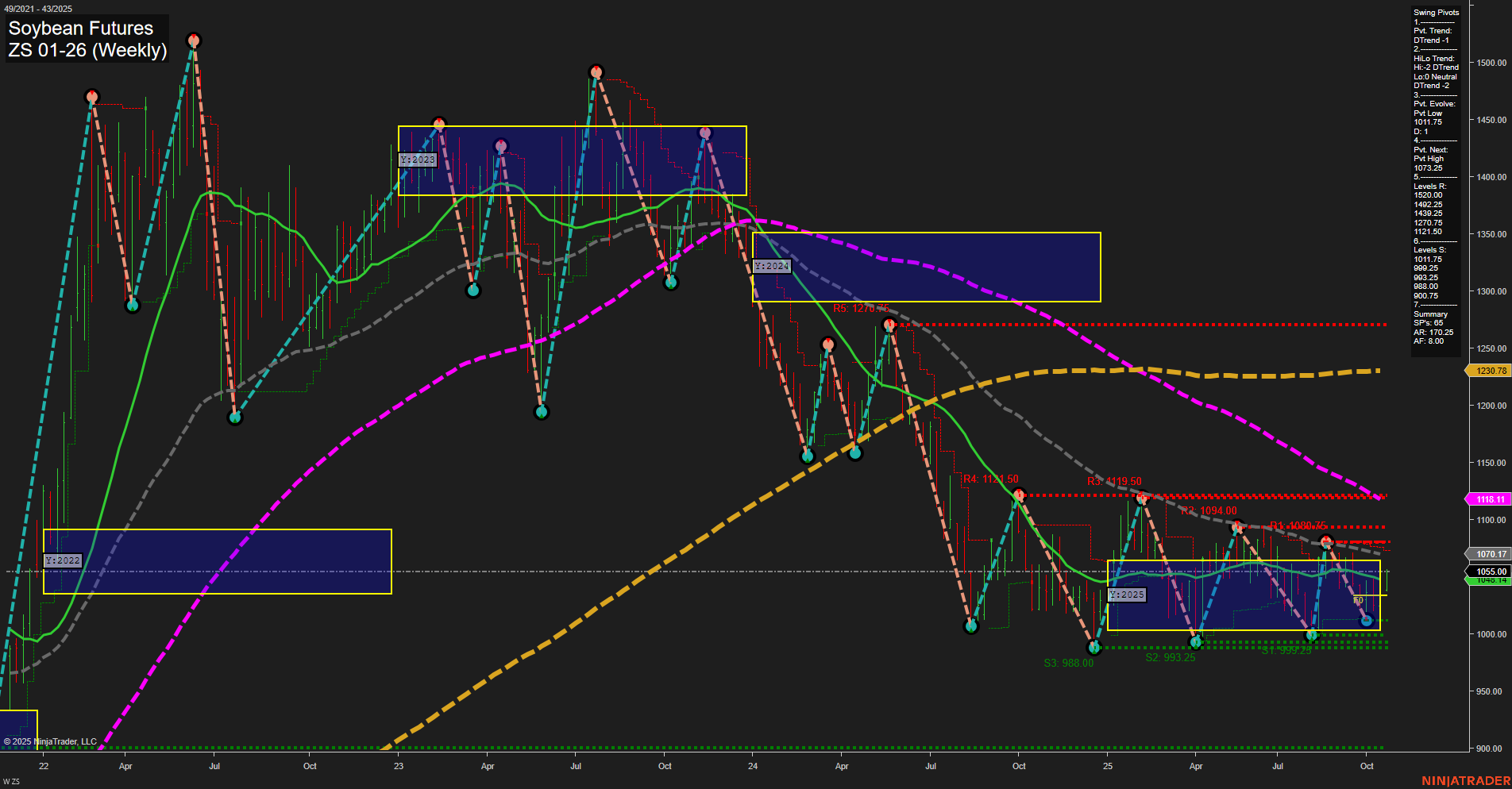

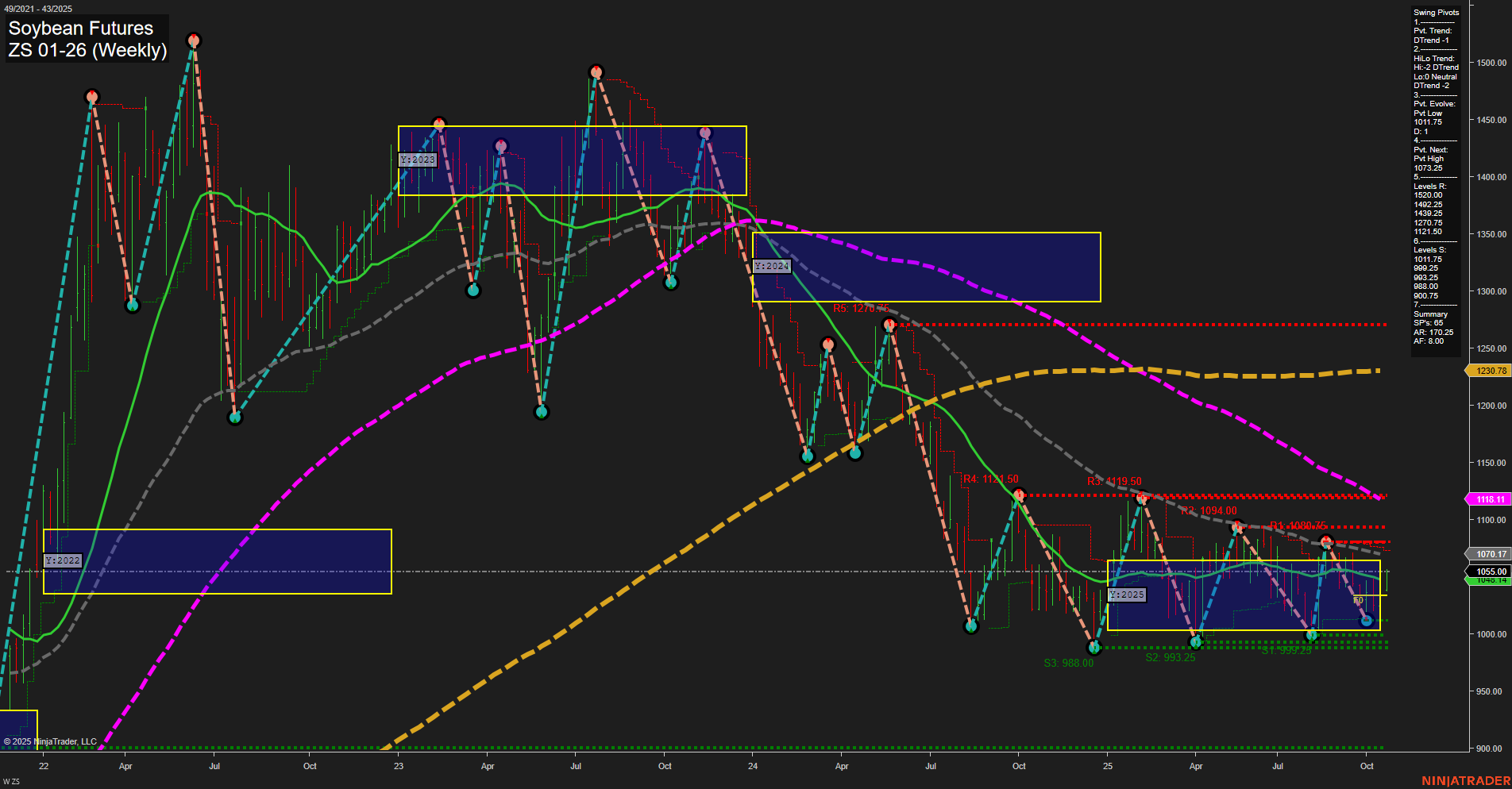

ZS Soybean Futures Weekly Chart Analysis: 2025-Oct-23 07:24 CT

Price Action

- Last: 1055.00,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: 70%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: 72%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 7%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 1011.75,

- 4. Pvt. Next: Pvt high 1073.25,

- 5. Levels R: 1270.75, 1191.50, 1094.00, 1080.75,

- 6. Levels S: 988.00, 983.25, 969.25, 905.75.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 1070.17 Down Trend,

- (Intermediate-Term) 10 Week: 1080.45 Down Trend,

- (Long-Term) 20 Week: 1111.11 Down Trend,

- (Long-Term) 55 Week: 1230.78 Down Trend,

- (Long-Term) 100 Week: 0.00,

- (Long-Term) 200 Week: 0.00.

Recent Trade Signals

- 20 Oct 2025: Long ZS 11-25 @ 1023.5 Signals.USAR-WSFG

- 16 Oct 2025: Long ZS 11-25 @ 1013 Signals.USAR.TR120

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

Soybean futures are currently trading at 1055.00, with medium-sized weekly bars and slow momentum, indicating a market in consolidation after recent volatility. The Weekly and Monthly Session Fib Grids (WSFG/MSFG) both show an upward trend with price above the NTZ center, suggesting some short-term bullish bias. However, the swing pivot structure is dominated by a downtrend in both short- and intermediate-term metrics, with the most recent pivot low at 1011.75 and the next resistance at 1073.25. Key resistance levels cluster between 1080.75 and 1270.75, while support is found at 988.00 and below. All visible benchmark moving averages (5, 10, 20, 55 week) are trending down, reinforcing a bearish intermediate- and long-term outlook. Recent trade signals have triggered long entries near support, but the overall structure remains capped by resistance and downward-trending averages. The market is in a broad range, with price action reflecting a choppy, sideways environment punctuated by lower highs and higher lows, typical of a base-building or consolidation phase. The technical landscape suggests that while short-term rallies are possible, the prevailing trend pressure remains to the downside until a decisive breakout above resistance levels occurs.

Chart Analysis ATS AI Generated: 2025-10-23 07:25 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.