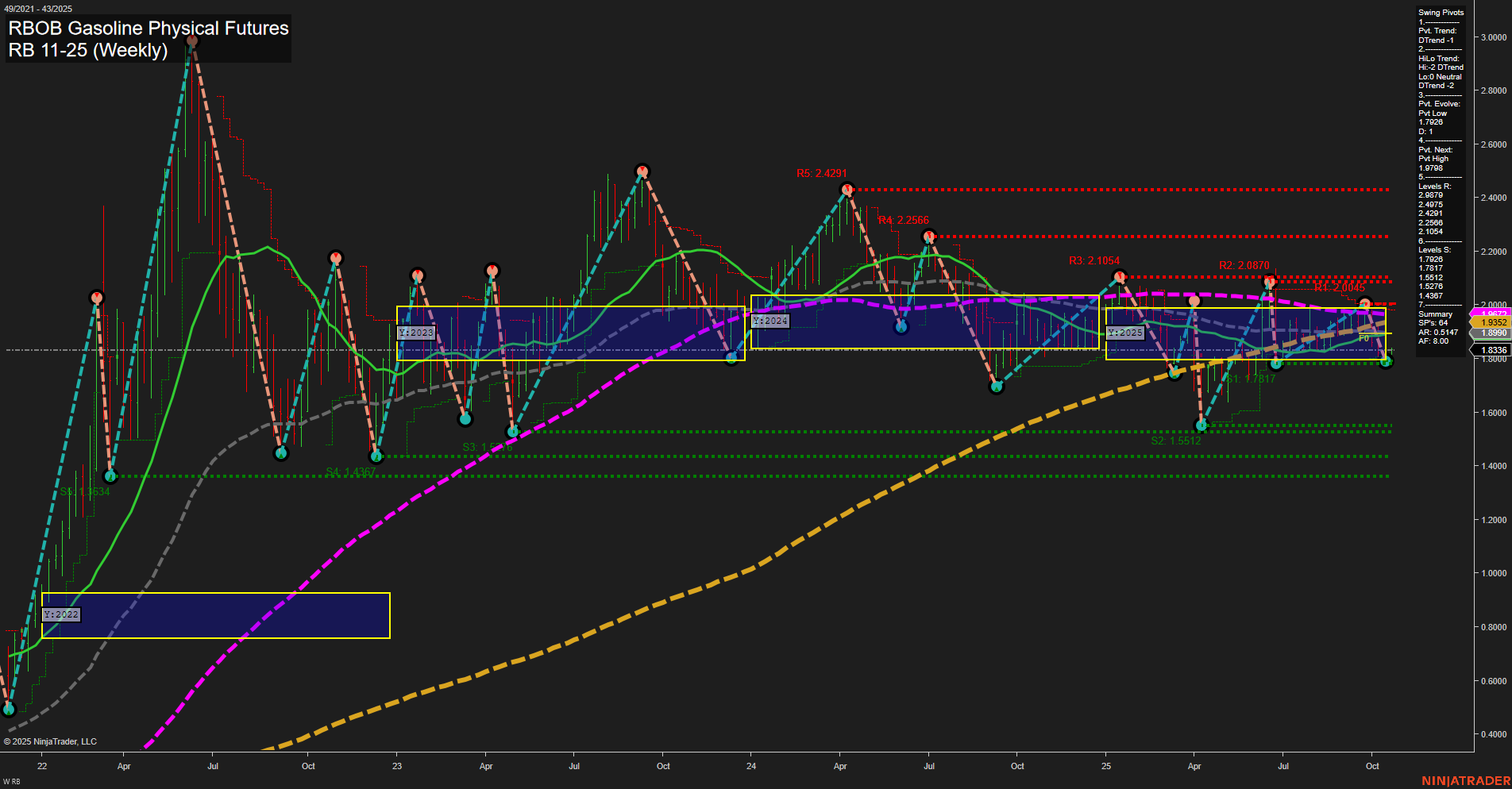

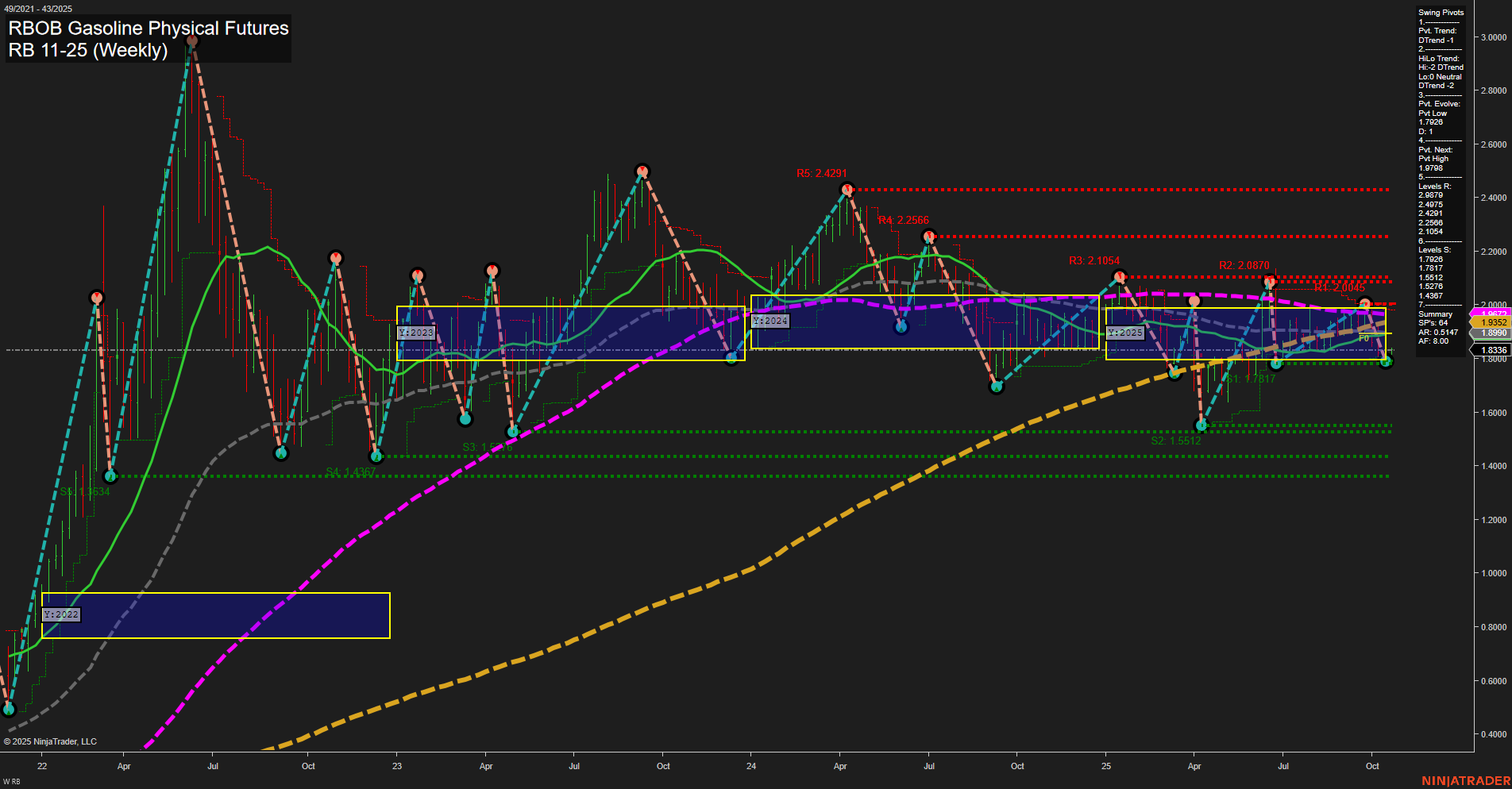

RB RBOB Gasoline Physical Futures Weekly Chart Analysis: 2025-Oct-21 07:16 CT

Price Action

- Last: 1.8336,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: 0%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: -46%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: -6%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 1.7026,

- 4. Pvt. Next: Pvt high 1.9708,

- 5. Levels R: 2.4291, 2.2566, 2.1054, 2.0870, 1.9708,

- 6. Levels S: 1.7026, 1.6512, 1.5148, 1.4537, 1.3937.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 1.8599 Down Trend,

- (Intermediate-Term) 10 Week: 1.8599 Down Trend,

- (Long-Term) 20 Week: 1.9392 Down Trend,

- (Long-Term) 55 Week: 1.8336 Down Trend,

- (Long-Term) 100 Week: 1.9517 Down Trend,

- (Long-Term) 200 Week: 2.0000 Down Trend.

Recent Trade Signals

- 17 Oct 2025: Long RB 11-25 @ 1.8265 Signals.USAR-WSFG

- 16 Oct 2025: Short RB 11-25 @ 1.8111 Signals.USAR.TR120

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

The RBOB Gasoline futures market is currently exhibiting a slow momentum environment with medium-sized weekly bars, reflecting a lack of strong directional conviction. Price is sitting at 1.8336, right at the 55-week benchmark, and below all major long-term moving averages, which are all trending down. The short-term WSFG is neutral, with price hovering around the NTZ center, indicating indecision and a lack of clear short-term trend. Intermediate and long-term Fib grid trends are both down, with price below their respective NTZ centers, confirming a bearish bias for both timeframes. Swing pivot analysis shows a dominant downtrend in both short- and intermediate-term trends, with the next significant resistance at 1.9708 and support at 1.7026. Recent trade signals show mixed short-term activity, with both a long and a short signal triggered in the past week, further highlighting the choppy, range-bound nature of the current market. Overall, the market is consolidating within a broad range, with a bearish tilt on higher timeframes and no clear breakout or breakdown yet. This environment is typical of late-seasonal transitions, where volatility contracts and price action becomes more indecisive, awaiting a catalyst for the next major move.

Chart Analysis ATS AI Generated: 2025-10-21 07:16 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.