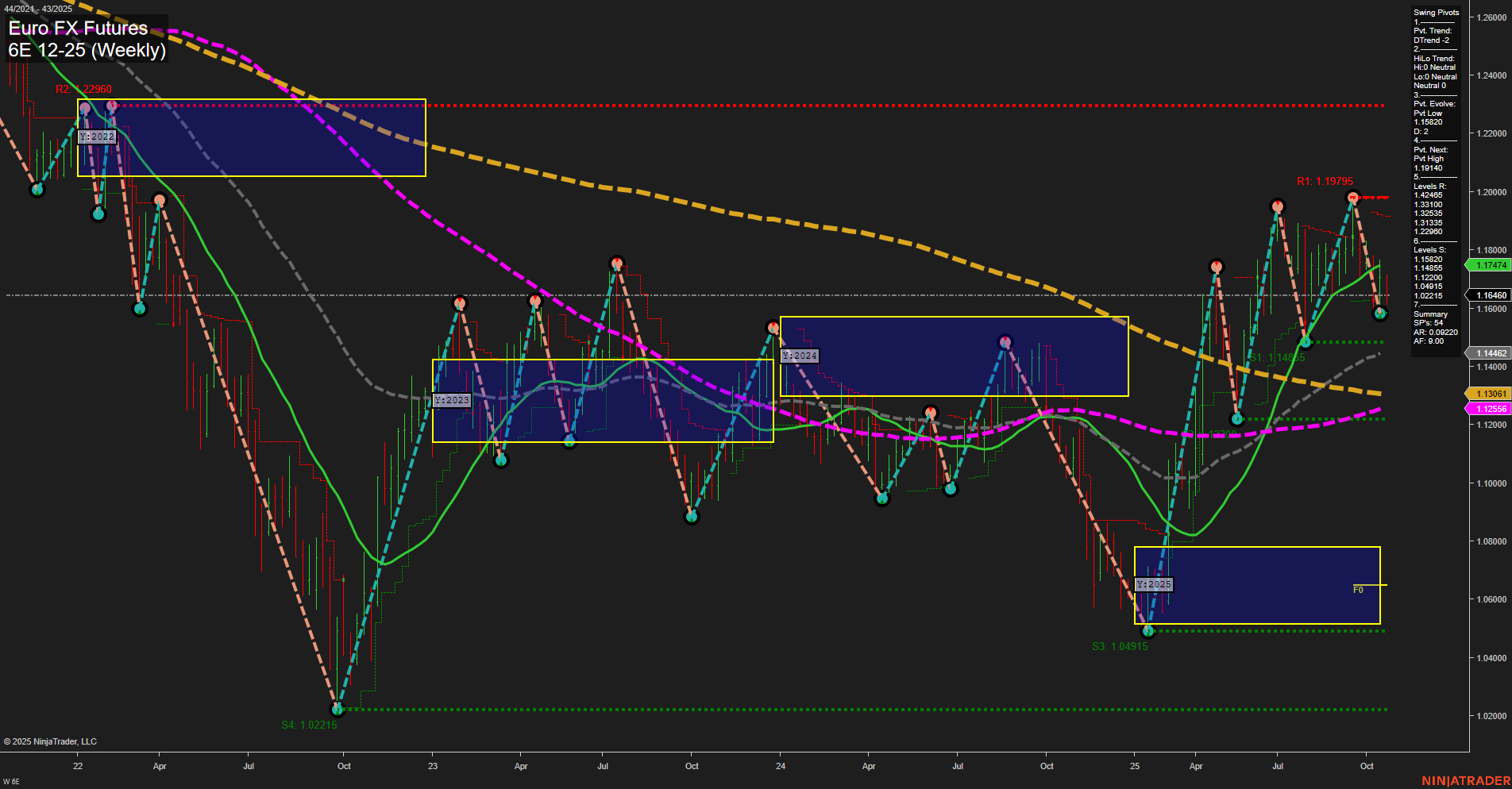

The 6E Euro FX Futures weekly chart shows a complex interplay of trends across timeframes. Short-term momentum is average, with price action currently below the weekly and monthly session fib grid (WSFG, MSFG) neutral zones, both of which are trending down. This is reinforced by a recent short signal and a short-term swing pivot downtrend, suggesting continued short-term bearishness. However, the intermediate-term picture is more mixed: while the monthly grid is down, the HiLo swing trend is up, and the 10- and 20-week moving averages are in uptrends, indicating a possible transition or consolidation phase. Long-term, the yearly session fib grid is strongly up, with price well above the yearly neutral zone and most long-term moving averages (20, 55 week) trending higher, though the 100- and 200-week MAs remain in downtrends, reflecting legacy resistance. Key resistance sits at 1.1979 and 1.2333, while support is clustered at 1.1464 and below. The market appears to be in a corrective pullback within a larger bullish structure, with short-term weakness but underlying long-term strength. Volatility remains moderate, and the market is likely digesting prior gains, with potential for further consolidation or a retest of support before any sustained move higher.