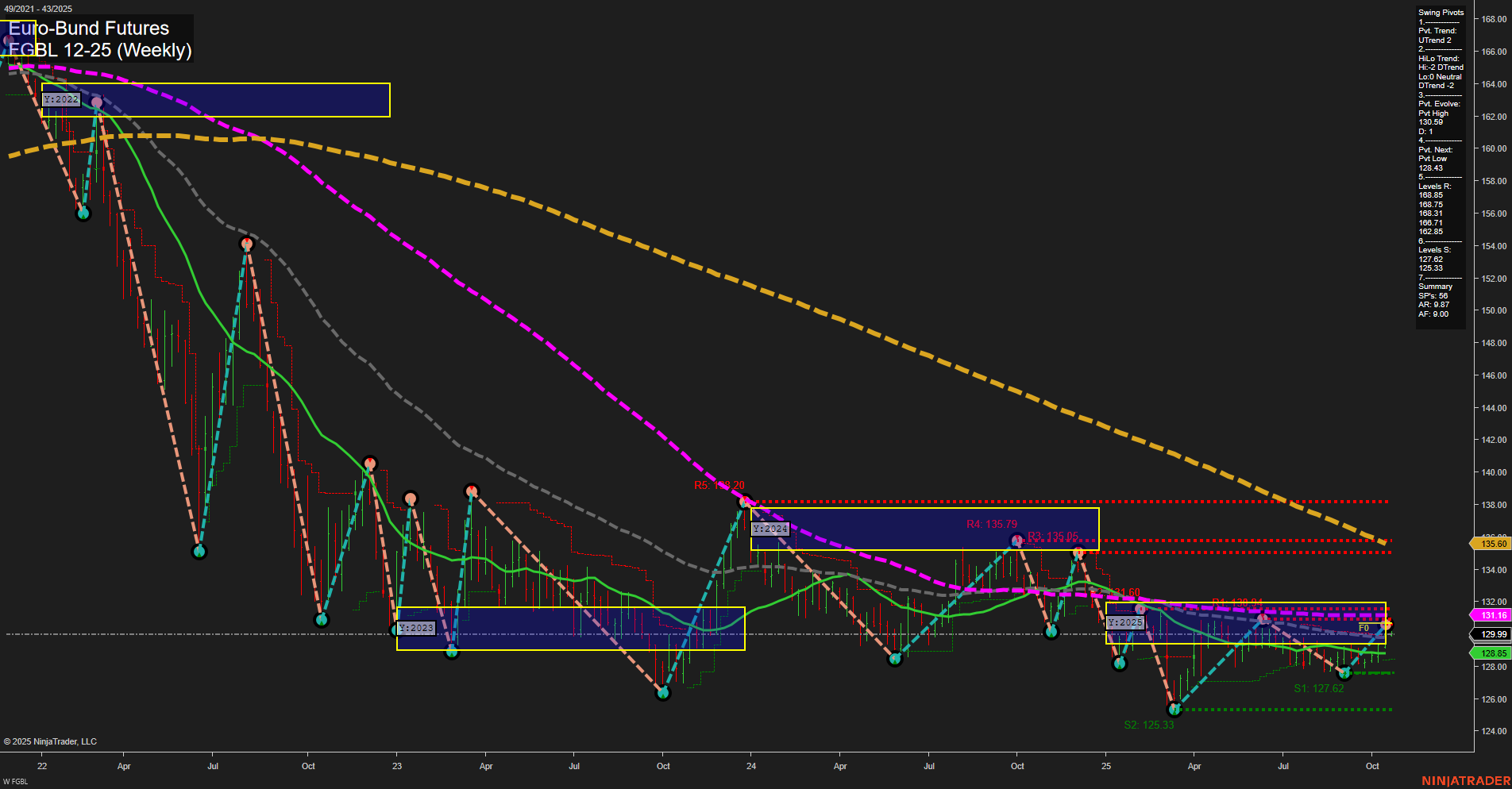

The FGBL Euro-Bund Futures weekly chart shows a market in transition. Short-term price action is neutral, with average momentum and medium-sized bars, reflecting indecision after a recent bounce. The Weekly Session Fib Grid (WSFG) and Monthly Session Fib Grid (MSFG) both indicate an upward trend, with price currently above their respective NTZ/F0% levels, suggesting some short-term bullishness. However, the Yearly Session Fib Grid (YSFG) remains in a downtrend, with price below the yearly NTZ/F0%, highlighting persistent long-term bearish pressure. Swing pivot analysis reveals a short-term uptrend, but the intermediate-term HiLo trend is still down, and resistance levels cluster above current price, notably at 130.19 and 131.71, with major resistance at 135.79. Support is found at 127.62 and 125.33. All key weekly moving averages (5, 10, 20, 55, 100, 200) are trending down and positioned above current price, reinforcing the dominant bearish structure. Recent trade signals show mixed short-term direction, with both a recent short and long signal, reflecting the choppy, range-bound nature of the current market. Overall, the chart suggests a market caught between short-term attempts to rally and a prevailing long-term downtrend, with significant overhead resistance and limited support below. The environment is characterized by consolidation and potential for volatility as the market tests key levels.