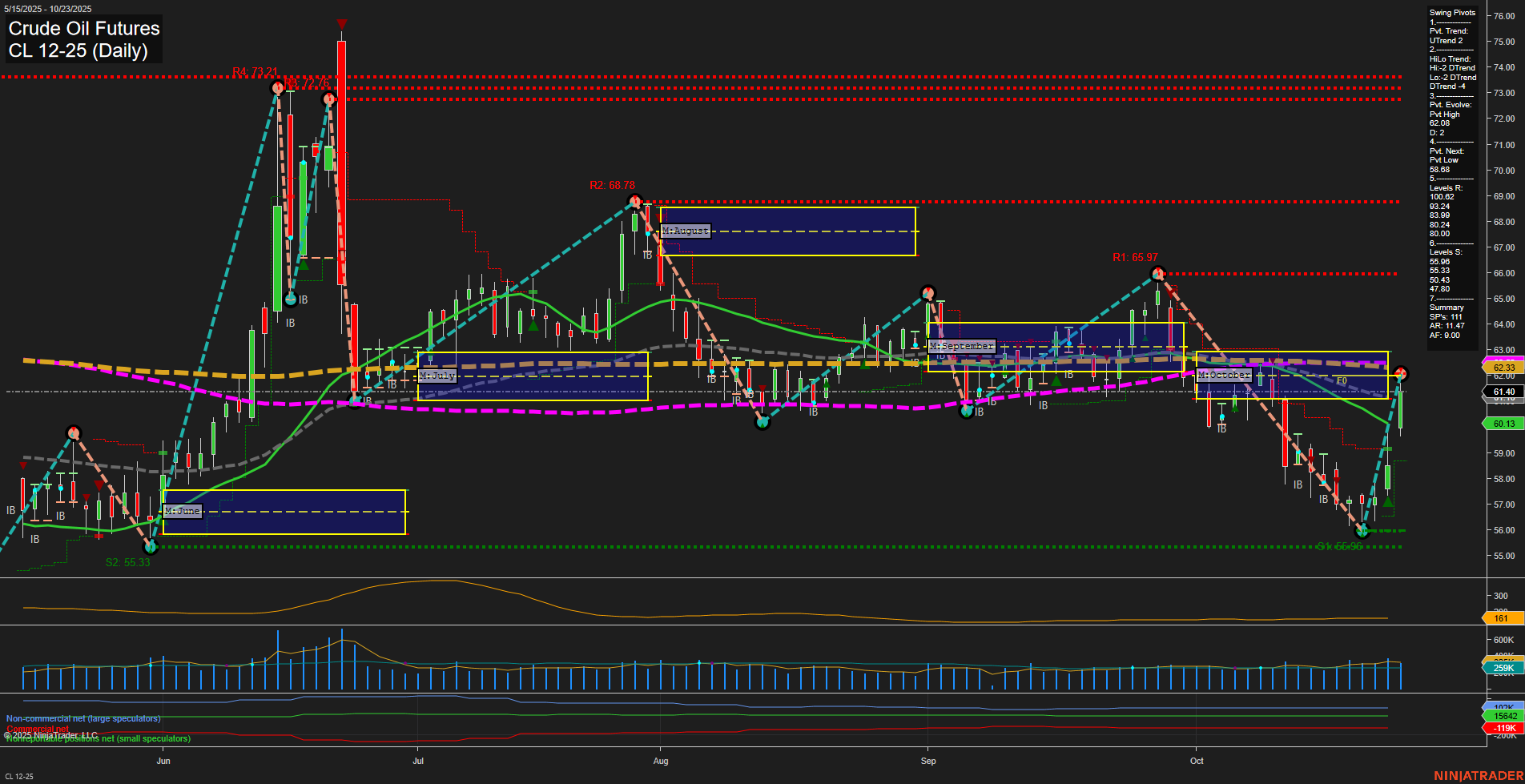

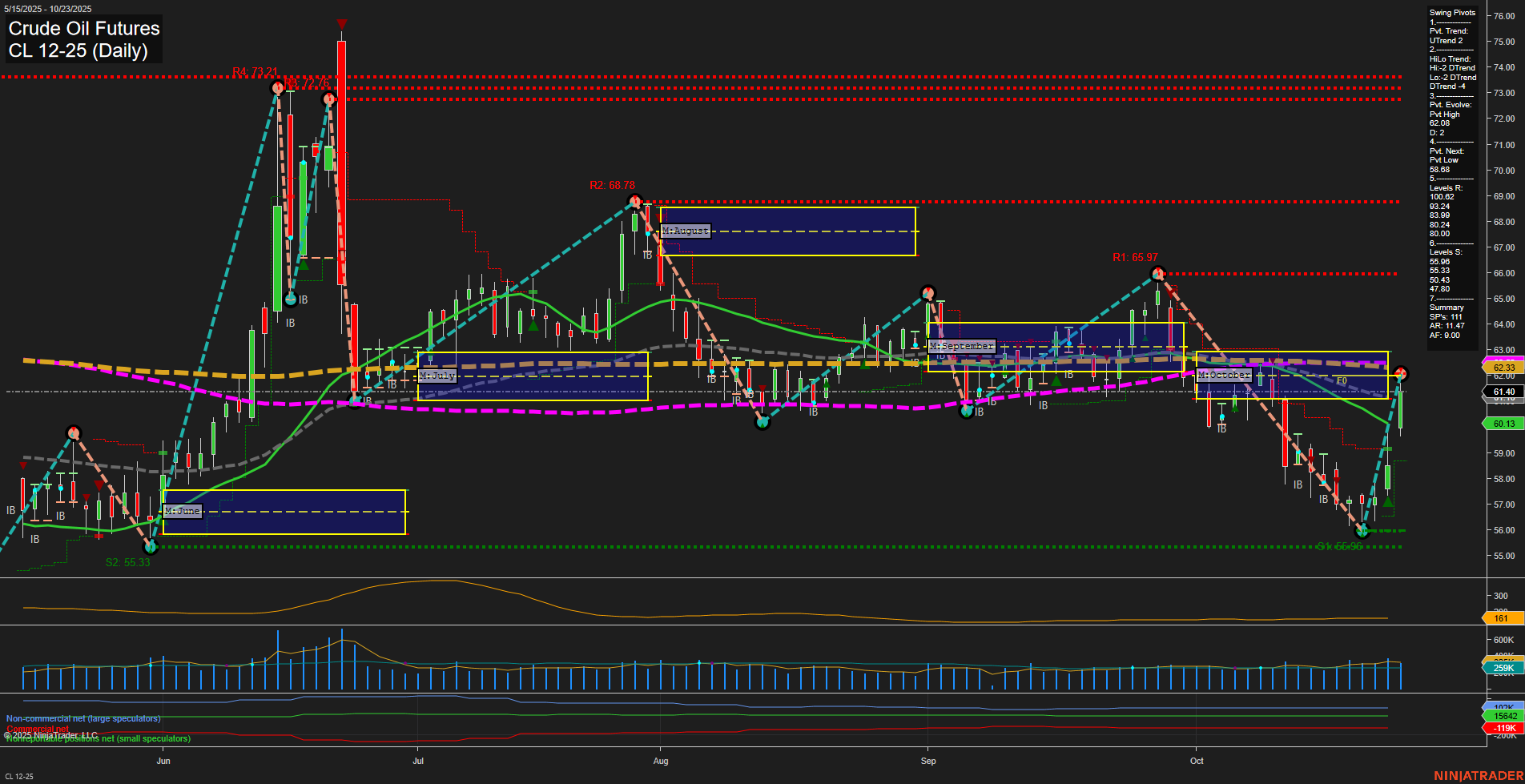

CL Crude Oil Futures Daily Chart Analysis: 2025-Oct-23 07:05 CT

Price Action

- Last: 62.33,

- Bars: Large,

- Mom: Fast.

WSFG Weekly

- Short-Term

- WSFG Current: 96%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: -8%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: -5%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt high 62.33,

- 4. Pvt. Next: Pvt low 58.88,

- 5. Levels R: 72.23, 68.78, 65.97, 62.33,

- 6. Levels S: 60.13, 56.96, 55.33, 47.80.

Daily Benchmarks

- (Short-Term) 5 Day: 59.11 Up Trend,

- (Short-Term) 10 Day: 58.47 Up Trend,

- (Intermediate-Term) 20 Day: 61.41 Down Trend,

- (Intermediate-Term) 55 Day: 63.24 Down Trend,

- (Long-Term) 100 Day: 64.96 Down Trend,

- (Long-Term) 200 Day: 62.74 Down Trend.

Additional Metrics

Recent Trade Signals

- 23 Oct 2025: Long CL 12-25 @ 60.23 Signals.USAR.TR720

- 22 Oct 2025: Long CL 12-25 @ 58.2 Signals.USAR-WSFG

- 22 Oct 2025: Long CL 12-25 @ 58.17 Signals.USAR.TR120

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

Crude oil futures have experienced a sharp rebound, with large, fast momentum bars pushing price above the weekly session fib grid (WSFG) NTZ, signaling a short-term bullish reversal. The short-term swing pivot trend has shifted to an uptrend, supported by recent long trade signals and rising 5- and 10-day moving averages. However, the intermediate- and long-term outlooks remain bearish, as price is still below the monthly and yearly fib grid NTZs, and all major intermediate and long-term moving averages are trending down. The intermediate-term swing pivot trend is still in a downtrend, and significant resistance levels remain overhead at 62.33, 65.97, 68.78, and 72.23. Support is established at 60.13, 56.96, and 55.33. Volatility is elevated (ATR 211), and volume is robust, indicating strong participation in this move. The market is currently in a countertrend rally within a broader bearish structure, with the potential for further upside in the short term, but with key resistance levels and longer-term downtrends still intact.

Chart Analysis ATS AI Generated: 2025-10-23 07:05 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.