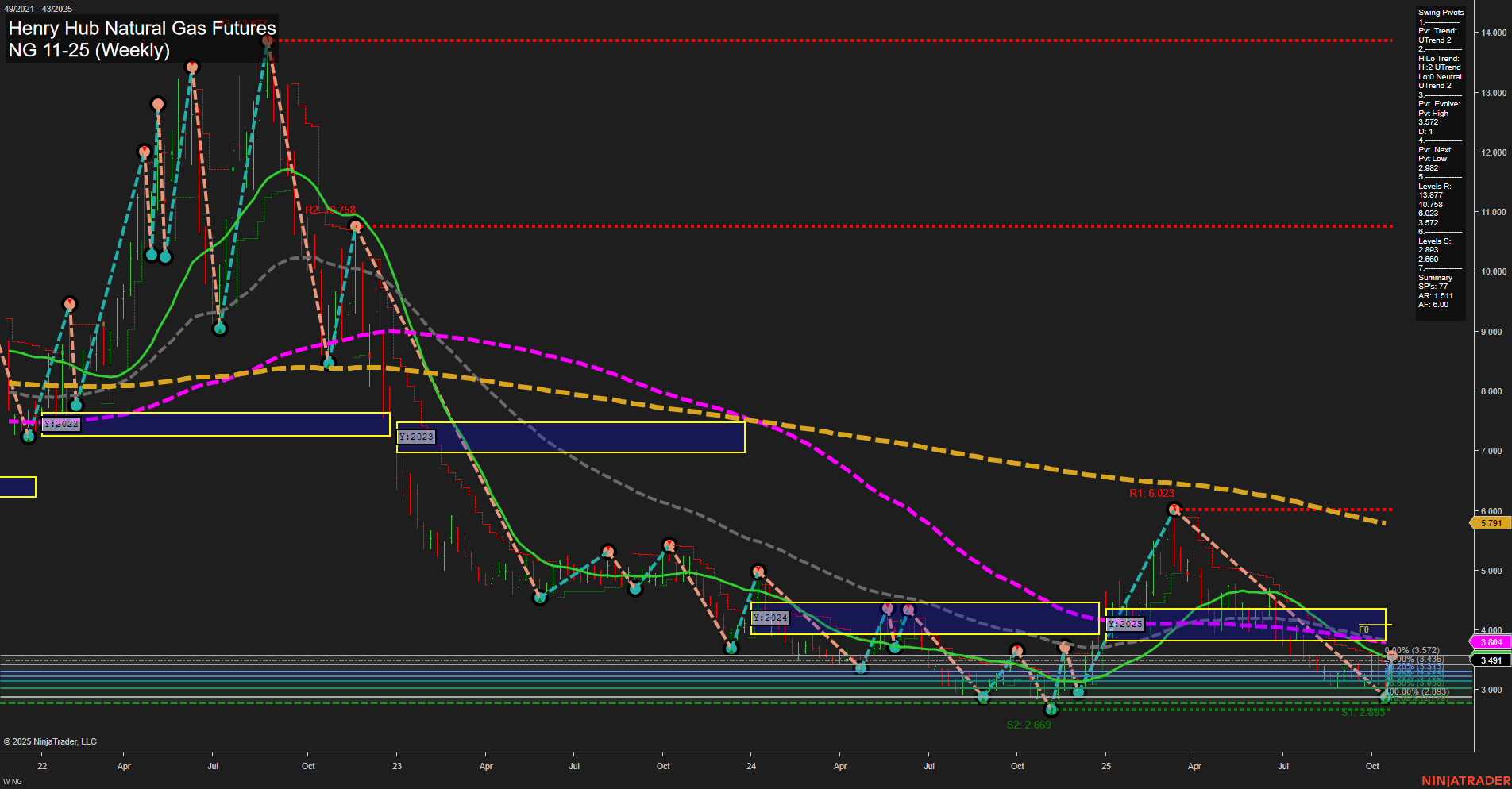

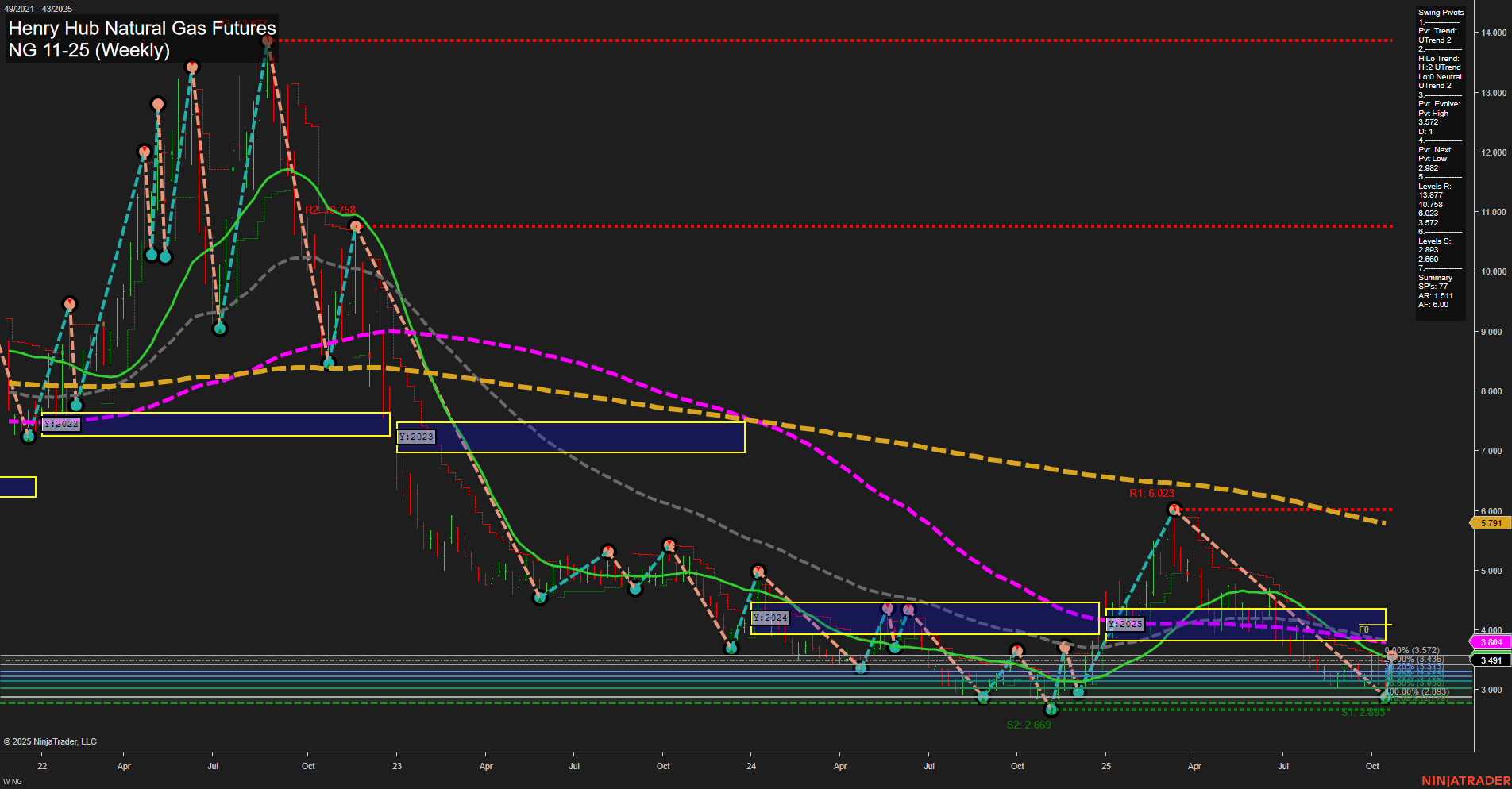

NG Henry Hub Natural Gas Futures Weekly Chart Analysis: 2025-Oct-23 07:14 CT

Price Action

- Last: 3.491,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 3.572,

- 4. Pvt. Next: Pvt low 2.882,

- 5. Levels R: 13.877, 10.758, 6.023, 3.572,

- 6. Levels S: 2.883, 2.669, 2.089.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 3.491 Up Trend,

- (Intermediate-Term) 10 Week: 3.491 Up Trend,

- (Long-Term) 20 Week: 3.904 Down Trend,

- (Long-Term) 55 Week: 5.791 Down Trend,

- (Long-Term) 100 Week: 6.023 Down Trend,

- (Long-Term) 200 Week: 10.758 Down Trend.

Recent Trade Signals

- 23 Oct 2025: Long NG 11-25 @ 3.451 Signals.USAR-MSFG

- 20 Oct 2025: Long NG 11-25 @ 3.304 Signals.USAR.TR720

- 20 Oct 2025: Long NG 11-25 @ 3.23 Signals.USAR-WSFG

- 17 Oct 2025: Long NG 11-25 @ 2.999 Signals.USAR.TR120

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bearish.

Key Insights Summary

Natural Gas futures have recently shifted to a short- and intermediate-term uptrend, as indicated by the swing pivot trends and a series of recent long trade signals. Price action is showing medium-sized bars with slow momentum, suggesting a measured recovery from recent lows. The price is currently consolidating just above key support levels (2.883, 2.669), with the next major resistance at 3.572 and further out at 6.023. While the 5- and 10-week moving averages have turned up, all long-term benchmarks (20, 55, 100, 200 week) remain in a downtrend, reflecting the broader bearish structure that has dominated since 2022. The neutral bias across all session fib grids (weekly, monthly, yearly) highlights a market in transition, with no clear breakout yet from the current range. The technical setup suggests a potential for further upside retracement or a base-building phase, but the long-term trend remains downward until major resistance levels are reclaimed. Volatility appears contained, with no signs of a breakout or breakdown, and the market is likely to remain sensitive to fundamental drivers such as weather, storage, and macroeconomic news.

Chart Analysis ATS AI Generated: 2025-10-23 07:14 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.