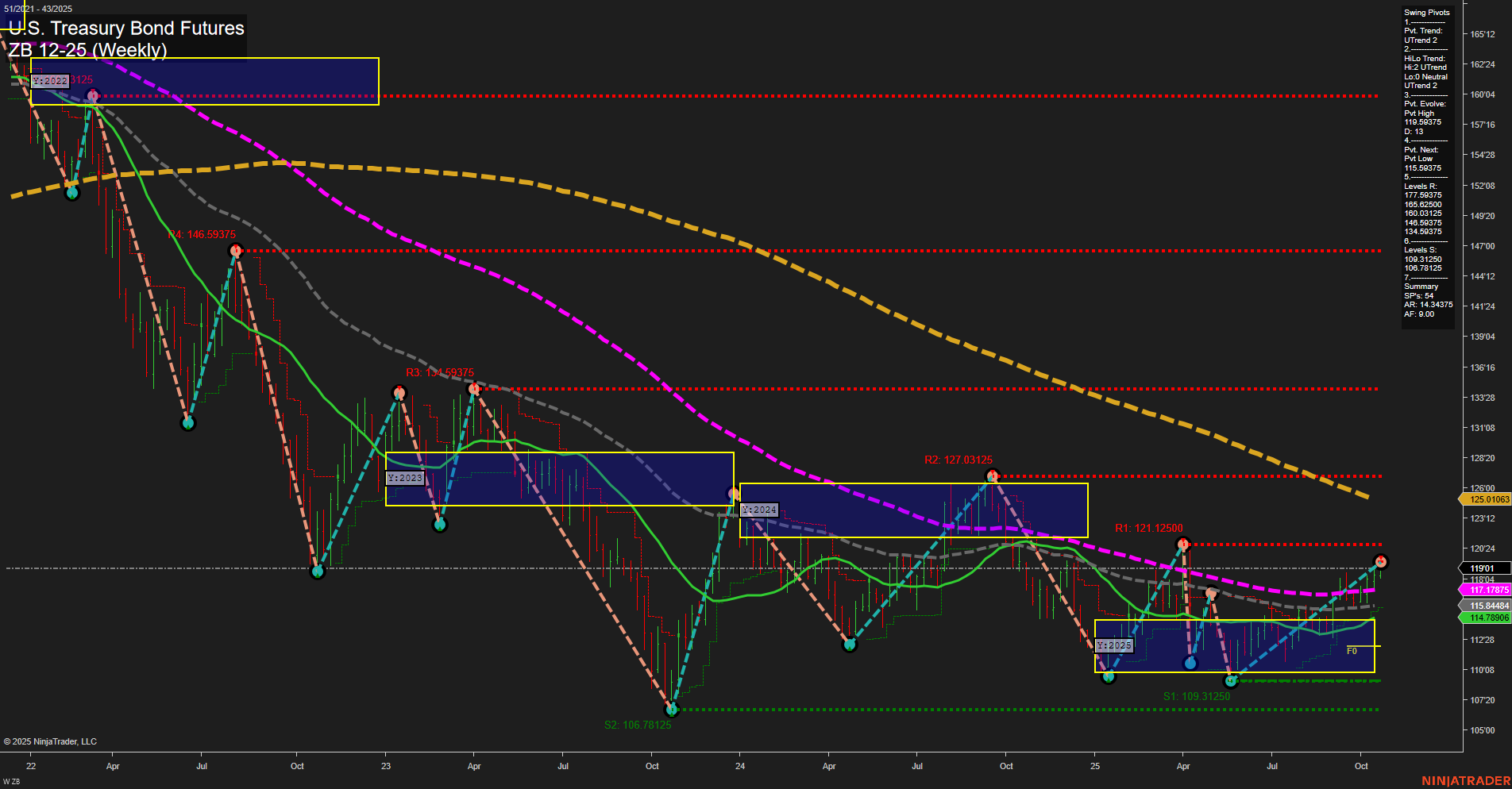

The ZB U.S. Treasury Bond Futures weekly chart shows a notable shift in momentum, with price action currently exhibiting medium-sized bars and average momentum. Both short-term and intermediate-term swing pivot trends have turned upward, supported by a series of higher lows and a recent pivot high at 119.59375. The price has moved above key intermediate and long-term moving averages (5, 10, 20, and 55 week), all of which are trending up, indicating a strengthening bullish bias in the short and intermediate timeframes. However, the 100 and 200 week moving averages remain in a downtrend, reflecting persistent long-term bearishness. Resistance levels are clustered above, with the nearest at 119.59375 and more significant resistance at 121.125 and 127.03125. Support is well-defined below at 115.59375 and 109.3125. The price is currently trading within the yearly NTZ (neutral zone), suggesting a period of consolidation or base-building after a prolonged decline. The overall structure hints at a potential recovery phase, but the long-term trend remains bearish until the price can sustain above the 100 and 200 week benchmarks. The market is in a transition phase, with short and intermediate-term bulls testing the resolve of long-term bears, and the next few weeks will be critical in determining if this rally can evolve into a sustained trend reversal.