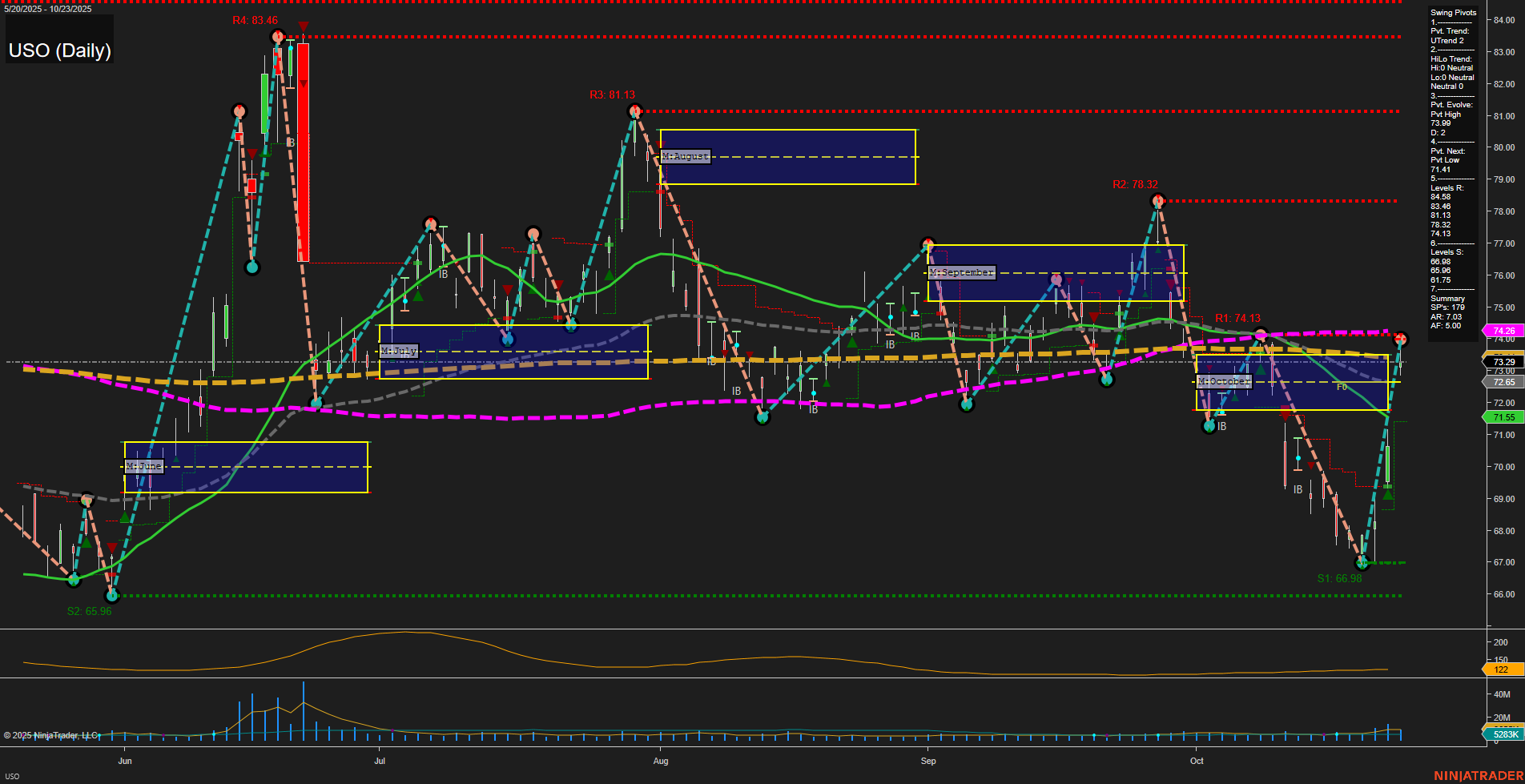

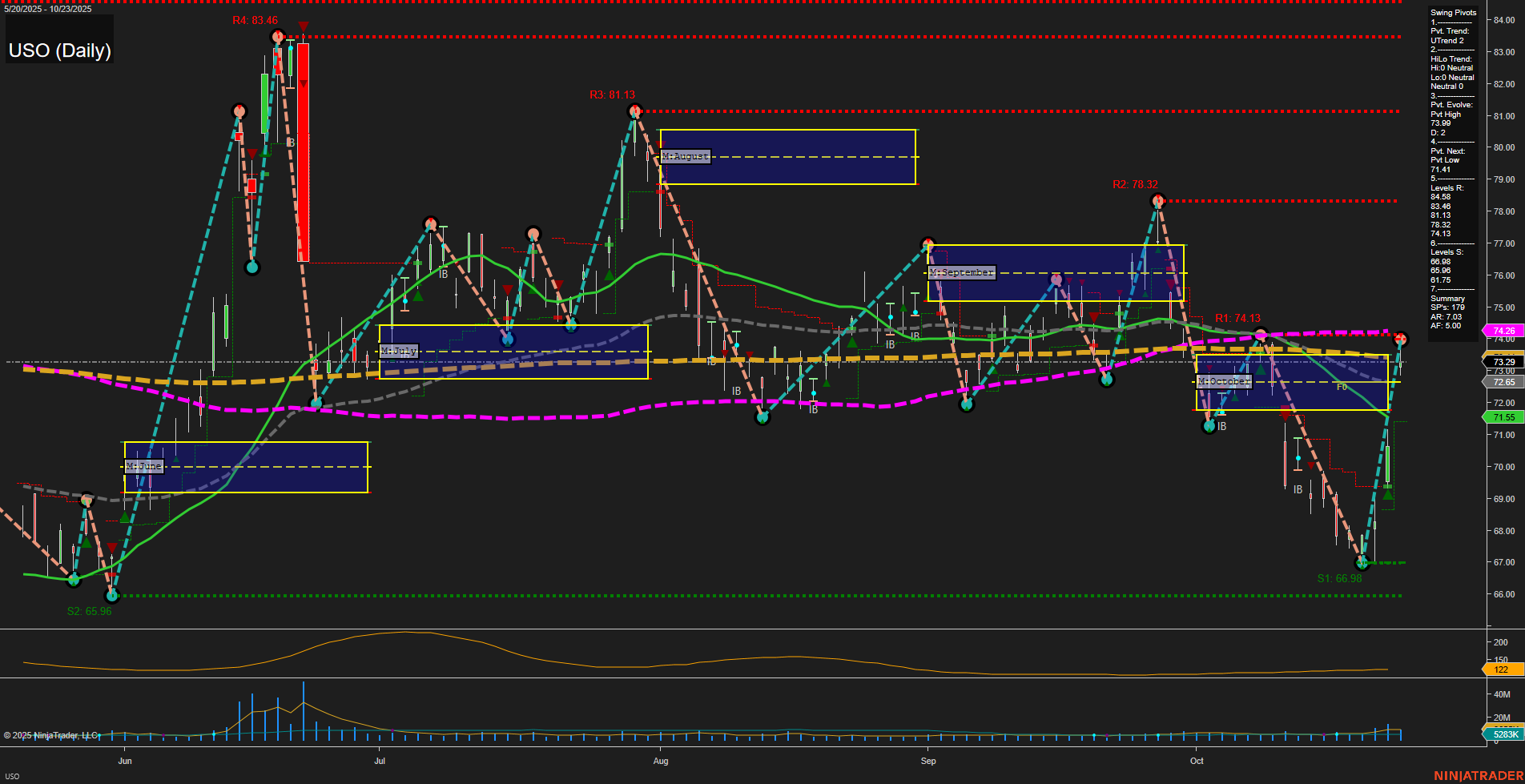

USO United States Oil Fund LP Daily Chart Analysis: 2025-Oct-24 07:52 CT

Price Action

- Last: 73.79,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: Neutral,

- 3. Pvt. Evolve: Pvt High 73.79,

- 4. Pvt. Next: Pvt Low 71.41,

- 5. Levels R: 83.46, 81.13, 78.32, 74.13,

- 6. Levels S: 66.98, 65.96.

Daily Benchmarks

- (Short-Term) 5 Day: 72.65 Up Trend,

- (Short-Term) 10 Day: 71.55 Up Trend,

- (Intermediate-Term) 20 Day: 72.05 Down Trend,

- (Intermediate-Term) 55 Day: 73.29 Down Trend,

- (Long-Term) 100 Day: 72.62 Down Trend,

- (Long-Term) 200 Day: 74.26 Down Trend.

Additional Metrics

- ATR: 138,

- VOLMA: 2,577,640.

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Neutral,

- Long-Term: Bearish.

Key Insights Summary

USO has experienced a sharp rally off recent lows, with large bars and fast momentum indicating strong short-term buying interest. The current swing pivot trend is up, and price has just marked a new pivot high at 73.79, with the next potential pivot low at 71.41. Resistance levels are stacked above, notably at 74.13 and higher, while support is well below at 66.98 and 65.96, suggesting a wide trading range. Short-term moving averages have turned up, confirming the bullish momentum, but intermediate and long-term benchmarks remain in downtrends, highlighting a lack of confirmation for a sustained reversal. The ATR is elevated, reflecting increased volatility, and volume is robust. Overall, the market is in a short-term bullish swing within a broader neutral-to-bearish context, with price action currently testing the lower end of the major moving average cluster. Swing traders should note the potential for continued volatility and the importance of monitoring for either a breakout continuation or a reversal at resistance.

Chart Analysis ATS AI Generated: 2025-10-24 07:53 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.