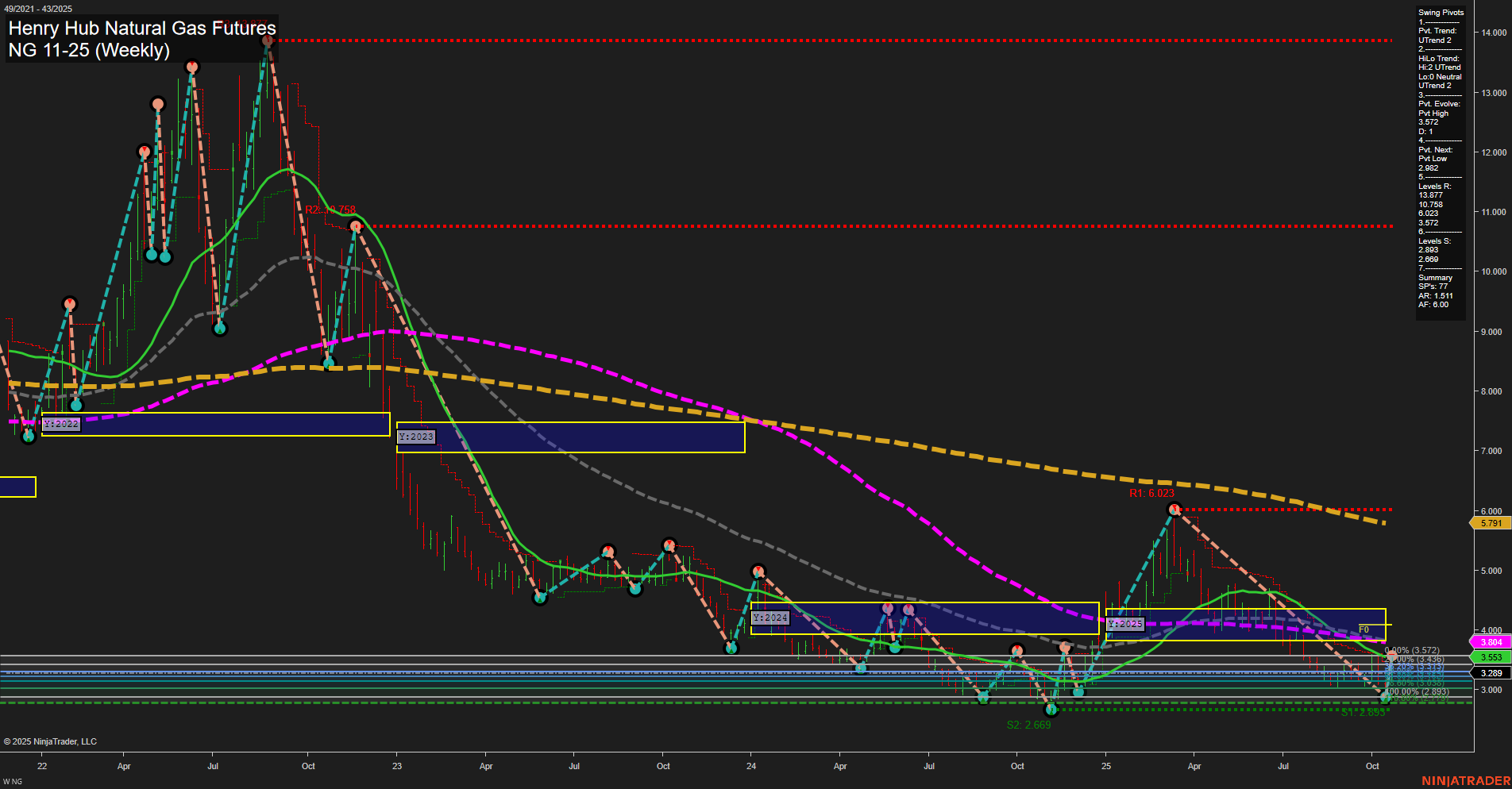

The weekly chart for NG Henry Hub Natural Gas Futures as of late October 2025 shows a market in consolidation after a prolonged downtrend. Price action is subdued, with medium-sized bars and slow momentum, reflecting indecision and a lack of strong directional conviction. All major Fib Grid trends (weekly, monthly, yearly) are neutral, indicating a pause in trend direction and a market searching for new catalysts. Swing pivot analysis highlights an evolving short-term uptrend, with the most recent pivot high at 3.572 and the next key support at 2.882. Both short- and intermediate-term swing trends are up, but the price remains below all major moving averages, which are aligned in a persistent downtrend from the 5-week through the 200-week benchmarks. This suggests that, despite some recent upward swings, the broader structure remains bearish. Recent trade signals are mixed, with both short and long entries triggered in the past week, further supporting the view of a choppy, range-bound environment. Resistance is layered above at 3.572 and 6.023, while support is found at 2.882 and 2.669, defining a broad trading range. Overall, the market is in a transitional phase, with short- and intermediate-term trends attempting to turn up against a dominant long-term bearish backdrop. The technical setup points to continued consolidation, with potential for volatility should price break decisively above resistance or below support. The lack of strong momentum and the alignment of moving averages to the downside suggest that any rallies may face significant overhead pressure unless a sustained catalyst emerges.