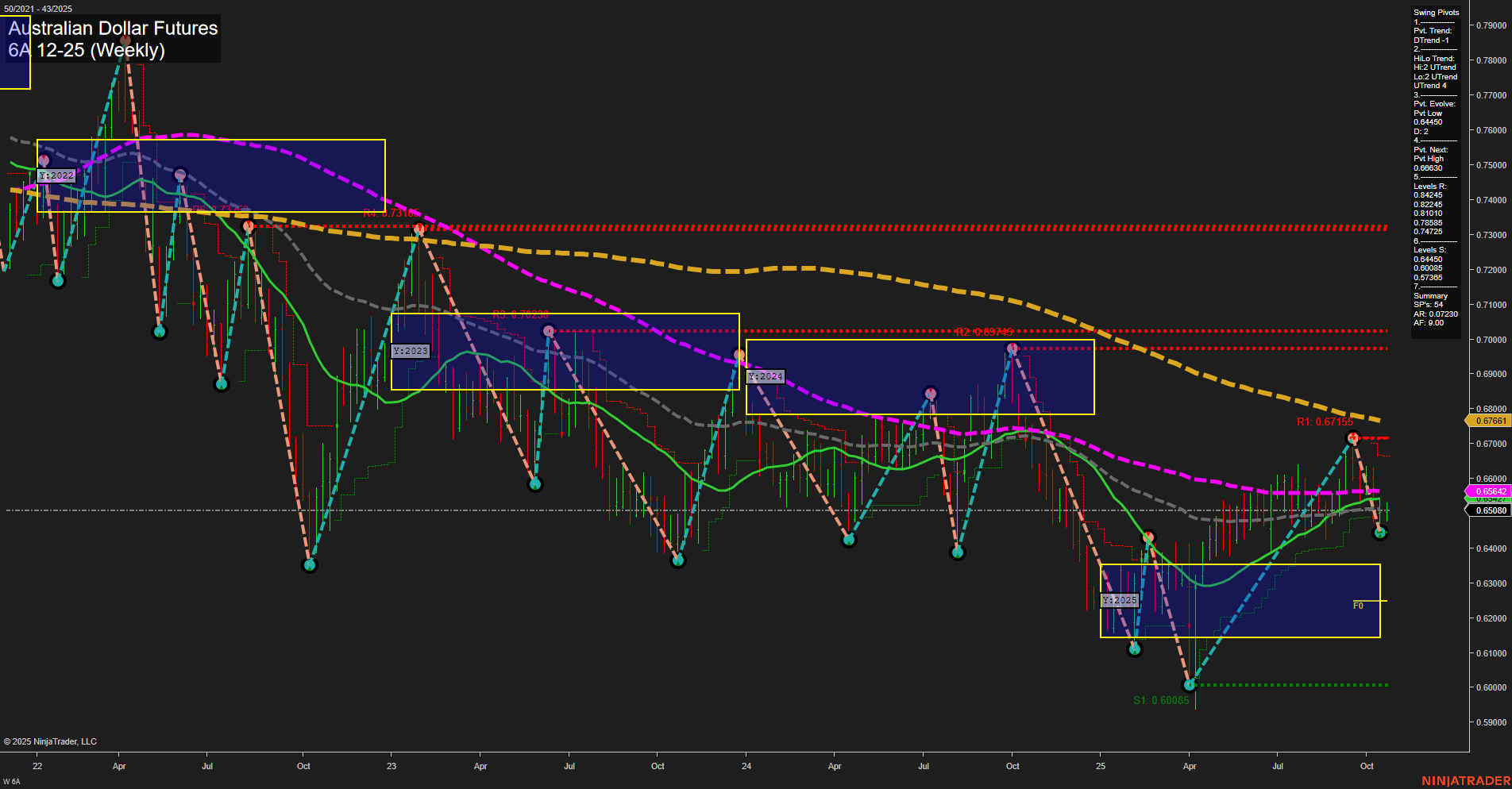

The 6A Australian Dollar Futures weekly chart shows a market in transition, with price currently at 0.6513 and trading within a medium-range bar structure. Momentum is average, indicating neither strong buying nor selling pressure at this time. The short-term and intermediate-term Fib grid trends are neutral, reflecting a lack of clear directional bias and suggesting ongoing consolidation. Swing pivot analysis highlights a short-term downtrend, but the intermediate-term trend remains up, with the most recent pivot low at 0.64540 and the next resistance pivot high at 0.67661. Key resistance levels are clustered between 0.65785 and 0.67661, while support is found at 0.64540 and further down at 0.60085. Weekly benchmarks show short- and intermediate-term moving averages trending down, while the 20-week MA is up, but all longer-term averages (55, 100, 200 week) remain in a downtrend, reinforcing a bearish long-term outlook. Recent trade signals have triggered long entries, indicating attempts to capture a potential bounce or reversal, but the overall structure remains mixed. The market is currently in a consolidation phase, with choppy price action and no decisive breakout, as it tests key support and resistance levels. The long-term trend remains bearish, but short- and intermediate-term conditions are neutral, awaiting a catalyst for a sustained move in either direction.