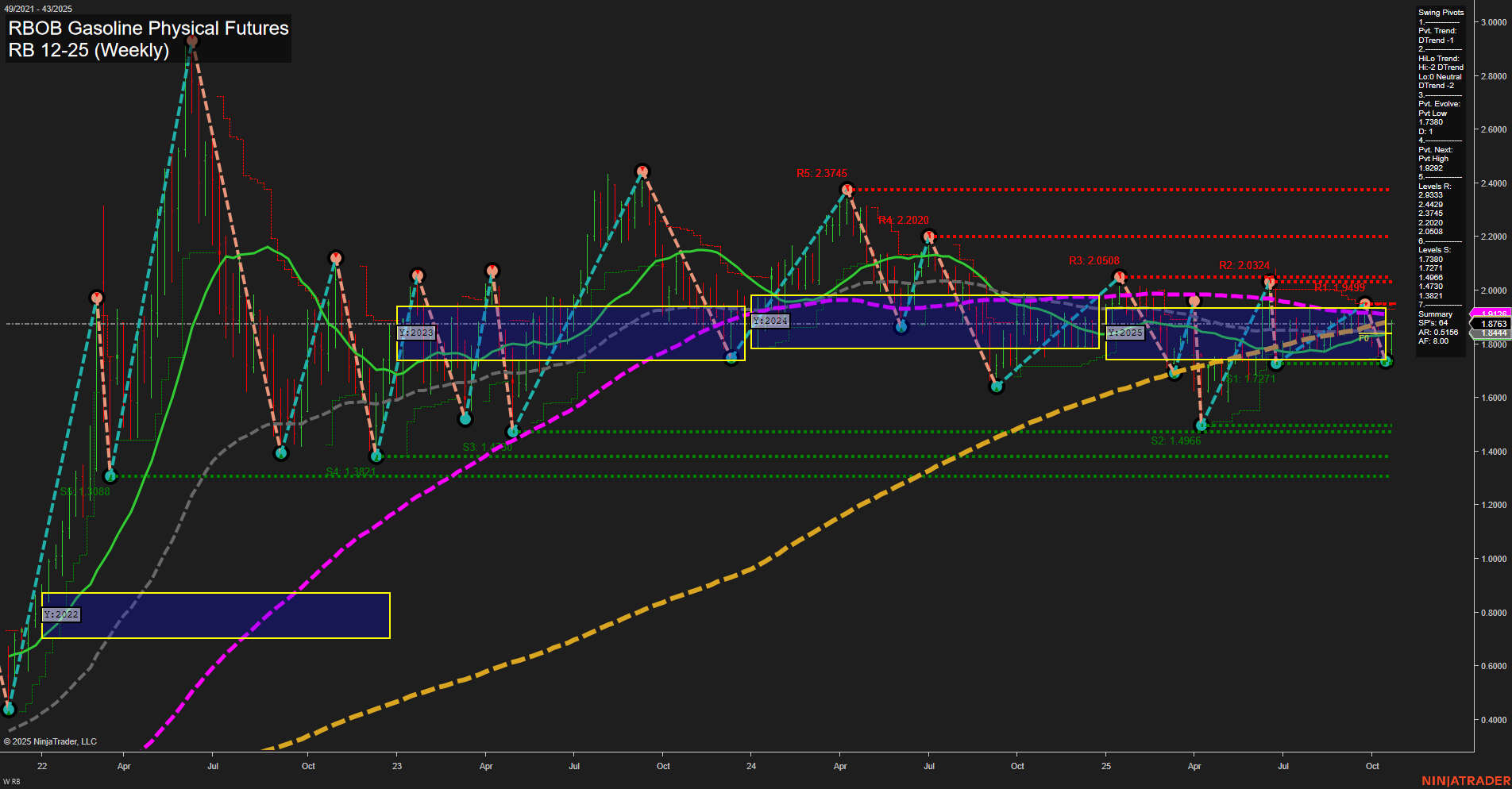

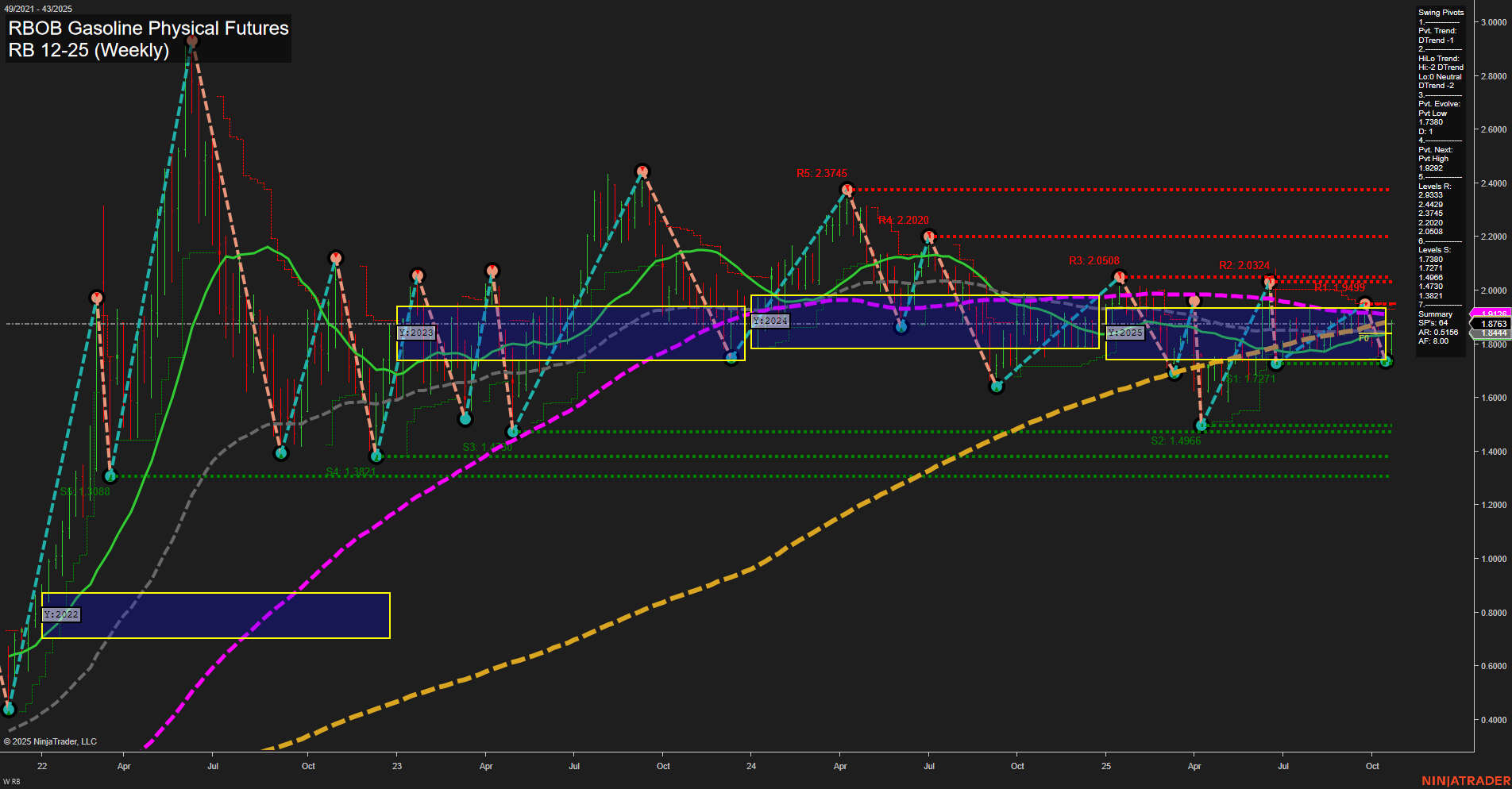

RB RBOB Gasoline Physical Futures Weekly Chart Analysis: 2025-Oct-24 07:47 CT

Price Action

- Last: 1.8912,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 98%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: 9%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 4%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 1.7380,

- 4. Pvt. Next: Pvt high 1.9923,

- 5. Levels R: 2.3745, 2.2020, 2.0508, 2.0324, 1.9923,

- 6. Levels S: 1.7380, 1.4971, 1.4271, 1.3821.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 1.8763 Up Trend,

- (Intermediate-Term) 10 Week: 1.8168 Up Trend,

- (Long-Term) 20 Week: 1.8912 Up Trend,

- (Long-Term) 55 Week: 1.8000 Up Trend,

- (Long-Term) 100 Week: 1.6000 Up Trend,

- (Long-Term) 200 Week: 1.4000 Up Trend.

Recent Trade Signals

- 24 Oct 2025: Long RB 12-25 @ 1.8843 Signals.USAR-MSFG

- 23 Oct 2025: Long RB 12-25 @ 1.8816 Signals.USAR.TR720

- 22 Oct 2025: Long RB 11-25 @ 1.8445 Signals.USAR-WSFG

- 16 Oct 2025: Short RB 11-25 @ 1.8111 Signals.USAR.TR120

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Neutral,

- Long-Term: Bullish.

Key Insights Summary

The RBOB Gasoline Physical Futures weekly chart shows a market in transition, with price action currently above all major moving averages and the NTZ center line, indicating underlying strength. The short-term trend is bullish, supported by upward momentum in the WSFG and a recent series of long trade signals. However, the intermediate-term HiLo trend is still in a downtrend, suggesting some residual consolidation or corrective activity within the broader uptrend. Long-term structure remains robustly bullish, with all major benchmarks trending higher and price well above key support levels. Resistance is layered above at 1.9923 and higher, while support is established at 1.7380 and below. The market appears to be emerging from a period of range-bound, choppy action, with the potential for a trend continuation if price can clear the next swing high. Volatility has moderated, and the recent higher lows point to a constructive base for further upside, though intermediate-term participants may still be watching for confirmation of a sustained breakout.

Chart Analysis ATS AI Generated: 2025-10-24 07:48 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.