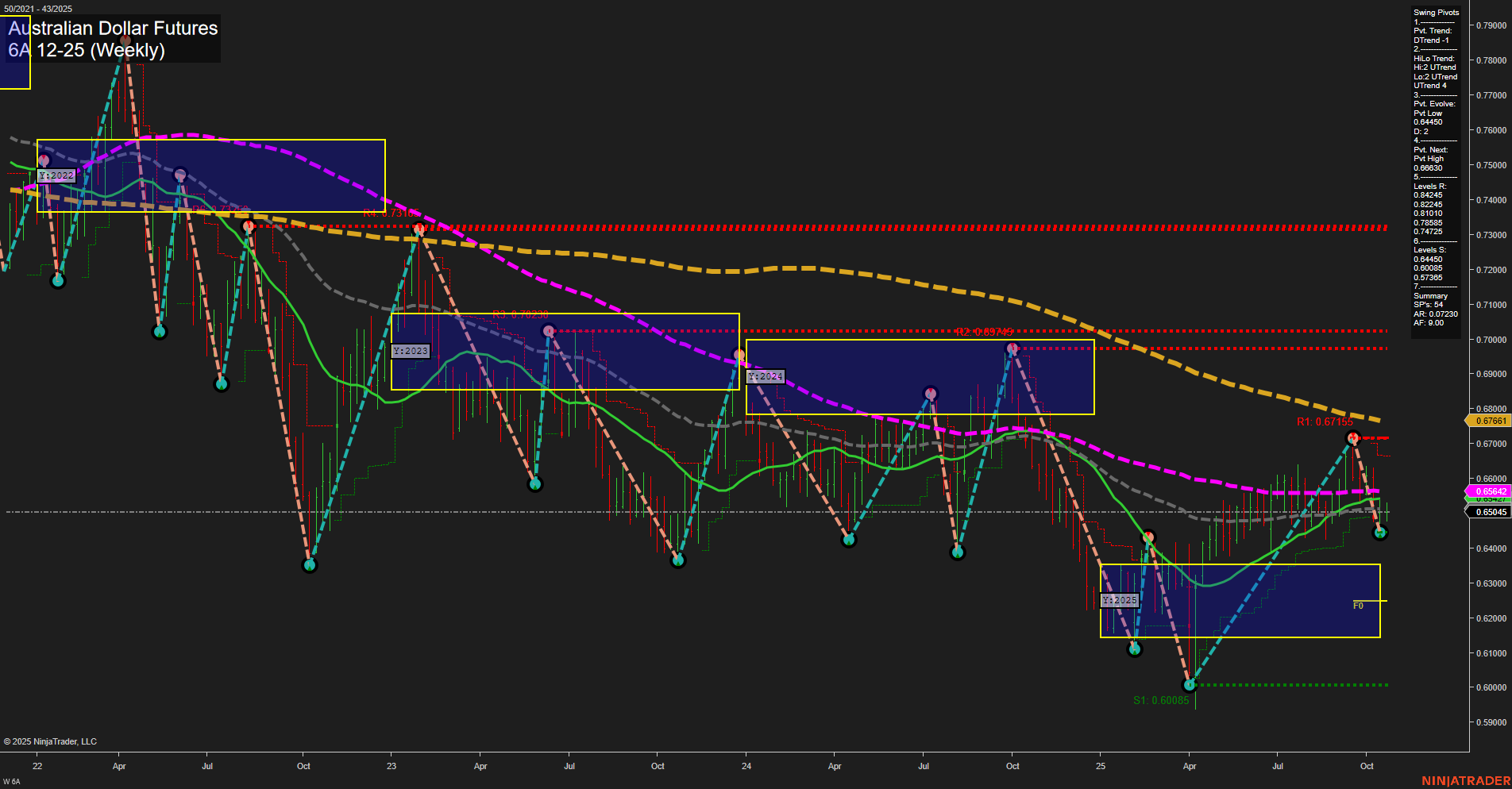

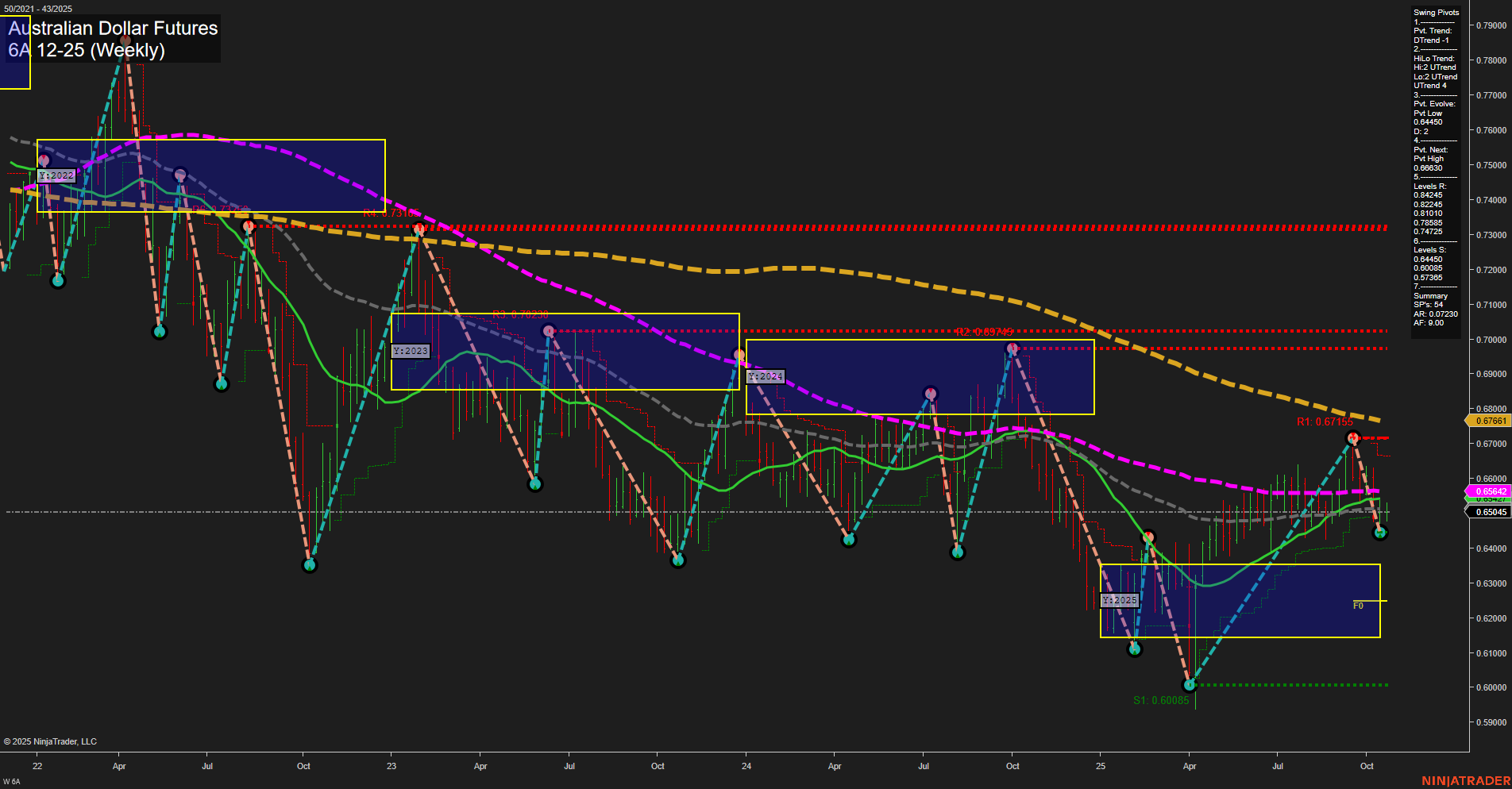

6A Australian Dollar Futures Weekly Chart Analysis: 2025-Oct-24 07:30 CT

Price Action

- Last: 0.6542,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 0.65045,

- 4. Pvt. Next: Pvt high 0.67661,

- 5. Levels R: 0.67661, 0.67155, 0.66008, 0.65735,

- 6. Levels S: 0.65045, 0.60085.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 0.6545 Down Trend,

- (Intermediate-Term) 10 Week: 0.6505 Up Trend,

- (Long-Term) 20 Week: 0.6542 Up Trend,

- (Long-Term) 55 Week: 0.6600 Down Trend,

- (Long-Term) 100 Week: 0.6650 Down Trend,

- (Long-Term) 200 Week: 0.6766 Down Trend.

Recent Trade Signals

- 23 Oct 2025: Long 6A 12-25 @ 0.6521 Signals.USAR-WSFG

- 20 Oct 2025: Long 6A 12-25 @ 0.65205 Signals.USAR.TR120

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Neutral,

- Long-Term: Bearish.

Key Insights Summary

The 6A Australian Dollar Futures weekly chart shows a market in transition, with price currently consolidating near 0.6542 after a recent bounce from support. Short-term momentum is average, and the price action is characterized by medium-sized bars, indicating neither strong trending nor high volatility. The Weekly, Monthly, and Yearly Session Fib Grids all reflect a neutral bias, suggesting a lack of clear directional conviction across timeframes. Swing pivot analysis highlights a short-term downtrend, but the intermediate-term trend remains up, with the next significant resistance at 0.67661 and support at 0.65045. Moving averages are mixed: short and intermediate-term MAs are flat to slightly positive, while longer-term MAs (55, 100, 200 week) remain in a downtrend, reinforcing a bearish long-term outlook. Recent trade signals have triggered long entries, but the overall environment is one of consolidation and indecision, with price caught between major support and resistance levels. The market appears to be in a corrective phase within a broader bearish structure, with no clear breakout or breakdown yet established.

Chart Analysis ATS AI Generated: 2025-10-24 07:31 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.