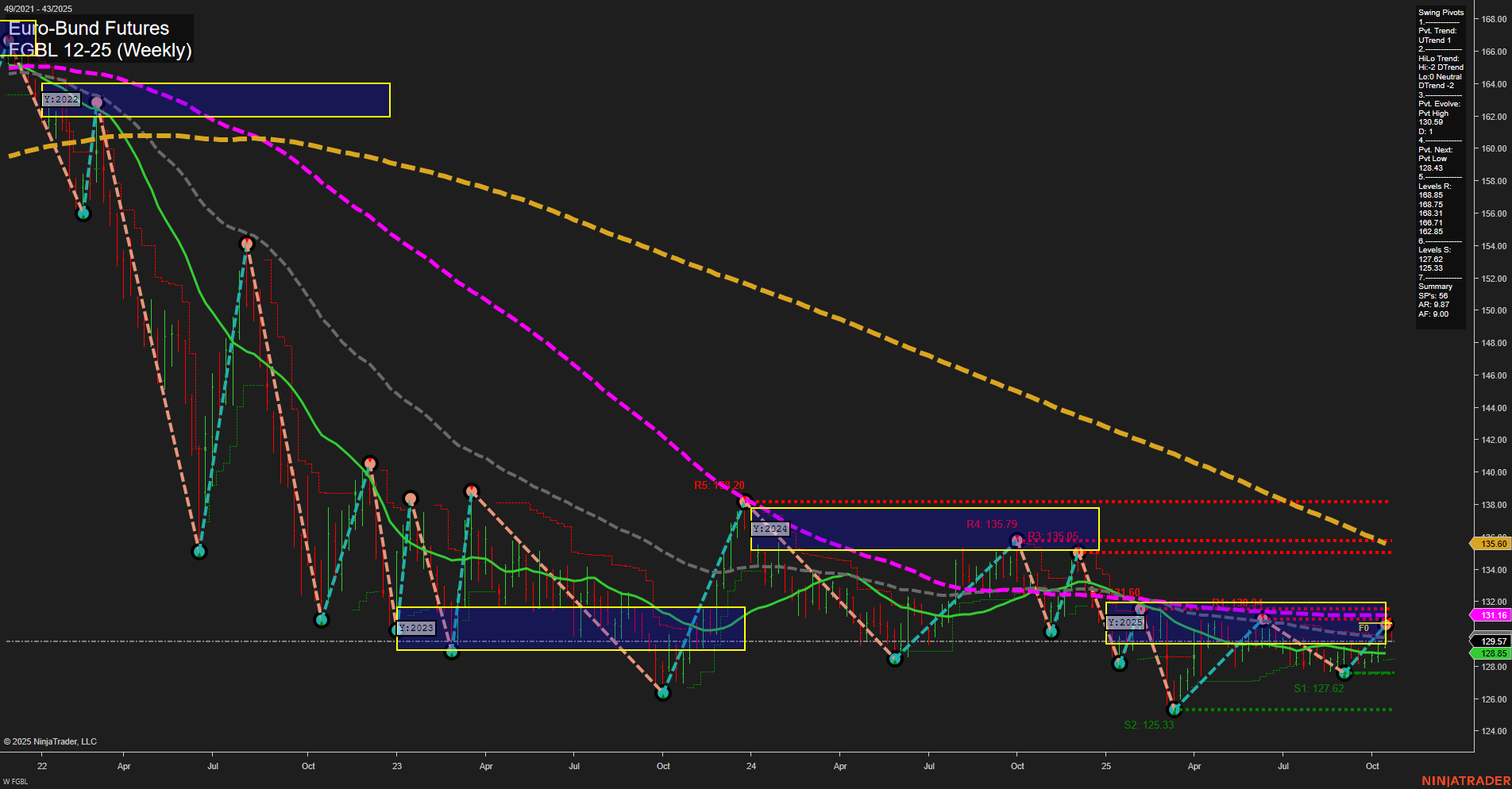

The FGBL Euro-Bund Futures weekly chart shows a market under persistent downward pressure across all major timeframes. Price action is subdued, with medium-sized bars and slow momentum, reflecting a lack of strong directional conviction. The short-term Weekly Session Fib Grid (WSFG) and long-term Yearly Session Fib Grid (YSFG) both indicate price trading below their respective NTZ/F0% levels, confirming a prevailing downtrend. Intermediate-term Monthly Session Fib Grid (MSFG) is the only outlier, showing an uptrend, but this is likely a countertrend move within a broader bearish structure. Swing pivot analysis highlights a dominant downtrend in both short-term and intermediate-term trends, with the most recent pivot high at 130.19 and the next key support at 128.43. Resistance levels cluster above at 129.75, 130.19, and 131.71, while support is found at 127.62 and 125.33. All benchmark moving averages from 5-week to 200-week are trending down, reinforcing the bearish outlook. Recent trade signals show mixed short-term activity but are generally aligned with the prevailing downward momentum. The overall technical landscape suggests the market is in a corrective or consolidative phase within a larger downtrend, with rallies being sold and support levels being tested. The environment remains challenging for bullish swing trades, with the path of least resistance still to the downside.