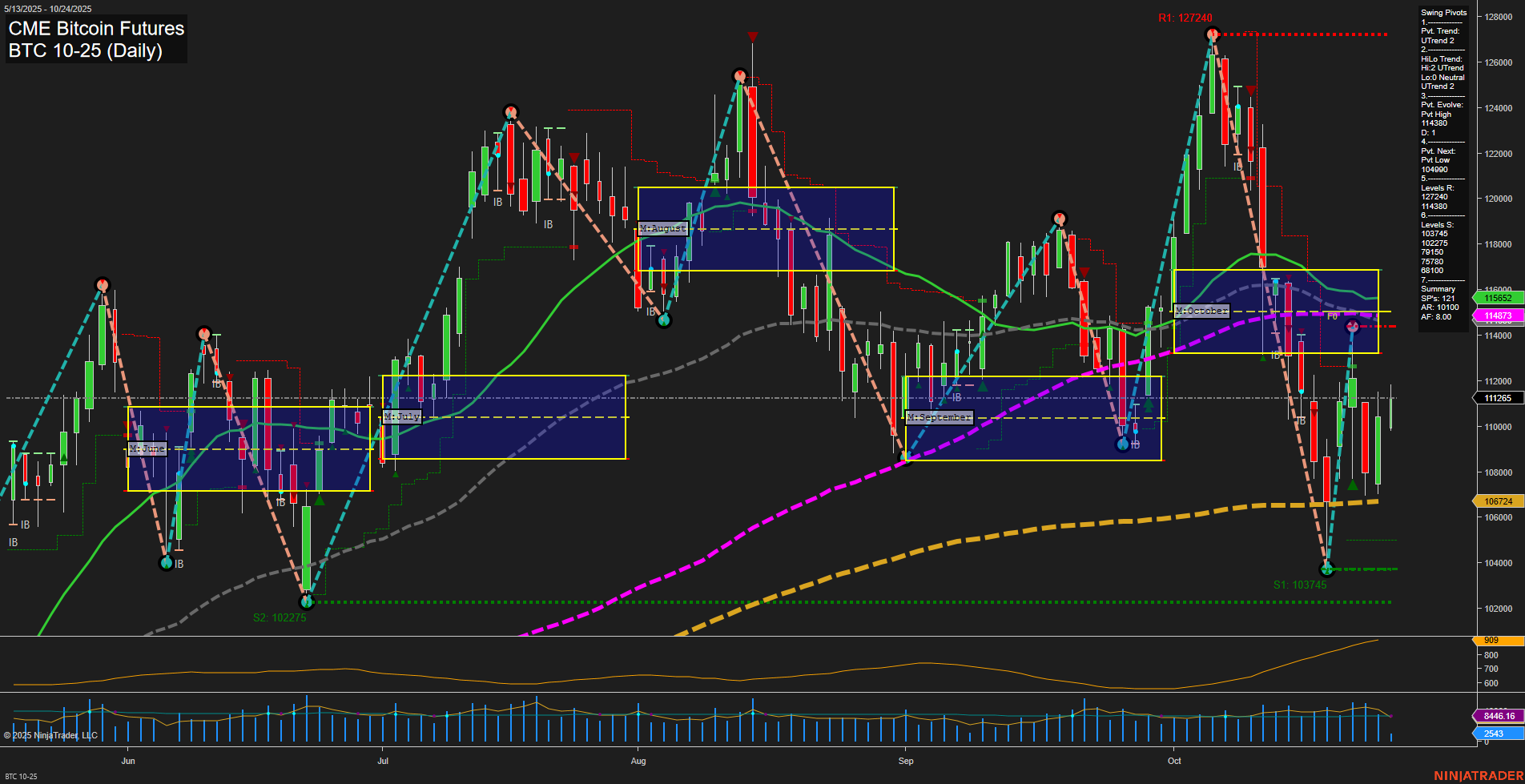

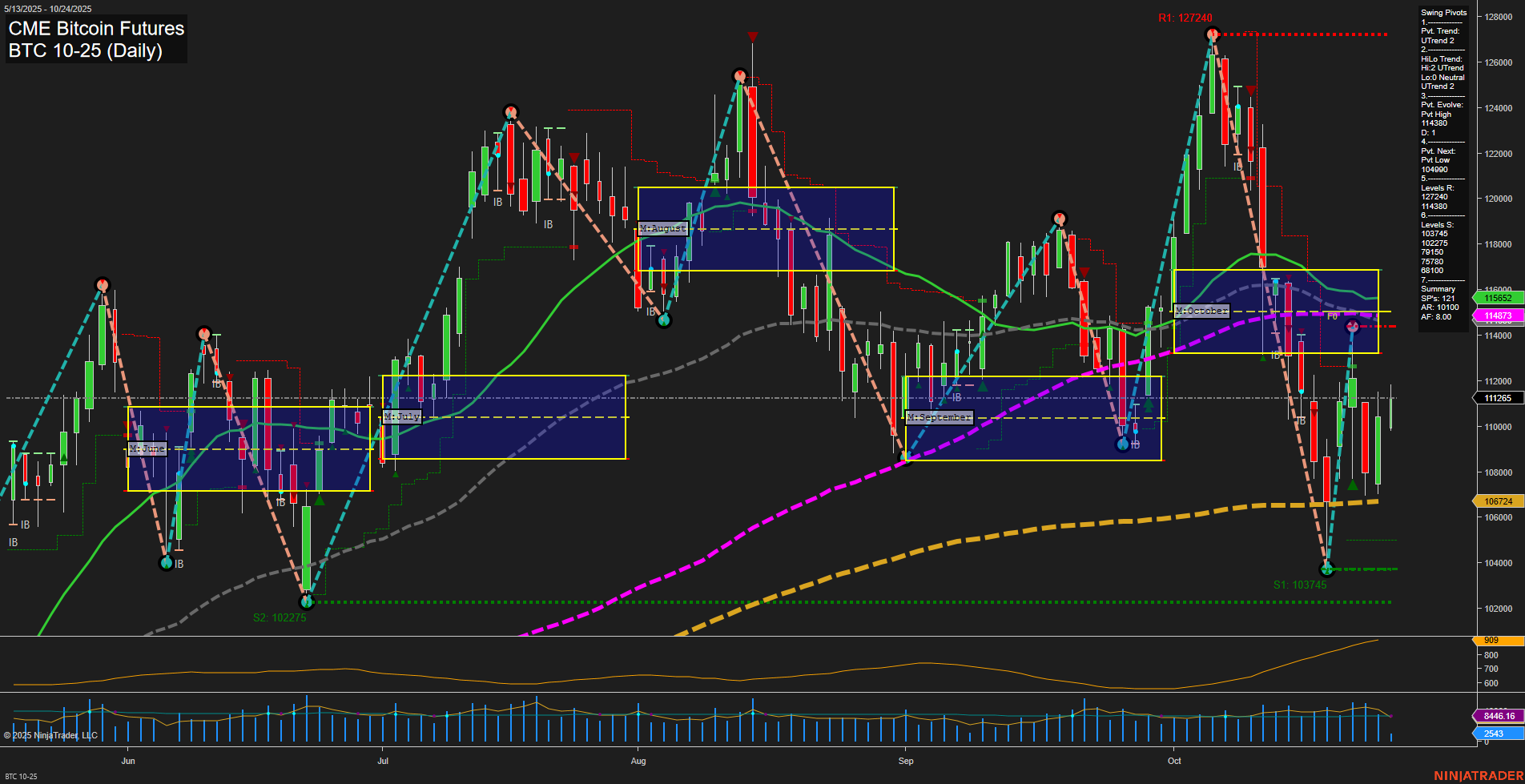

BTC CME Bitcoin Futures Daily Chart Analysis: 2025-Oct-24 07:33 CT

Price Action

- Last: 111265,

- Bars: Large,

- Mom: Fast.

WSFG Weekly

- Short-Term

- WSFG Current: 40%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: -26%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 44%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 103745,

- 4. Pvt. Next: Pvt high 114380,

- 5. Levels R: 127240, 114380, 112765, 110275,

- 6. Levels S: 103745, 102275.

Daily Benchmarks

- (Short-Term) 5 Day: 111552 Down Trend,

- (Short-Term) 10 Day: 114373 Down Trend,

- (Intermediate-Term) 20 Day: 115652 Down Trend,

- (Intermediate-Term) 55 Day: 115652 Down Trend,

- (Long-Term) 100 Day: 114373 Down Trend,

- (Long-Term) 200 Day: 106724 Up Trend.

Additional Metrics

Recent Trade Signals

- 23 Oct 2025: Long BTC 10-25 @ 109710 Signals.USAR-WSFG

- 22 Oct 2025: Short BTC 10-25 @ 108170 Signals.USAR.TR120

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bullish.

Key Insights Summary

The current BTC CME futures daily chart reflects a market in transition. Price action has been volatile, with large bars and fast momentum indicating heightened activity and possible short-term exhaustion. The short-term (WSFG) trend is up, but the price is currently below the monthly session fib grid (MSFG), which is trending down, suggesting intermediate-term weakness. Both short-term and intermediate-term swing pivot trends are down, with the most recent pivot low at 103745 and the next key resistance at 114380. Daily benchmarks across short and intermediate timeframes are all in downtrends, reinforcing the prevailing bearish sentiment in the near term. However, the long-term (YSFG) trend remains up, and the 200-day moving average is still in an uptrend, indicating that the broader bullish structure is intact. Recent trade signals show both long and short entries, highlighting the choppy and reactive nature of the current environment. Overall, the market is experiencing a corrective phase within a larger uptrend, with potential for further volatility as it tests key support and resistance levels.

Chart Analysis ATS AI Generated: 2025-10-24 07:34 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.