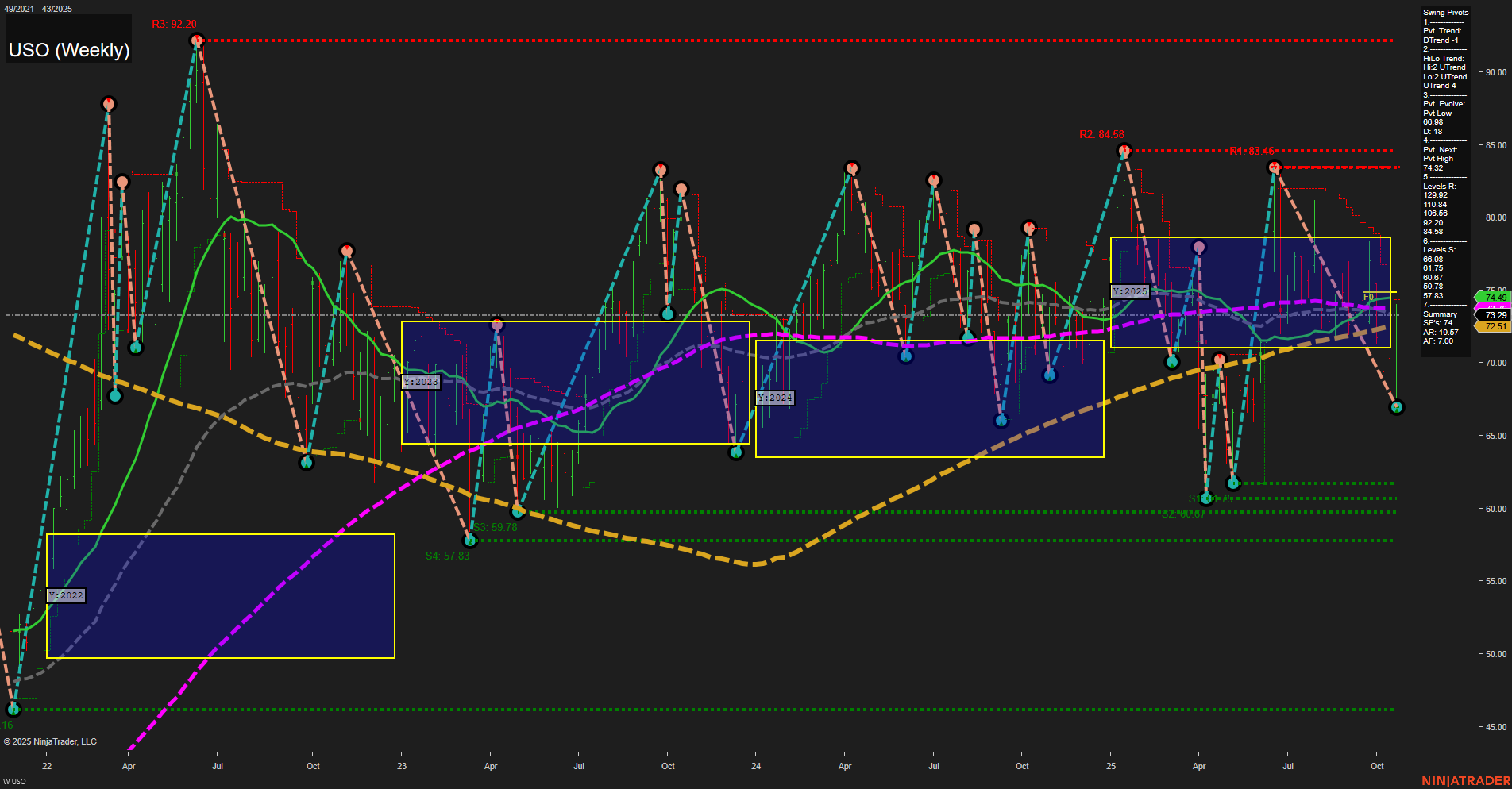

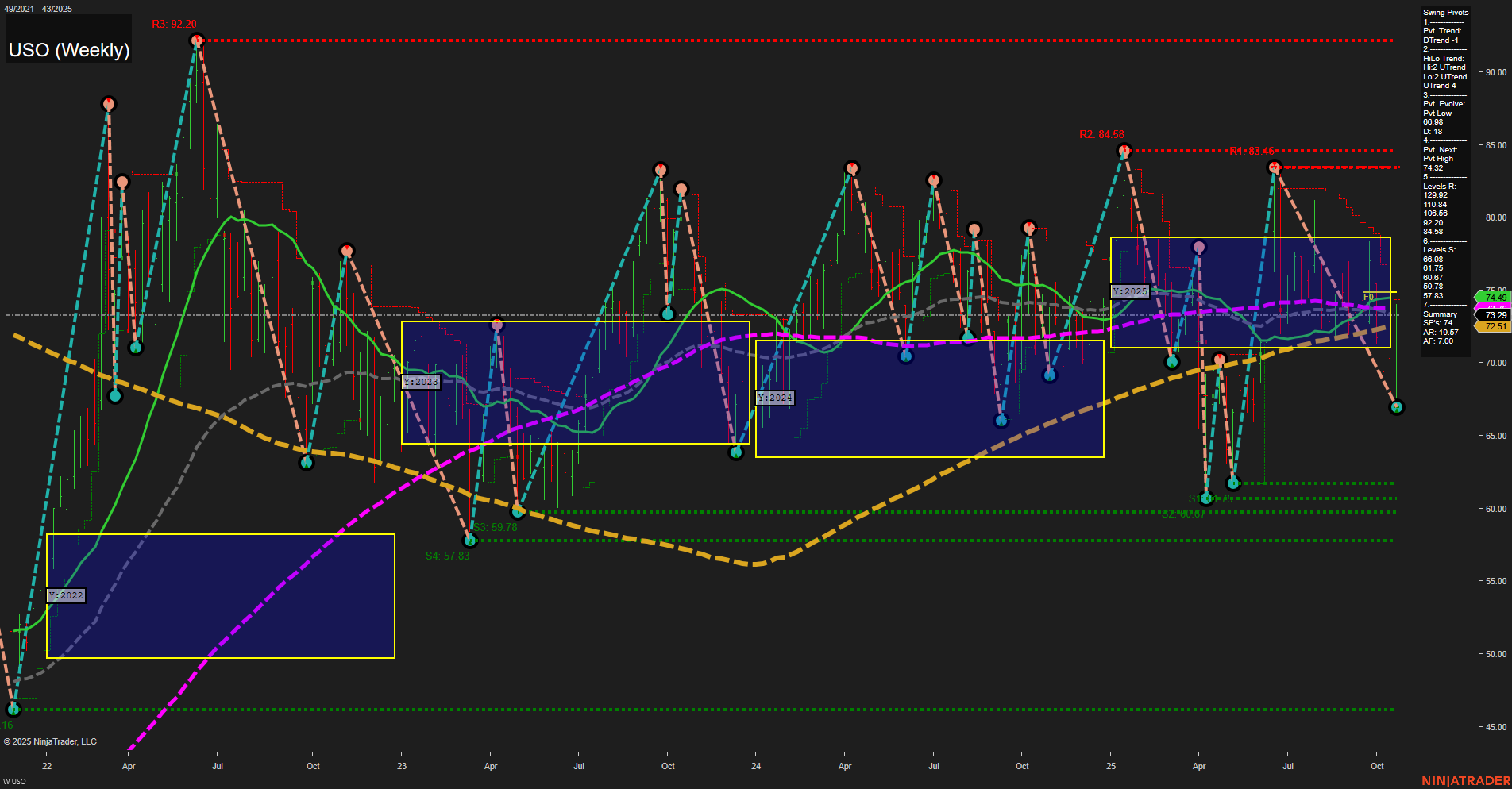

USO United States Oil Fund LP Weekly Chart Analysis: 2025-Oct-24 07:53 CT

Price Action

- Last: 73.29,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 67.95,

- 4. Pvt. Next: Pvt high 83.46,

- 5. Levels R: 92.20, 84.58, 83.46,

- 6. Levels S: 66.75, 59.78, 57.83.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 74.44 Down Trend,

- (Intermediate-Term) 10 Week: 73.29 Down Trend,

- (Long-Term) 20 Week: 72.51 Up Trend,

- (Long-Term) 55 Week: 73.29 Down Trend,

- (Long-Term) 100 Week: 73.29 Down Trend,

- (Long-Term) 200 Week: 74.44 Down Trend.

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Neutral,

- Long-Term: Bearish.

Key Insights Summary

USO is currently trading in a consolidation phase with a slow momentum and medium-sized weekly bars, reflecting indecision and a lack of strong directional conviction. The short-term swing pivot trend is down, supported by the majority of weekly benchmarks (5, 10, 55, 100, and 200 week MAs) all trending lower, while only the 20-week MA shows a slight uptrend. Intermediate-term HiLo trend remains up, suggesting some underlying support, but this is countered by the prevailing bearish tone in the long-term moving averages. Price is situated within the yearly NTZ, with no clear bias from the session fib grids, and is currently closer to support levels (66.75, 59.78) than resistance (83.46, 84.58, 92.20). The overall structure points to a market in a corrective or sideways phase, with potential for further downside if support levels are breached, but also the possibility of a range-bound environment as long as key supports hold. No strong breakout or reversal signals are present, and the market appears to be digesting prior moves, awaiting a catalyst for the next directional leg.

Chart Analysis ATS AI Generated: 2025-10-24 07:53 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.