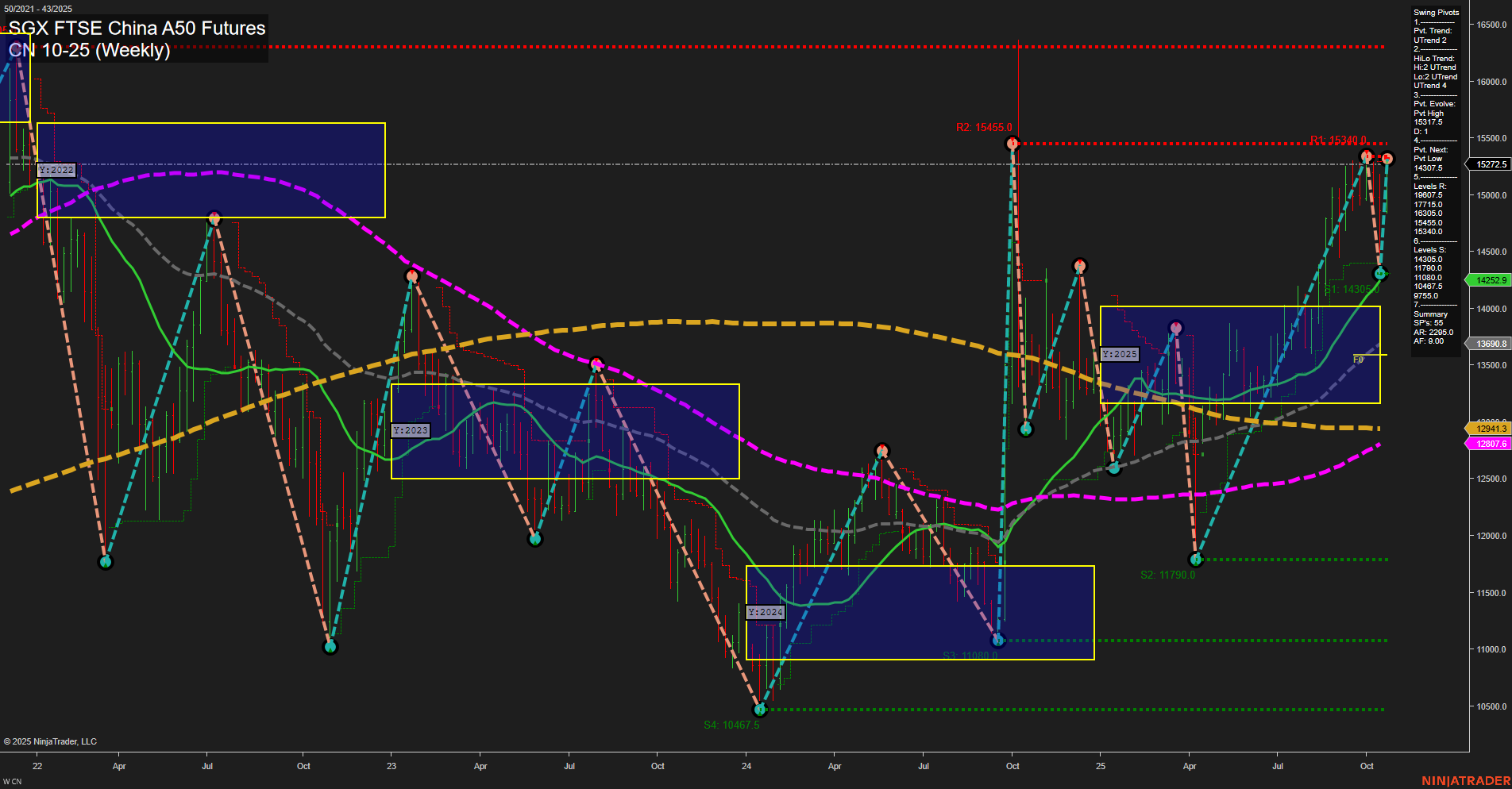

The CN SGX FTSE China A50 Futures weekly chart shows a strong bullish recovery from the 2024 lows, with price action characterized by large bars and fast momentum, indicating heightened volatility and strong directional conviction. Both short-term and intermediate-term swing pivot trends are up, with the most recent pivot high at 15317.7 and the next key support at 14307.5. Resistance is layered above at 15340.0 and 15455.0, suggesting the market is testing significant overhead supply. All key weekly moving averages (5, 10, 20, 55) are trending up, confirming the bullish structure, though the 100 and 200 week MAs remain in a downtrend, reflecting longer-term caution and the potential for mean reversion or consolidation at higher levels. The price is currently trading above all major moving averages, reinforcing the positive momentum. The neutral bias in the session fib grids (WSFG, MSFG, YSFG) suggests the market is at a critical inflection point, possibly pausing after a strong rally to digest gains. Overall, the technical landscape favors the bulls in the short and intermediate term, but the presence of major resistance and lagging long-term averages warrants close monitoring for signs of exhaustion or reversal.