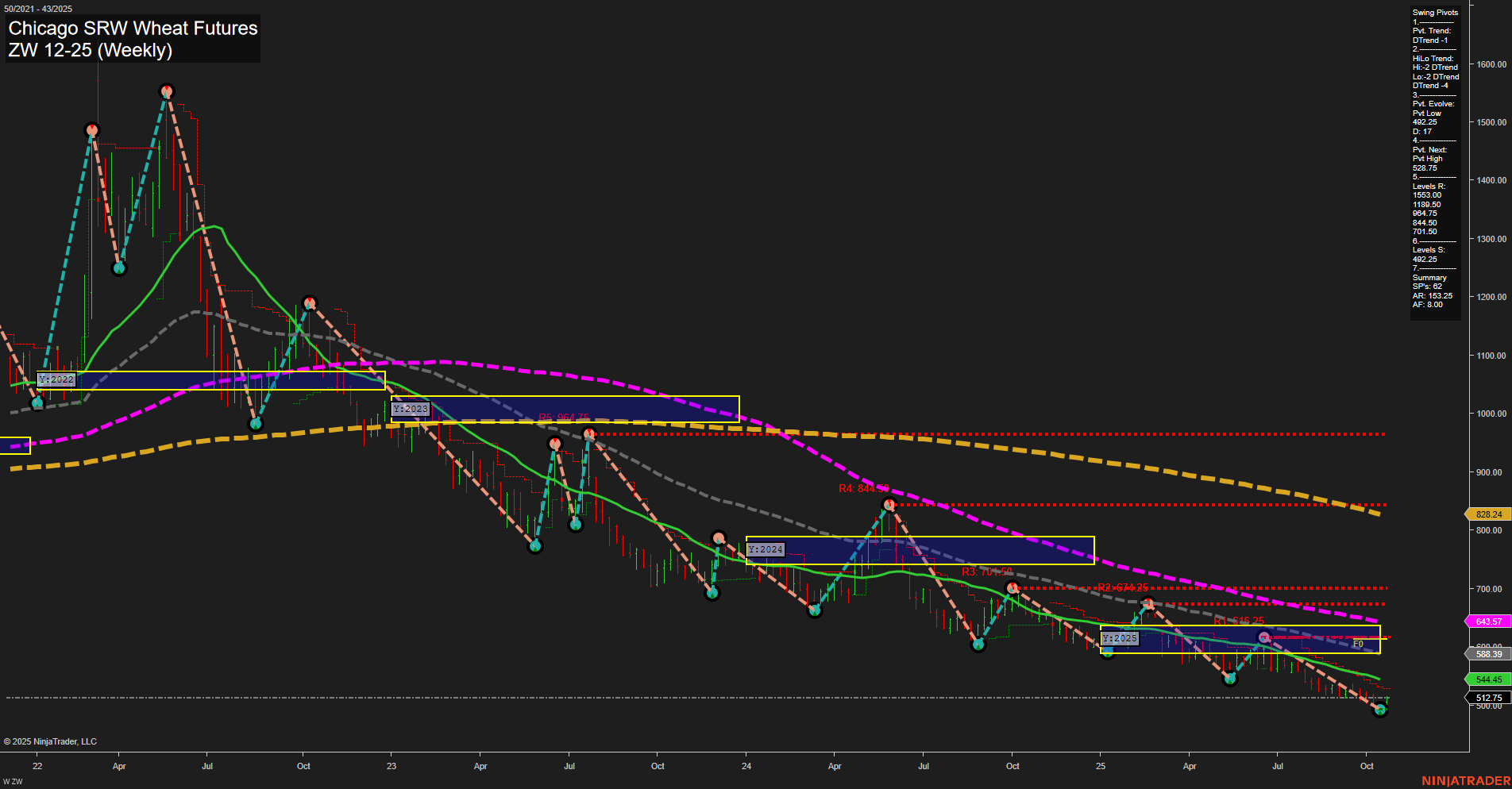

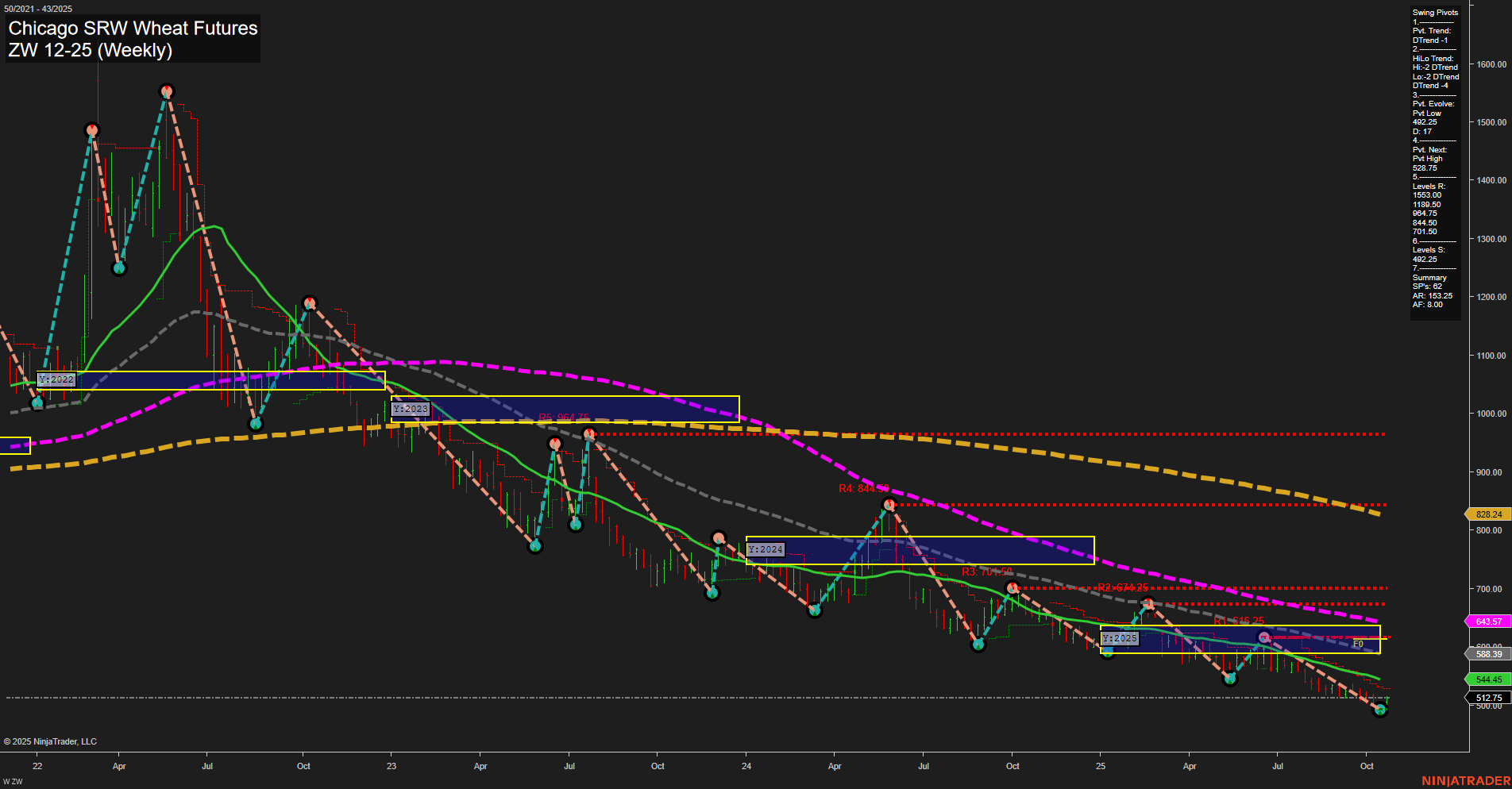

ZW Chicago SRW Wheat Futures Weekly Chart Analysis: 2025-Oct-24 07:57 CT

Price Action

- Last: 512.75,

- Bars: Small,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: 51%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: 19%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: -42%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 492.25,

- 4. Pvt. Next: Pvt high 628.75,

- 5. Levels R: 1163.00, 1048.50, 944.50, 844.00, 701.50, 646.25,

- 6. Levels S: 492.25.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: [not shown] [not shown],

- (Intermediate-Term) 10 Week: [not shown] [not shown],

- (Long-Term) 20 Week: 544.45 Down Trend,

- (Long-Term) 55 Week: 588.39 Down Trend,

- (Long-Term) 100 Week: 643.57 Down Trend,

- (Long-Term) 200 Week: 828.24 Down Trend.

Recent Trade Signals

- 24 Oct 2025: Long ZW 12-25 @ 512.75 Signals.USAR-MSFG

- 23 Oct 2025: Long ZW 12-25 @ 507.75 Signals.USAR-WSFG

- 21 Oct 2025: Short ZW 12-25 @ 500 Signals.USAR.TR120

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Neutral,

- Long-Term: Bearish.

Key Insights Summary

The ZW Chicago SRW Wheat Futures weekly chart shows a market that has been in a persistent long-term downtrend, as evidenced by the downward sloping 20, 55, 100, and 200 week moving averages and the negative YSFG trend. However, recent price action has seen a stabilization and a modest bounce from the 492.25 swing low, with small bars and slow momentum indicating a lack of strong conviction in either direction. Both the weekly and monthly session fib grids (WSFG and MSFG) are showing an upward trend with price currently above their respective NTZ/F0% levels, suggesting some short- and intermediate-term recovery attempts. Swing pivot analysis confirms the dominant downtrend in both short- and intermediate-term trends, but the emergence of recent long trade signals and a pivot low may indicate the early stages of a potential base or consolidation phase. Resistance remains significant overhead, with multiple levels between 646 and 1163, while support is defined at the recent swing low. Overall, the market is showing early signs of stabilization in the short- and intermediate-term, but the long-term structure remains bearish until key resistance levels and moving averages are reclaimed.

Chart Analysis ATS AI Generated: 2025-10-24 07:57 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.