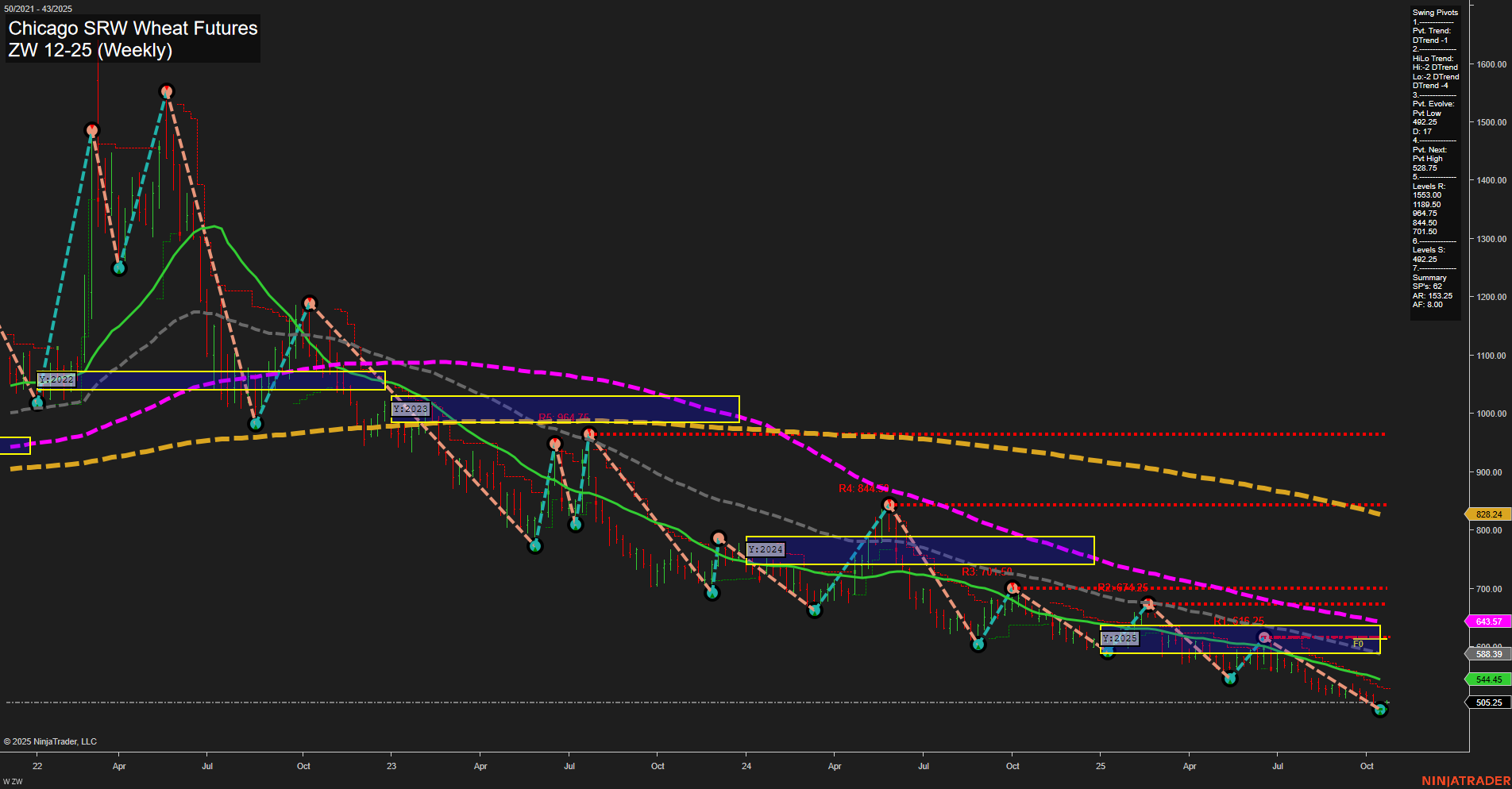

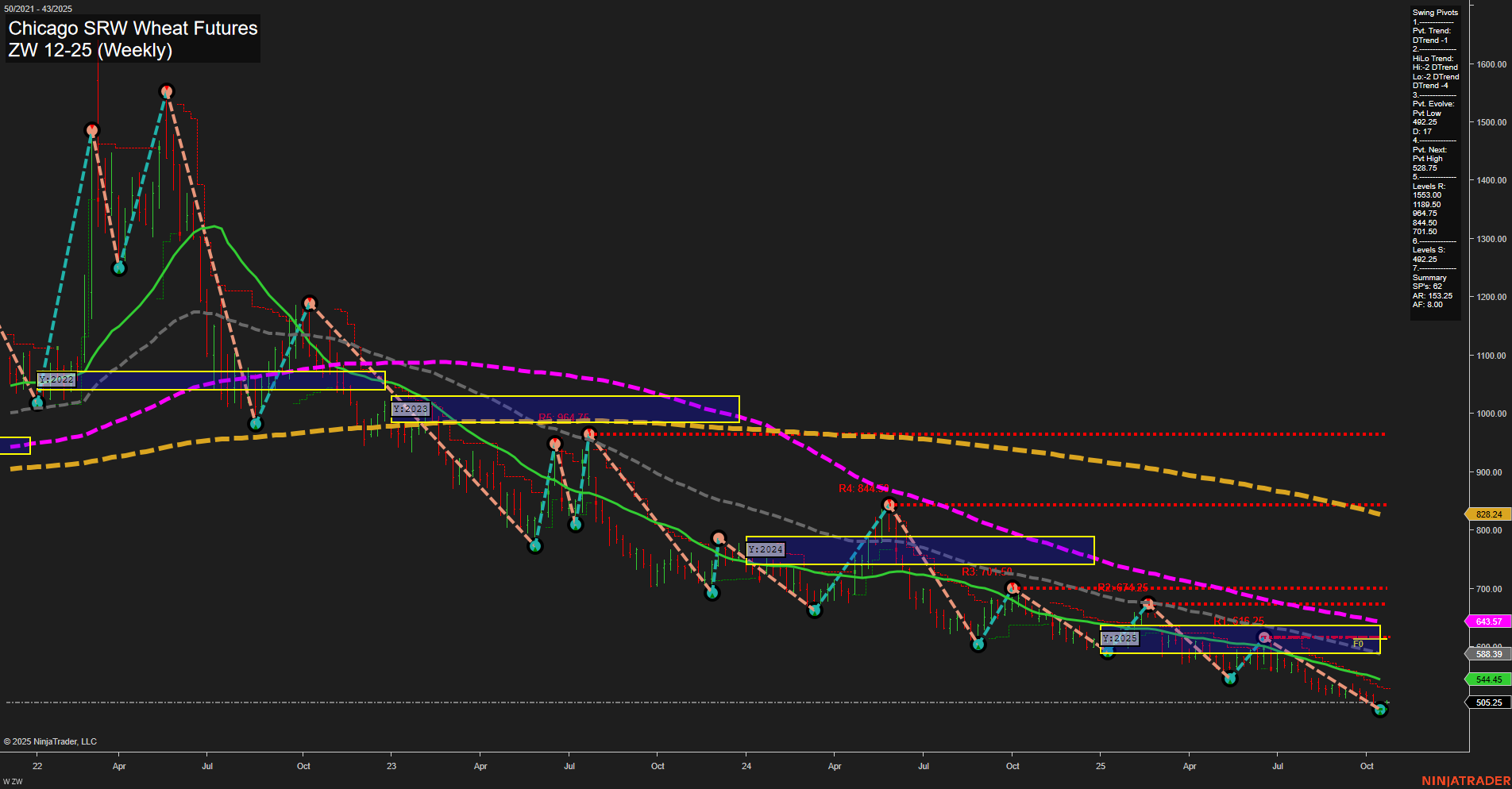

ZW Chicago SRW Wheat Futures Weekly Chart Analysis: 2025-Oct-23 07:25 CT

Price Action

- Last: 505.25,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: 1%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: -6%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: -46%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 492.25,

- 4. Pvt. Next: Pvt high 528.75,

- 5. Levels R: 1143.00, 1048.50, 944.50, 844.50, 701.50, 646.25,

- 6. Levels S: 492.25.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: [not shown] [Down Trend],

- (Intermediate-Term) 10 Week: [not shown] [Down Trend],

- (Long-Term) 20 Week: 544.54 Down Trend,

- (Long-Term) 55 Week: 588.39 Down Trend,

- (Long-Term) 100 Week: 643.57 Down Trend,

- (Long-Term) 200 Week: 828.24 Down Trend.

Recent Trade Signals

- 22 Oct 2025: Short ZW 12-25 @ 499.25 Signals.USAR-MSFG

- 21 Oct 2025: Short ZW 12-25 @ 500 Signals.USAR.TR120

- 20 Oct 2025: Long ZW 12-25 @ 506.5 Signals.USAR-WSFG

Overall Rating

- Short-Term: Neutral

- Intermediate-Term: Bearish

- Long-Term: Bearish

Key Insights Summary

The ZW Chicago SRW Wheat Futures market remains in a pronounced long-term and intermediate-term downtrend, as indicated by the negative YSFG and MSFG trends, and the persistent downward direction of all major long-term moving averages. Price action is subdued, with slow momentum and medium-sized bars, reflecting a lack of strong conviction in either direction. The most recent swing pivot is a low at 492.25, with the next potential resistance at 528.75, but the overall structure continues to print lower highs and lower lows. Short-term, there is a slight upward bias as price sits just above the weekly session fib grid center, but this is countered by recent short trade signals and the dominant downward trends in higher timeframes. The market is consolidating near multi-year lows, with only minor support at 492.25 and significant resistance overhead. This environment suggests ongoing pressure from sellers, with any rallies likely to encounter resistance from the prevailing bearish structure and long-term moving averages. The technical landscape is characterized by persistent weakness, failed recoveries, and a lack of bullish follow-through, keeping the overall outlook negative except for brief short-term stabilization attempts.

Chart Analysis ATS AI Generated: 2025-10-23 07:26 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.