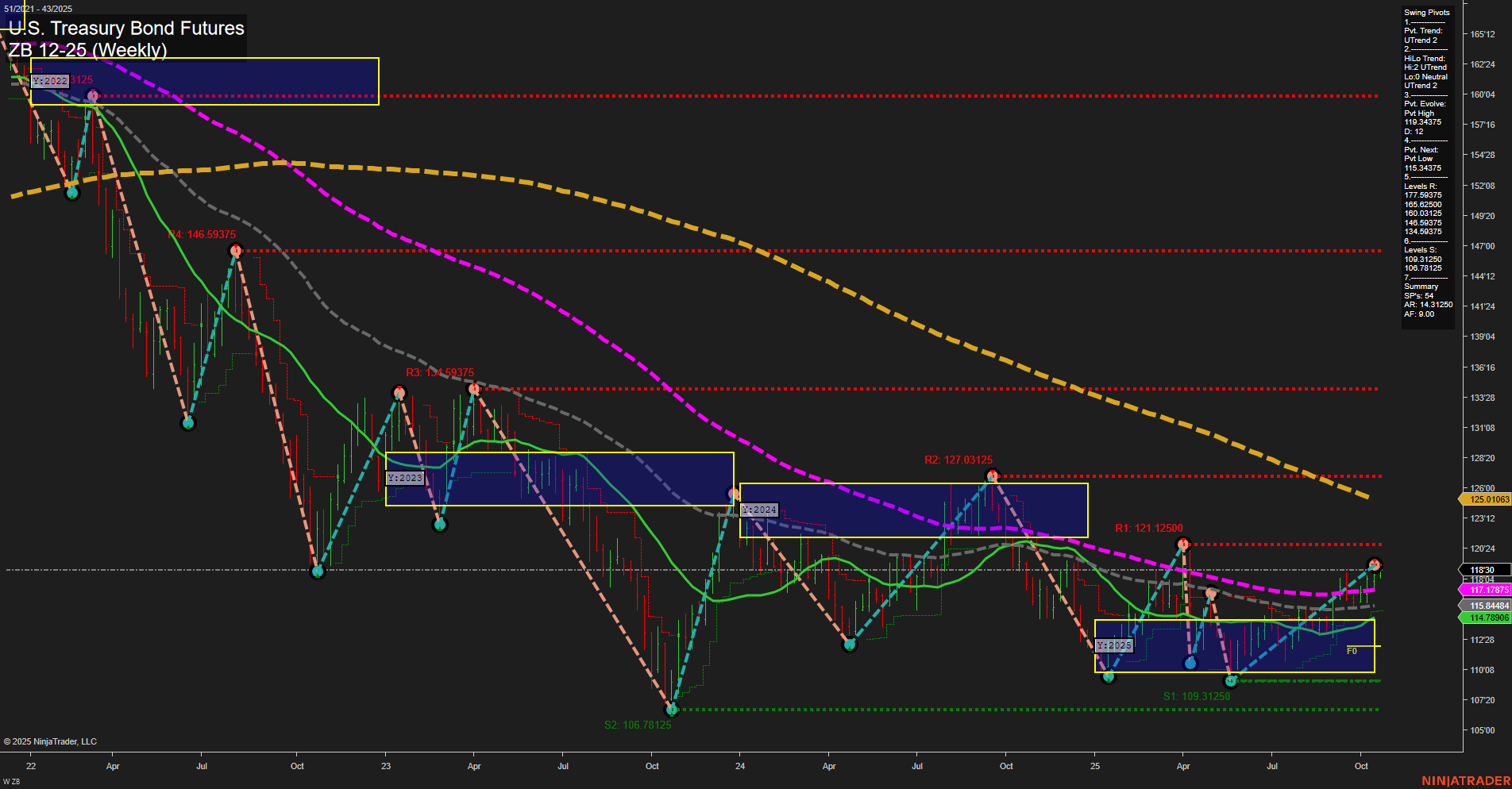

The ZB U.S. Treasury Bond Futures weekly chart shows a market in transition. Price action has stabilized with medium-sized bars and average momentum, indicating a pause after previous volatility. The short-term trend is neutral, as reflected by the WSFG and the current price position within the NTZ zone, suggesting indecision and a lack of clear directional bias. Intermediate-term signals are more constructive, with the HiLo trend up and all short/intermediate moving averages (5, 10, 20 week) trending higher, supporting a bullish bias for swing traders looking at multi-week horizons. However, the long-term picture remains bearish, with the 55, 100, and 200 week moving averages all in downtrends and price still well below these benchmarks. Key resistance levels are clustered above, notably at 119.59, 121.12, and 127.03, while support is found at 115.94, 109.31, and 106.78. The market is consolidating after a significant downtrend, with recent price action forming higher lows but still facing overhead resistance. This setup suggests a potential for further range-bound trading or a base-building phase, with any breakout above resistance or breakdown below support likely to set the next directional move. The overall environment is one of transition, with swing traders watching for confirmation of either a sustained reversal or a resumption of the longer-term downtrend.