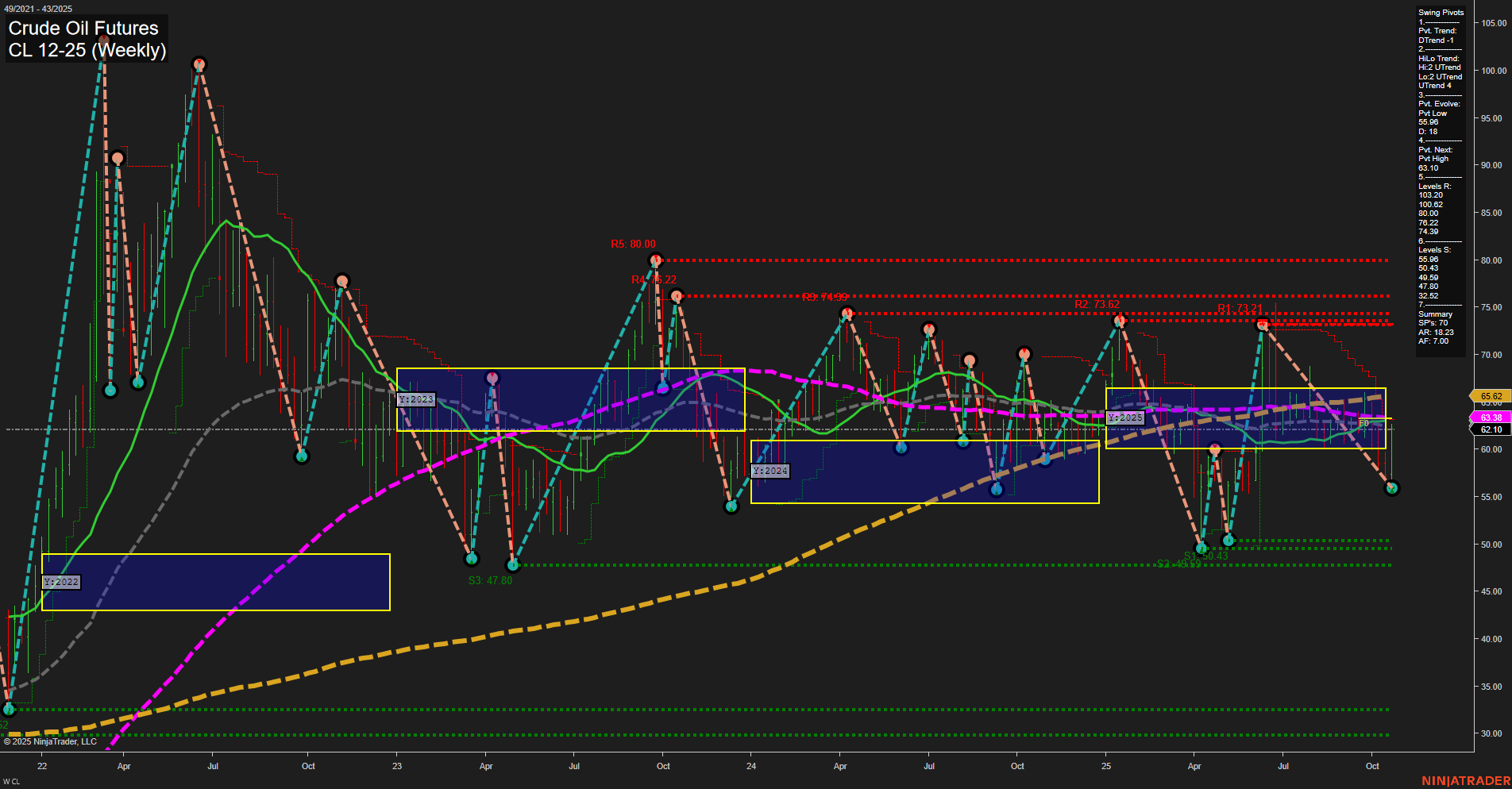

Crude oil futures are currently trading at 62.10, with medium-sized bars and slow momentum, indicating a period of consolidation after recent volatility. The short-term WSFG and intermediate-term MSFG both show price above their respective NTZ centers and are trending up, suggesting a recent bounce or recovery attempt. However, the yearly YSFG trend remains down, with price below the annual NTZ, reflecting persistent long-term weakness. Swing pivots highlight a short-term downtrend, but the intermediate-term HiLo trend is up, pointing to a possible transition phase or a corrective rally within a broader downtrend. Resistance levels are clustered in the low-to-mid 70s and 80, while support is established in the mid-50s and lower, indicating a wide trading range. All benchmark moving averages from 5 to 200 weeks are in a downtrend, reinforcing the dominant bearish long-term structure. Recent trade signals have triggered long entries in the high 50s to low 60s, aligning with the short-term and intermediate-term upward bias but counter to the prevailing long-term trend. Overall, the market is in a complex phase: short-term action is neutral as price consolidates, intermediate-term signals are bullish on a potential recovery, but the long-term outlook remains bearish. This reflects a market caught between a possible cyclical bottoming process and ongoing structural weakness, with volatility likely as price tests key support and resistance levels.