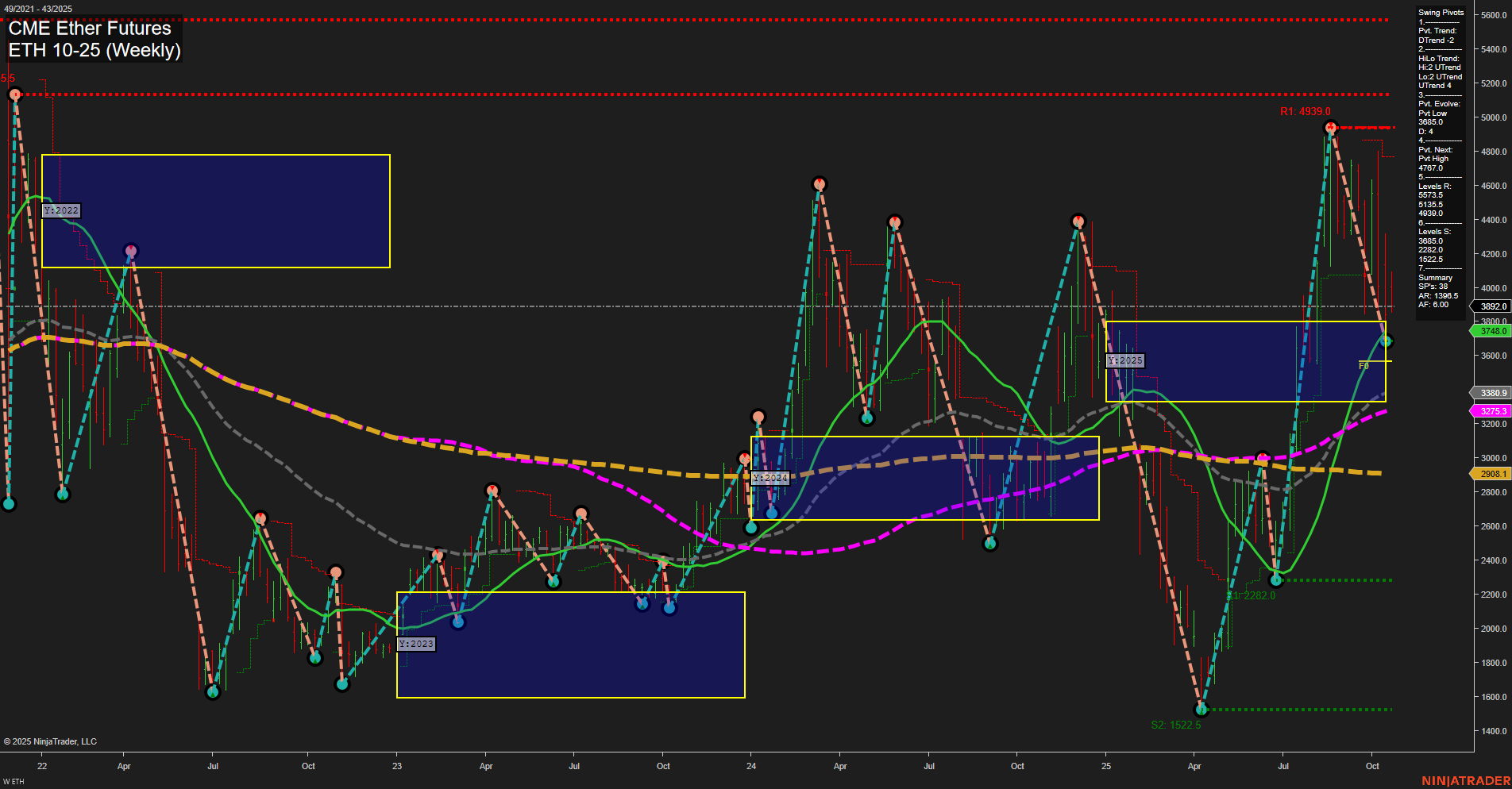

The current weekly chart for ETH CME Ether Futures shows a market in transition. Price action is volatile with large bars and fast momentum, reflecting recent swings and heightened activity. Short-term (WSFG) and long-term (YSFG) session fib grid trends are both up, with price holding above their respective NTZ/F0% levels, indicating underlying bullish structure. However, the intermediate-term (MSFG) trend is down, with price below the monthly NTZ, suggesting a counter-trend pullback or consolidation phase within a broader uptrend. Swing pivots highlight a recent pivot high at 4939.0 and a next key support at 2282.0, with resistance levels stacked above current price and major support well below, indicating a wide trading range. The short-term swing pivot trend is down, but the intermediate-term HiLo trend remains up, showing mixed signals and potential for choppy or range-bound action. Weekly benchmarks show most moving averages trending up, except for the 5-week (short-term down) and the 200-week (long-term down), reinforcing the idea of a corrective phase within a larger bullish context. Recent trade signals are mixed, with both long and short entries triggered in close succession, reflecting indecision and possible mean reversion or volatility-driven setups. Overall, the chart suggests a market at a decision point: short- and intermediate-term trends are neutral due to conflicting signals and recent volatility, while the long-term outlook remains bullish as price holds above key moving averages and yearly fib levels. Traders may observe for resolution of this consolidation, with attention to whether price can reclaim short-term momentum or if further retracement toward support levels unfolds.