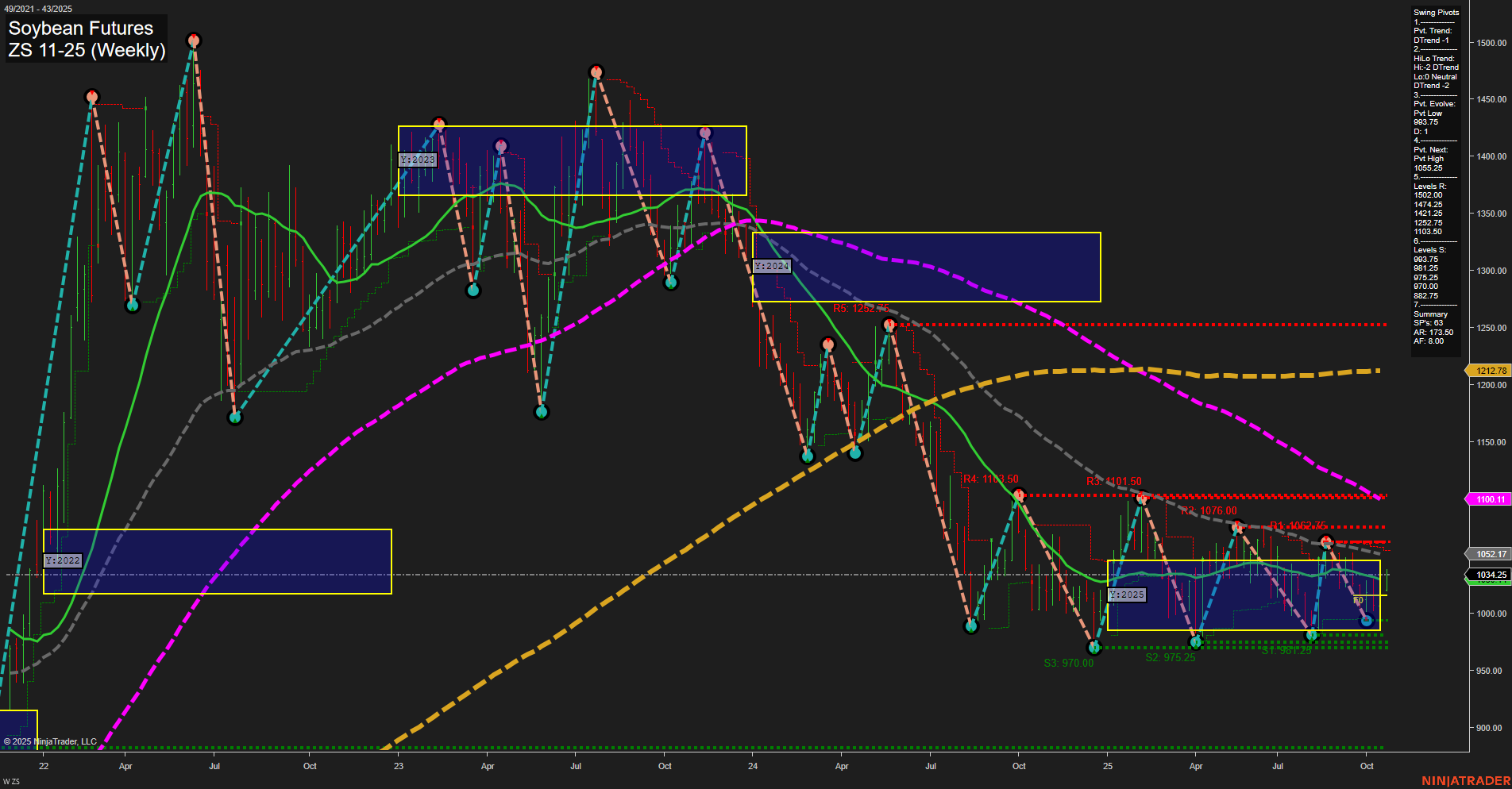

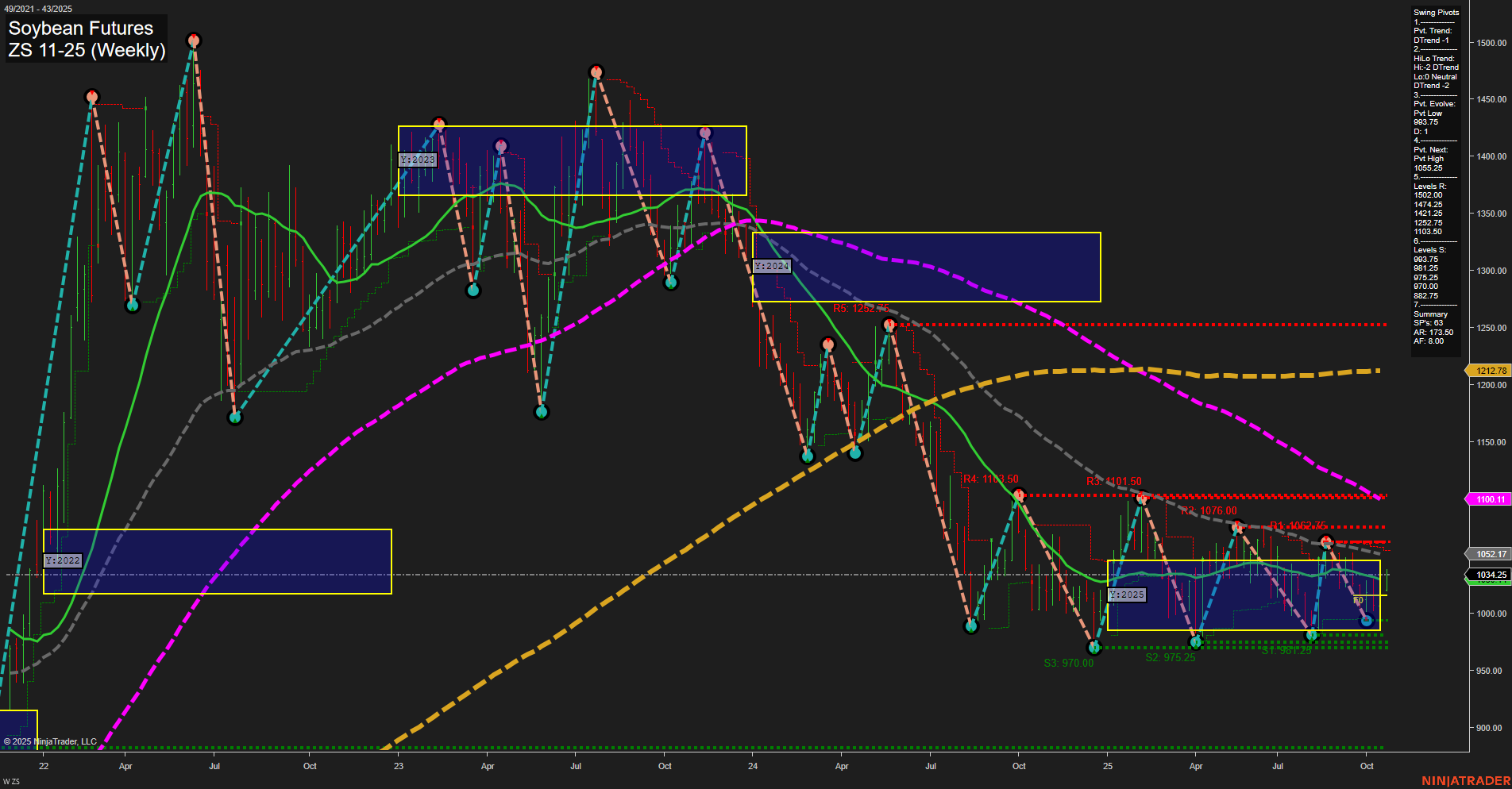

ZS Soybean Futures Weekly Chart Analysis: 2025-Oct-21 07:23 CT

Price Action

- Last: 1036.00,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: 58%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: 64%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 7%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 963.75,

- 4. Pvt. Next: Pvt high 1095.25,

- 5. Levels R: 1262.25, 1247.25, 1142.25, 1106.25, 1095.25, 1076.00, 1062.25, 1101.50, 1106.25, 1076.00,

- 6. Levels S: 981.25, 975.25, 970.00, 963.75, 882.75.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 1052.17 Down Trend,

- (Intermediate-Term) 10 Week: 1100.11 Down Trend,

- (Long-Term) 20 Week: 1212.78 Down Trend,

- (Long-Term) 55 Week: 1100.11 Down Trend,

- (Long-Term) 100 Week: 1212.78 Down Trend,

- (Long-Term) 200 Week: 1212.78 Down Trend.

Recent Trade Signals

- 20 Oct 2025: Long ZS 11-25 @ 1023.5 Signals.USAR-WSFG

- 16 Oct 2025: Long ZS 11-25 @ 1013 Signals.USAR.TR120

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Neutral,

- Long-Term: Bearish.

Key Insights Summary

Soybean futures are showing a short-term bullish bias, supported by recent long trade signals and an upward trend in the Weekly Session Fib Grid (WSFG). Price is currently above the NTZ center line, and the most recent swing pivot is a low, suggesting a possible attempt to form a higher low. However, intermediate and long-term moving averages remain in a downtrend, and the intermediate-term HiLo trend is still down, indicating that the broader trend structure is not yet fully supportive of a sustained rally. The market is trading within a well-defined range, with resistance levels clustered above 1076 and support levels near 970–963.75. This suggests a choppy, range-bound environment with potential for short-term bounces but continued overhead pressure from longer-term resistance. The overall structure reflects a market in transition, with short-term momentum attempting to reverse a longer-term bearish trend, but confirmation from higher timeframes is still lacking.

Chart Analysis ATS AI Generated: 2025-10-21 07:24 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.