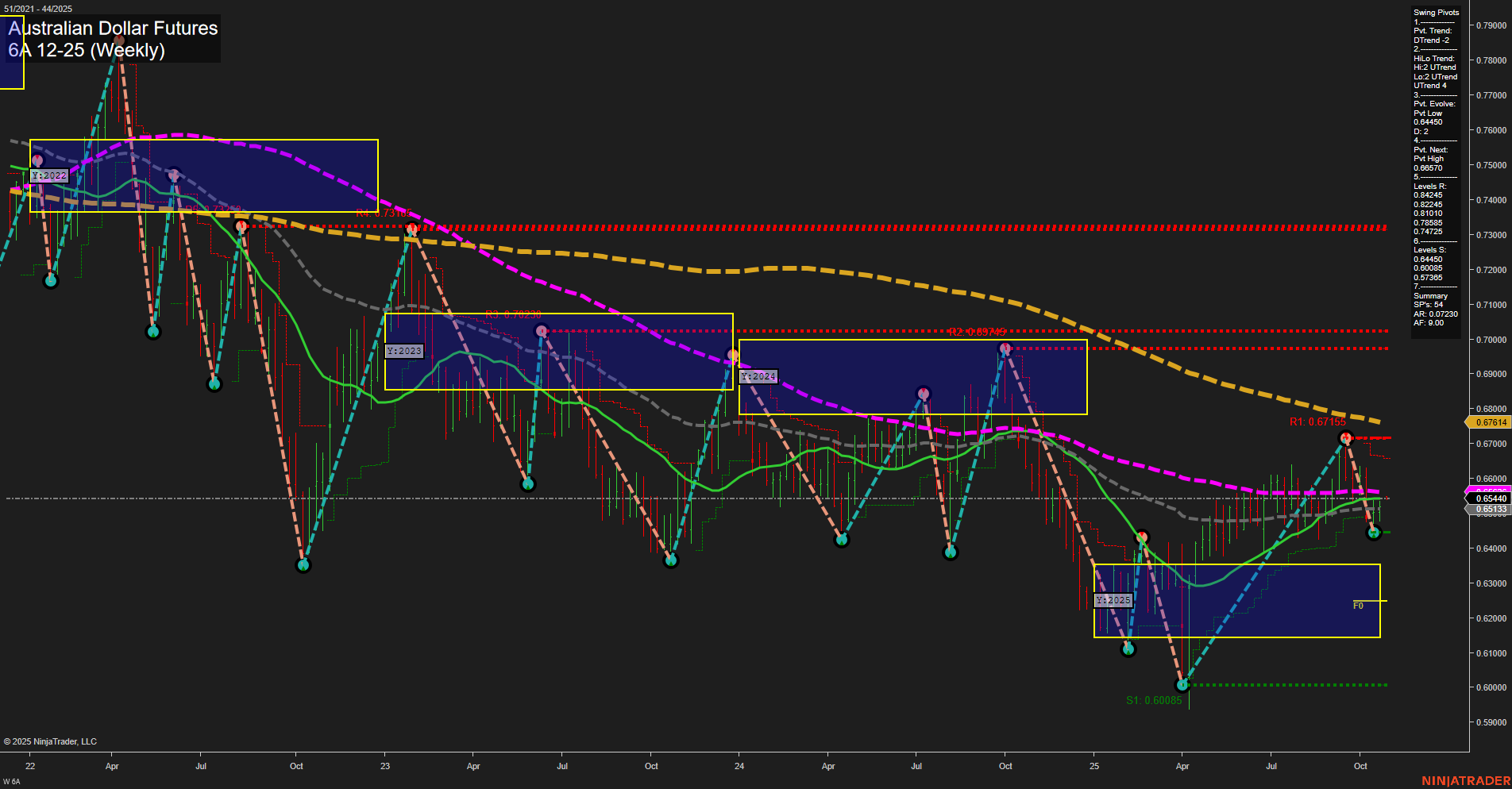

6A Australian Dollar Futures Weekly Chart Analysis: 2025-Oct-26 18:00 CT

Price Action

- Last: 0.65443,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 0.65443,

- 4. Pvt. Next: Pvt high 0.67155,

- 5. Levels R: 0.67155, 0.68949, 0.70381,

- 6. Levels S: 0.65443, 0.60085.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 0.65353 Down Trend,

- (Intermediate-Term) 10 Week: 0.65385 Down Trend,

- (Long-Term) 20 Week: 0.66144 Up Trend,

- (Long-Term) 55 Week: 0.65785 Up Trend,

- (Long-Term) 100 Week: 0.67220 Down Trend,

- (Long-Term) 200 Week: 0.70376 Down Trend.

Recent Trade Signals

- 23 Oct 2025: Long 6A 12-25 @ 0.6521 Signals.USAR-WSFG

- 20 Oct 2025: Long 6A 12-25 @ 0.65205 Signals.USAR.TR120

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Neutral,

- Long-Term: Bearish.

Key Insights Summary

The 6A Australian Dollar Futures weekly chart shows a market in transition, with price currently at 0.65443 and medium-sized bars reflecting average momentum. The short-term and intermediate-term session fib grid trends are neutral, indicating a lack of clear directional conviction. Swing pivot analysis reveals a short-term downtrend, but the intermediate-term trend remains up, suggesting a possible corrective phase within a broader recovery attempt. Key resistance levels are clustered above at 0.67155, 0.68949, and 0.70381, while support is found at 0.65443 and 0.60085. Weekly benchmarks show short-term moving averages trending down, while the 20 and 55 week MAs are up, but the longer-term 100 and 200 week MAs remain in a downtrend, highlighting persistent bearish pressure on a macro scale. Recent trade signals have triggered long entries, reflecting attempts to capture a bounce from support, but the overall structure remains mixed. The market is consolidating after a significant rally off yearly lows, with price action caught between major moving averages and fib grid zones. This environment suggests a choppy, range-bound phase with no dominant trend, as the market digests prior moves and awaits new catalysts.

Chart Analysis ATS AI Generated: 2025-10-26 18:00 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.