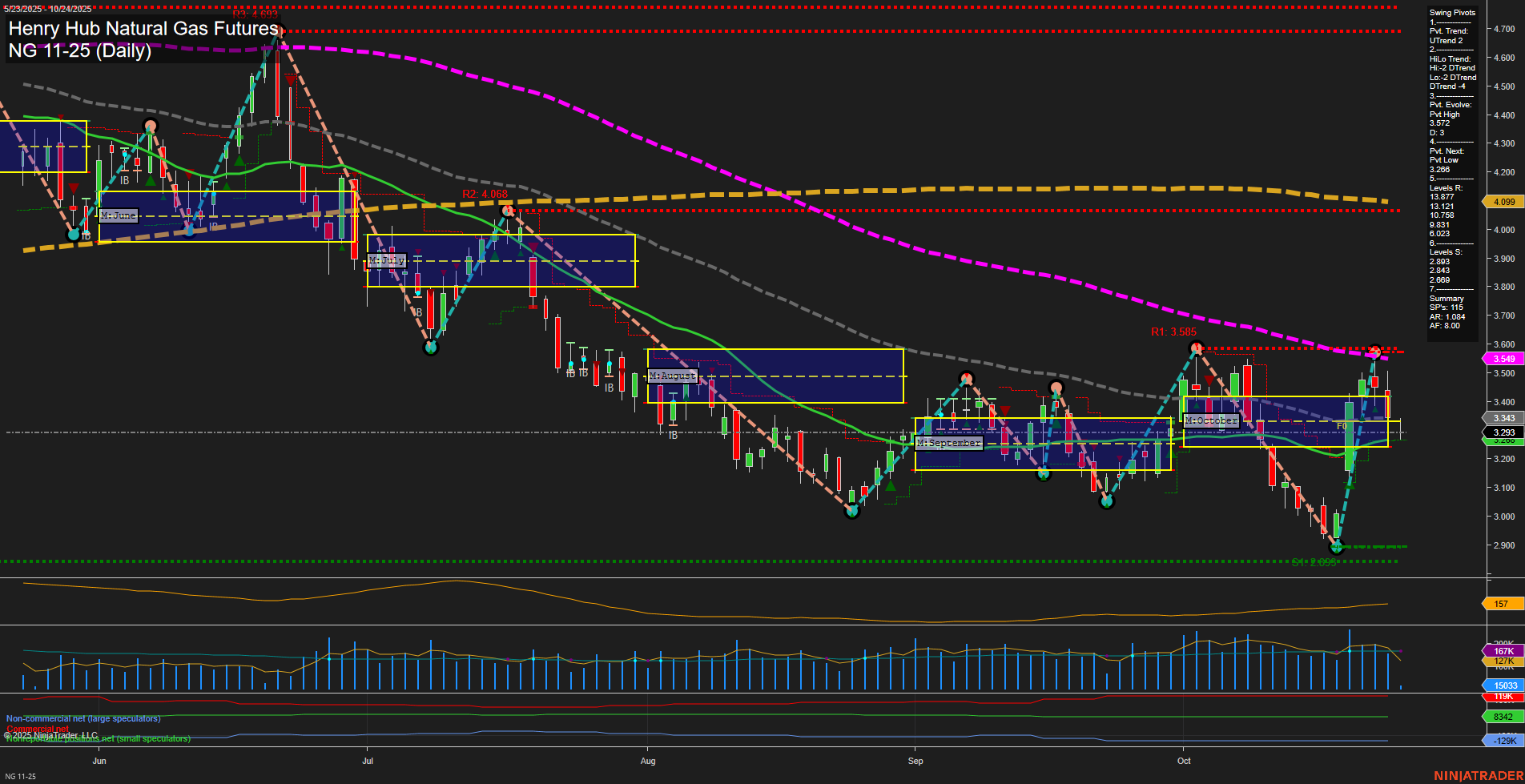

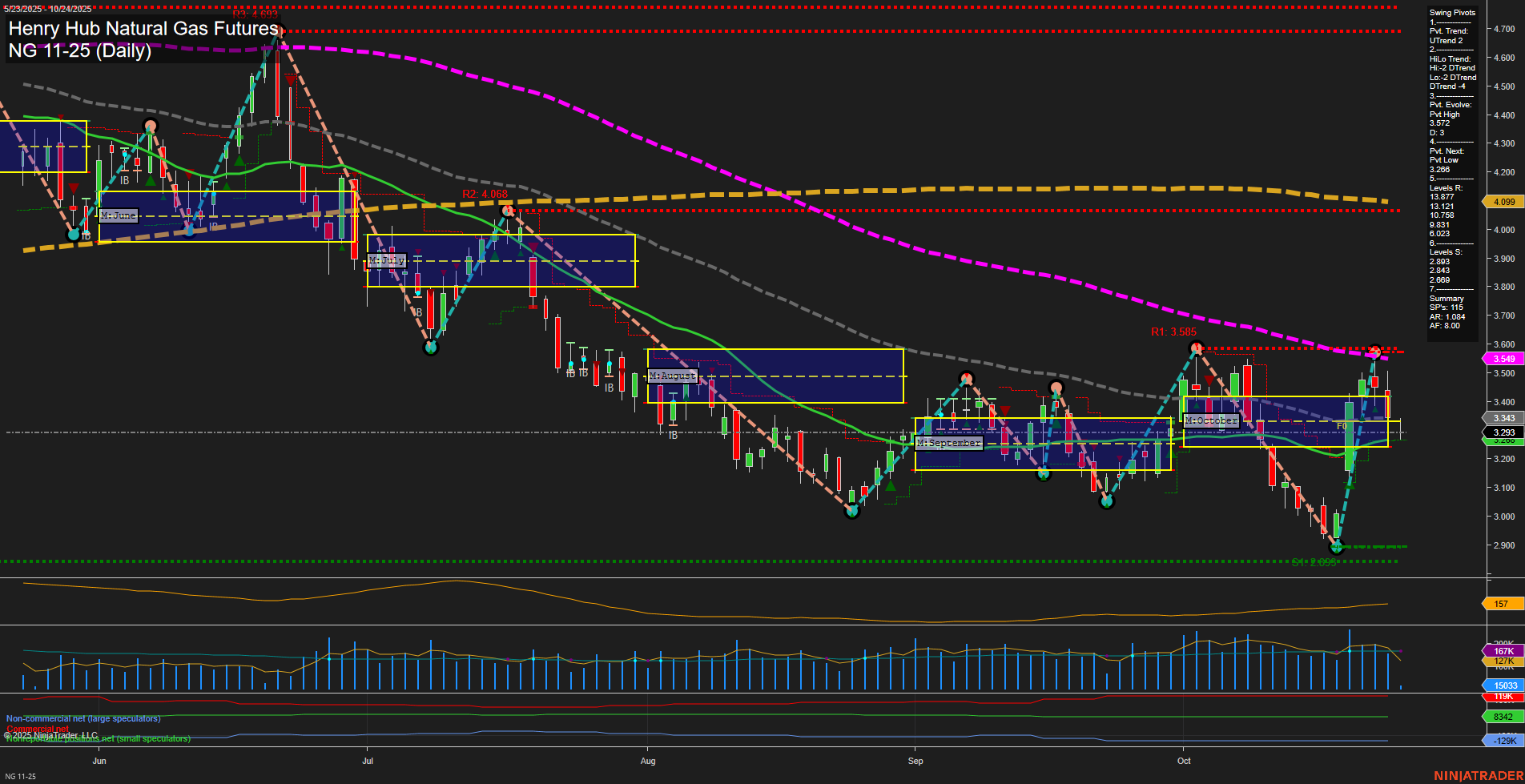

NG Henry Hub Natural Gas Futures Daily Chart Analysis: 2025-Oct-24 07:43 CT

Price Action

- Last: 3.293,

- Bars: Large,

- Mom: Fast.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt high 3.572,

- 4. Pvt. Next: Pvt low 3.298,

- 5. Levels R: 4.187, 3.585, 3.572, 3.343,

- 6. Levels S: 2.849, 2.669, 2.098.

Daily Benchmarks

- (Short-Term) 5 Day: 3.34 Up Trend,

- (Short-Term) 10 Day: 3.23 Up Trend,

- (Intermediate-Term) 20 Day: 3.20 Up Trend,

- (Intermediate-Term) 55 Day: 3.10 Down Trend,

- (Long-Term) 100 Day: 3.27 Down Trend,

- (Long-Term) 200 Day: 4.10 Down Trend.

Additional Metrics

Recent Trade Signals

- 23 Oct 2025: Short NG 11-25 @ 3.285 Signals.USAR-MSFG

- 23 Oct 2025: Short NG 11-25 @ 3.358 Signals.USAR.TR120

- 20 Oct 2025: Long NG 11-25 @ 3.304 Signals.USAR.TR720

- 20 Oct 2025: Long NG 11-25 @ 3.23 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Neutral,

- Long-Term: Bearish.

Key Insights Summary

Natural Gas futures have recently experienced a sharp rally, as indicated by large, fast momentum bars and a short-term uptrend in both price action and moving averages (5, 10, and 20 day MAs all trending up). However, the intermediate-term trend remains neutral, with the 55-day MA still in a downtrend and the swing pivot HiLo trend showing a downward bias. Long-term structure is bearish, with both the 100-day and 200-day MAs trending down and significant resistance overhead (notably at 3.585 and 4.187). The recent price surge has brought the market into a key resistance zone, with multiple short signals triggered near current levels, suggesting a potential for near-term pullback or consolidation. Volatility is elevated (ATR 285), and volume is robust, reflecting active participation. The market is at a technical crossroads: short-term momentum is strong, but longer-term headwinds and resistance levels may limit upside unless a sustained breakout occurs. Swing traders should note the mixed signals across timeframes, with short-term bullishness facing intermediate and long-term resistance.

Chart Analysis ATS AI Generated: 2025-10-24 07:43 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.