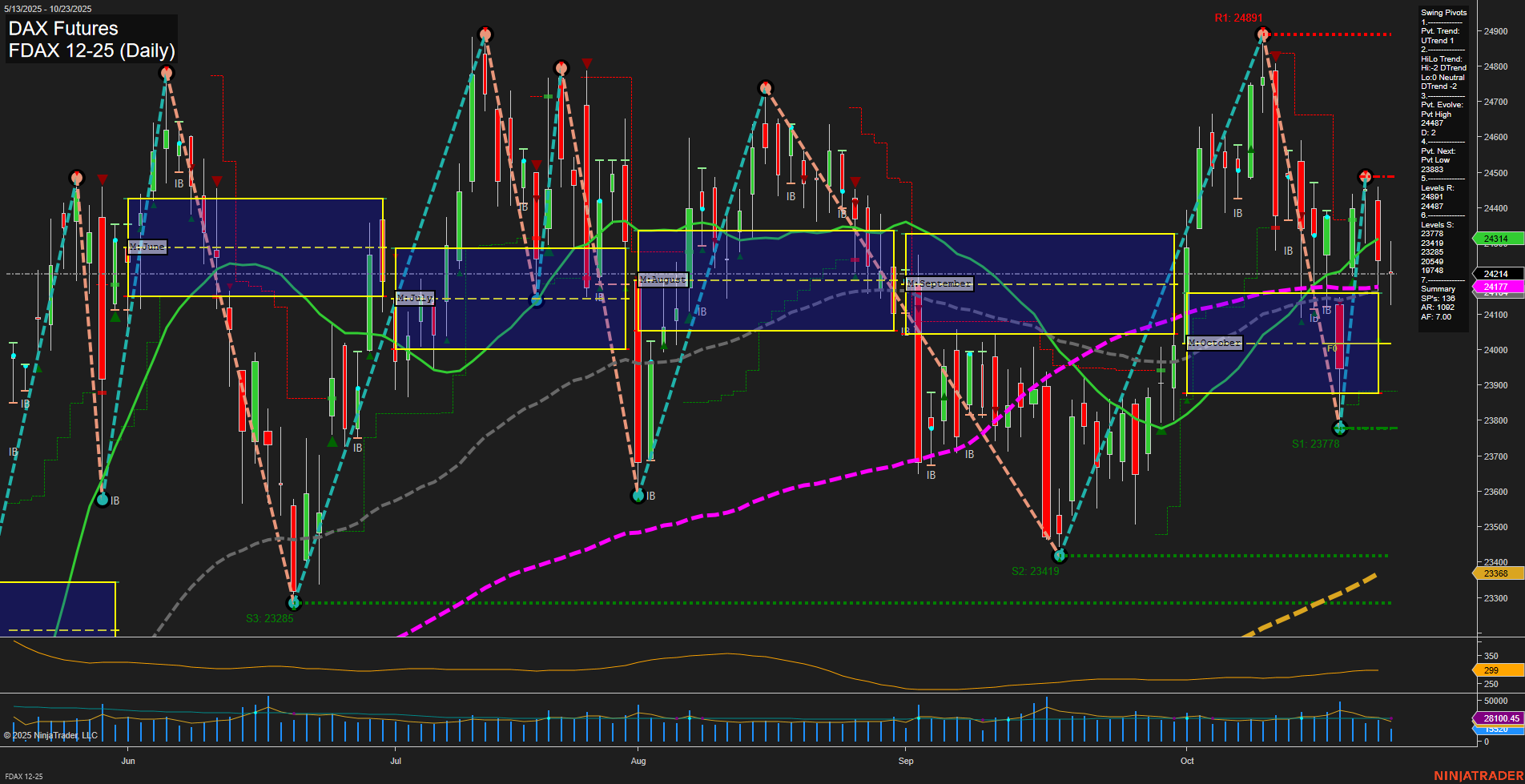

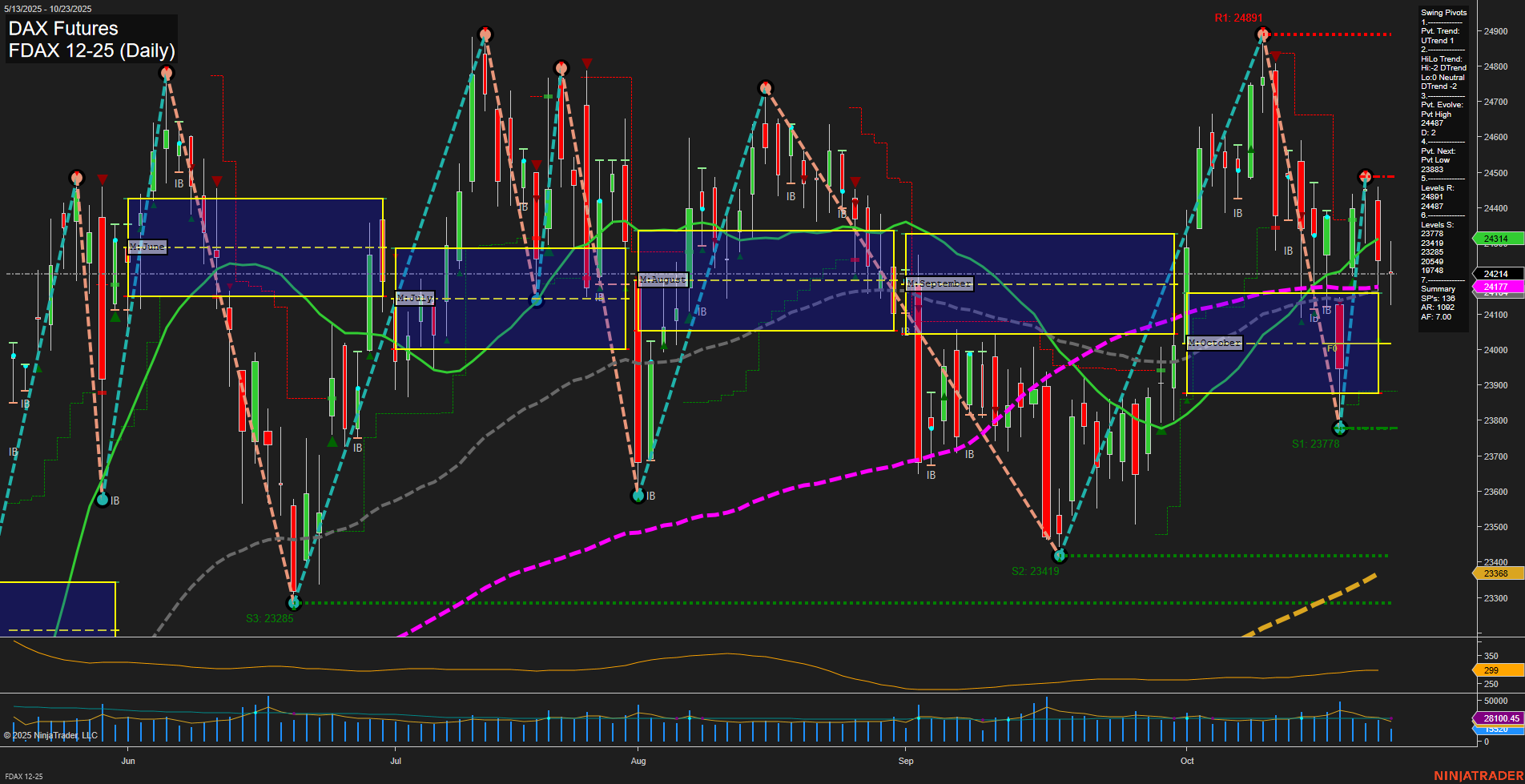

FDAX DAX Futures Daily Chart Analysis: 2025-Oct-23 07:10 CT

Price Action

- Last: 24314,

- Bars: Medium,

- Mom: Average.

WSFG Weekly

- Short-Term

- WSFG Current: 16%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: 16%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 111%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt High 24891,

- 4. Pvt. Next: Pvt Low 23883,

- 5. Levels R: 24891, 24487,

- 6. Levels S: 23778, 23419, 23386.

Daily Benchmarks

- (Short-Term) 5 Day: 24314 Up Trend,

- (Short-Term) 10 Day: 24214 Up Trend,

- (Intermediate-Term) 20 Day: 24177 Up Trend,

- (Intermediate-Term) 55 Day: 24114 Up Trend,

- (Long-Term) 100 Day: 24177 Up Trend,

- (Long-Term) 200 Day: 23386 Up Trend.

Additional Metrics

Recent Trade Signals

- 20 Oct 2025: Long FDAX 12-25 @ 24227 Signals.USAR.TR120

- 20 Oct 2025: Long FDAX 12-25 @ 24227 Signals.USAR-MSFG

- 20 Oct 2025: Long FDAX 12-25 @ 24137 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Neutral,

- Long-Term: Bullish.

Key Insights Summary

The FDAX daily chart shows a market in recovery mode after a recent swing low at 23778, with price action now above all key moving averages and the NTZ/F0% levels for weekly, monthly, and yearly session fib grids. The short-term trend is up, supported by a series of recent long signals and a strong cluster of support from both swing pivots and moving averages just below current price. However, the intermediate-term HiLo trend remains down, reflecting the recent correction from the 24891 swing high, suggesting some caution as the market consolidates gains. Volatility is moderate, and volume is steady, indicating healthy participation. The overall structure points to a bullish bias in the short and long term, with the potential for further upside if resistance at 24487 and 24891 is challenged. The market is currently in a phase of trend continuation with higher lows, but traders should be mindful of possible pullbacks or consolidations as the intermediate-term trend works to resolve itself.

Chart Analysis ATS AI Generated: 2025-10-23 07:10 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.