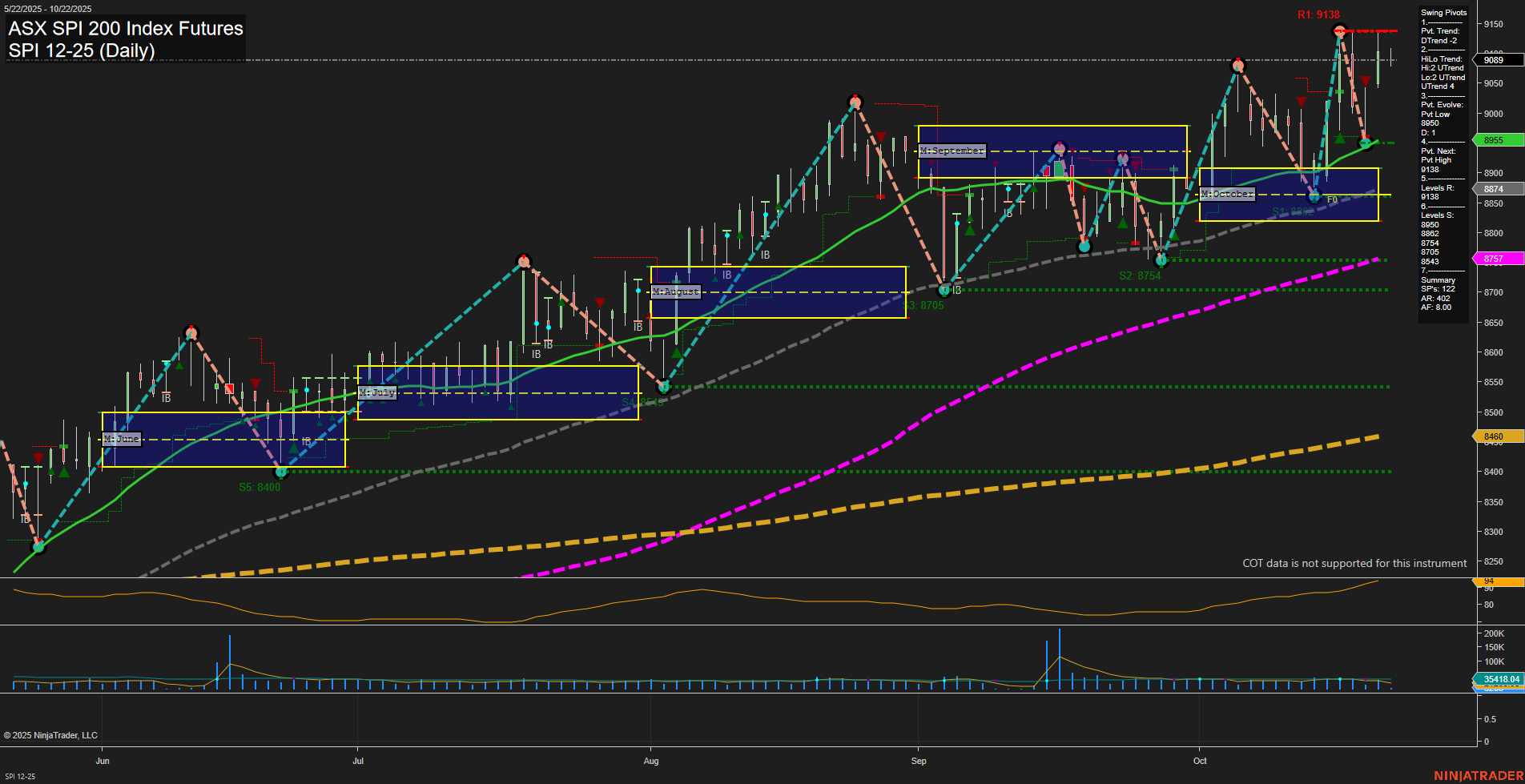

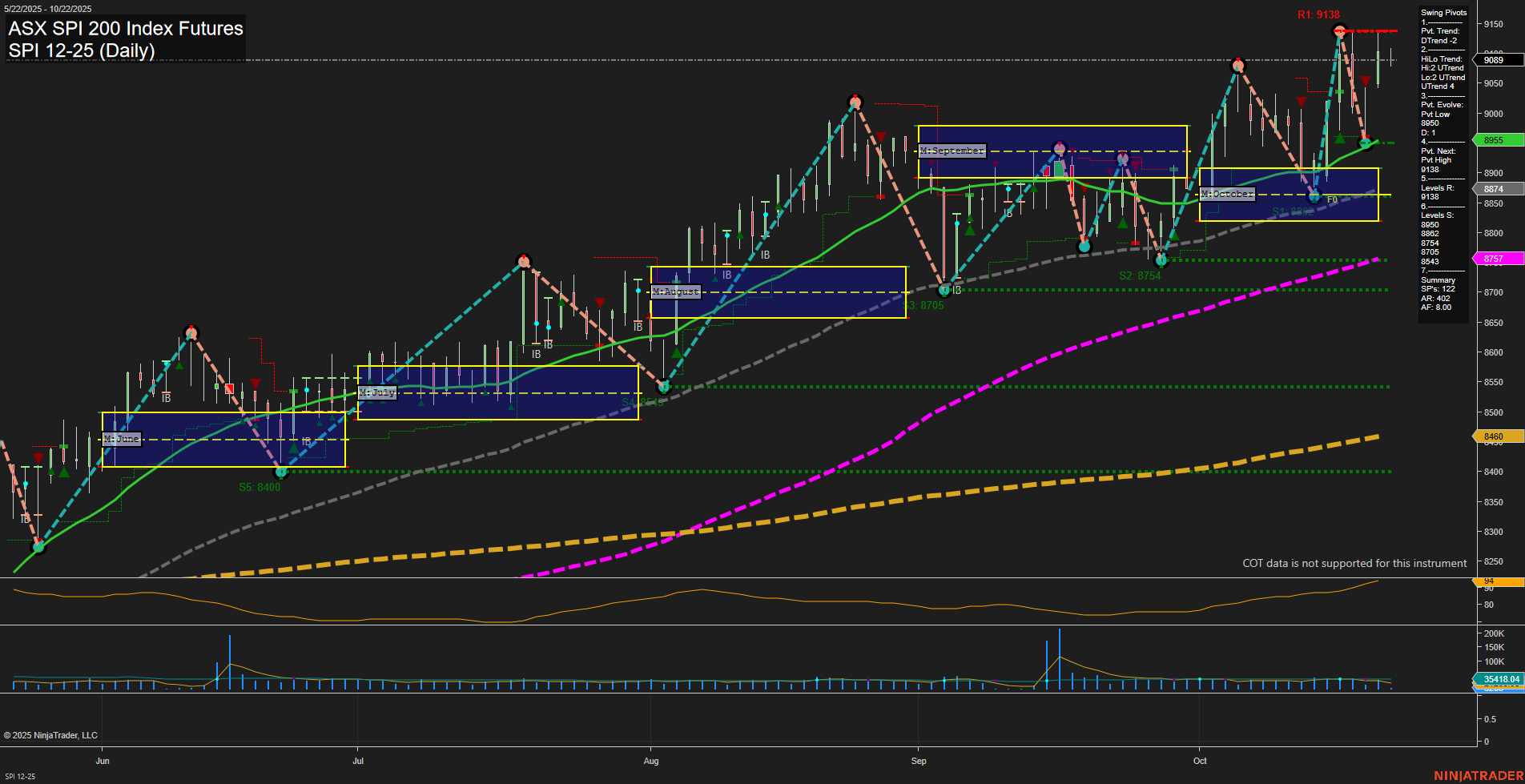

SPI ASX SPI 200 Index Futures Daily Chart Analysis: 2025-Oct-21 07:18 CT

Price Action

- Last: 9089,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 9089,

- 4. Pvt. Next: Pvt high 9138,

- 5. Levels R: 9138,

- 6. Levels S: 8955, 8754, 8705, 8400.

Daily Benchmarks

- (Short-Term) 5 Day: 9082 Up Trend,

- (Short-Term) 10 Day: 9022 Up Trend,

- (Intermediate-Term) 20 Day: 8955 Up Trend,

- (Intermediate-Term) 55 Day: 8757 Up Trend,

- (Long-Term) 100 Day: 8757 Up Trend,

- (Long-Term) 200 Day: 8460 Up Trend.

Additional Metrics

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The SPI 200 futures are consolidating near recent highs after a strong multi-month uptrend, as indicated by the persistent uptrend in all major moving averages (from short to long term). The short-term swing pivot has shifted to a downtrend, suggesting a possible pause or minor pullback within the broader bullish structure. Intermediate and long-term trends remain firmly upward, supported by higher lows and a series of successful retests of support levels. Volatility is moderate, and volume remains healthy, indicating continued market participation. The market is currently trading just below a key resistance at 9138, with strong support levels layered below, particularly at 8955 and 8754. The overall structure suggests a market in a consolidation phase within a dominant uptrend, with potential for further upside if resistance is cleared, but also room for short-term retracement or sideways movement as the market digests recent gains.

Chart Analysis ATS AI Generated: 2025-10-21 07:18 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.