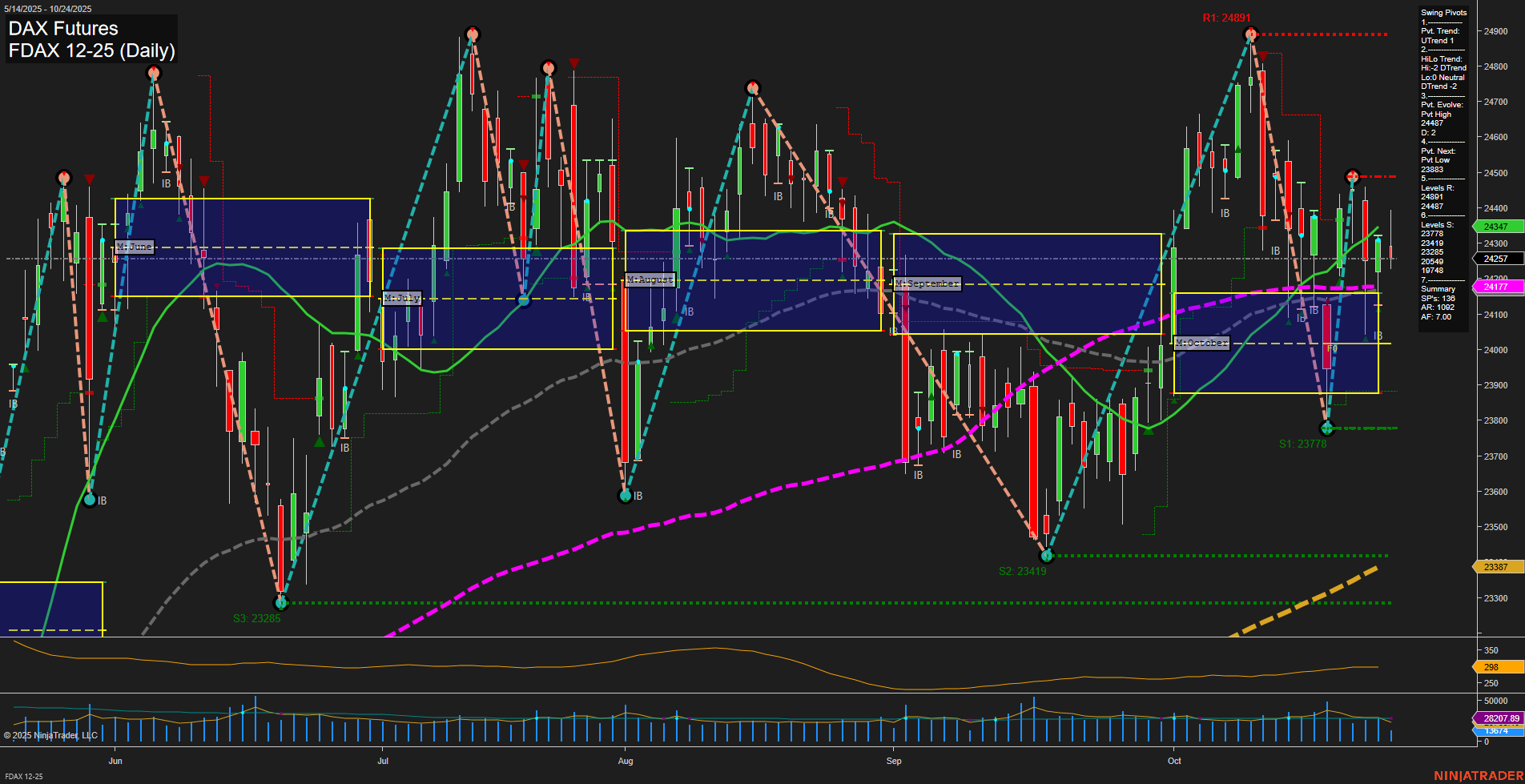

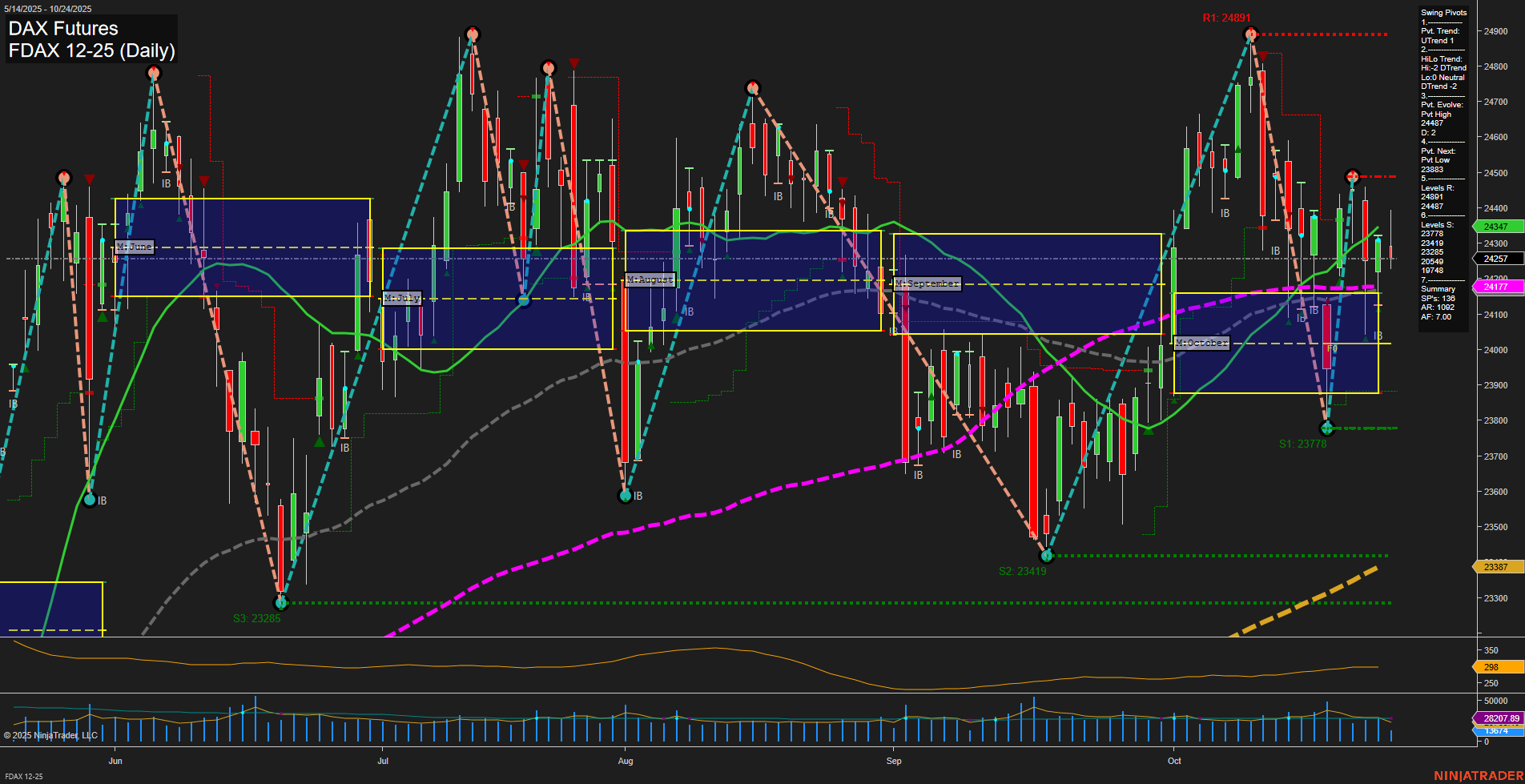

FDAX DAX Futures Daily Chart Analysis: 2025-Oct-24 07:39 CT

Price Action

- Last: 24,437,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 38%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: 32%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 116%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt High 24,891,

- 4. Pvt. Next: Pvt low 23,883,

- 5. Levels R: 24,891, 24,487,

- 6. Levels S: 23,778, 23,419, 23,285.

Daily Benchmarks

- (Short-Term) 5 Day: 24,330 Up Trend,

- (Short-Term) 10 Day: 24,157 Up Trend,

- (Intermediate-Term) 20 Day: 24,177 Up Trend,

- (Intermediate-Term) 55 Day: 24,017 Down Trend,

- (Long-Term) 100 Day: 24,577 Up Trend,

- (Long-Term) 200 Day: 23,387 Up Trend.

Additional Metrics

Recent Trade Signals

- 20 Oct 2025: Long FDAX 12-25 @ 24,227 Signals.USAR.TR120

- 20 Oct 2025: Long FDAX 12-25 @ 24,227 Signals.USAR-MSFG

- 20 Oct 2025: Long FDAX 12-25 @ 24,137 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Neutral,

- Long-Term: Bullish.

Key Insights Summary

The FDAX daily chart shows a market in recovery mode after a recent swing low at 23,778, with price action now above key monthly and weekly session fib grid levels, indicating renewed upward momentum. The short-term trend is bullish, supported by a series of recent long trade signals and upward-sloping short-term moving averages. Intermediate-term signals are mixed, with the HiLo trend still in a downtrend, suggesting the market is in a transition phase and may be consolidating after a strong bounce. Long-term structure remains bullish, with price well above the 200-day and 100-day moving averages, and the yearly fib grid trend firmly up. Volatility is moderate, and volume is steady, supporting the current move. The market is testing resistance near 24,487 and 24,891, with support levels at 23,778 and below, setting up a potential range for the next swing. Overall, the technical backdrop favors a bullish bias in the short and long term, while the intermediate-term outlook is neutral as the market digests recent gains and awaits further directional cues.

Chart Analysis ATS AI Generated: 2025-10-24 07:40 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.