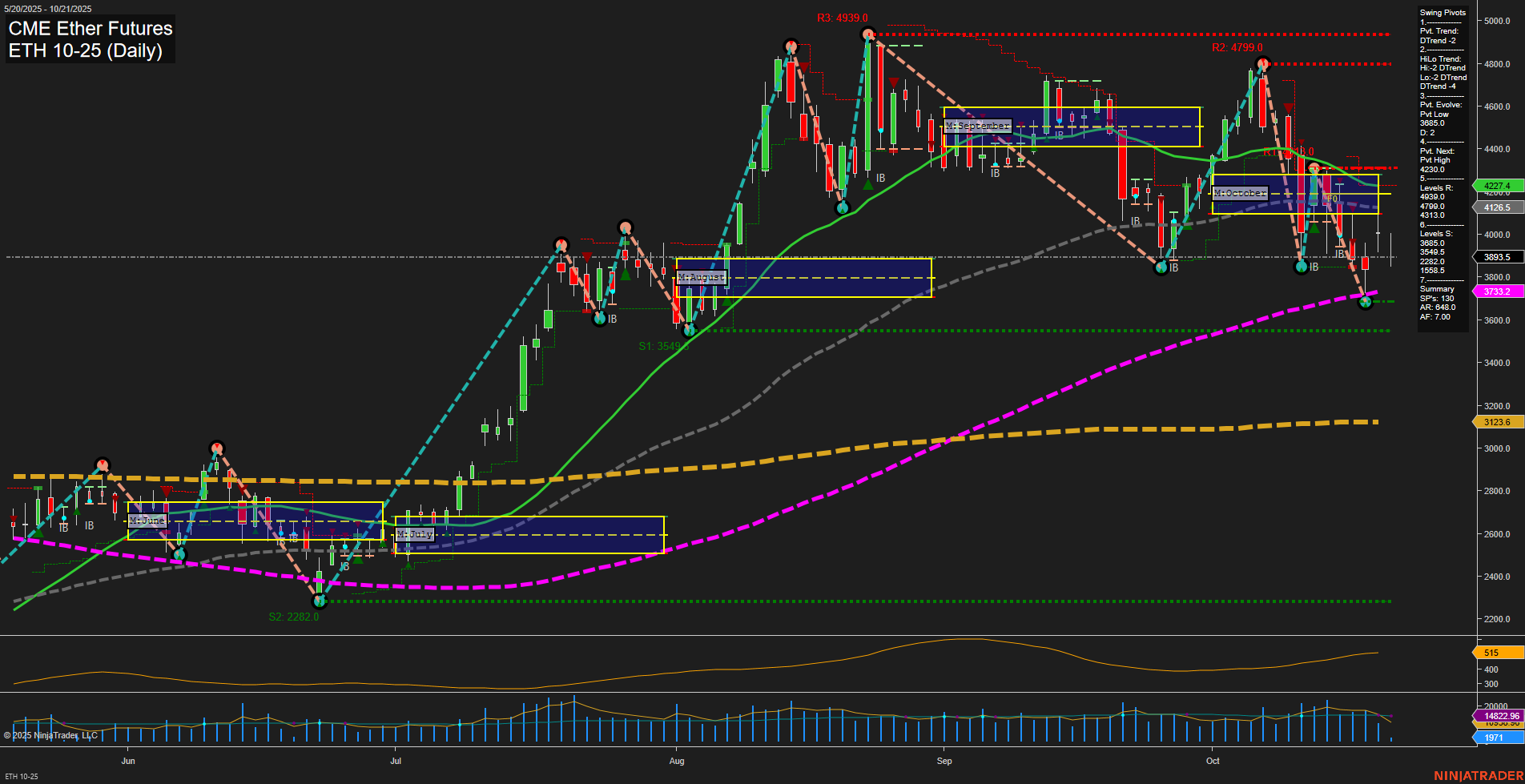

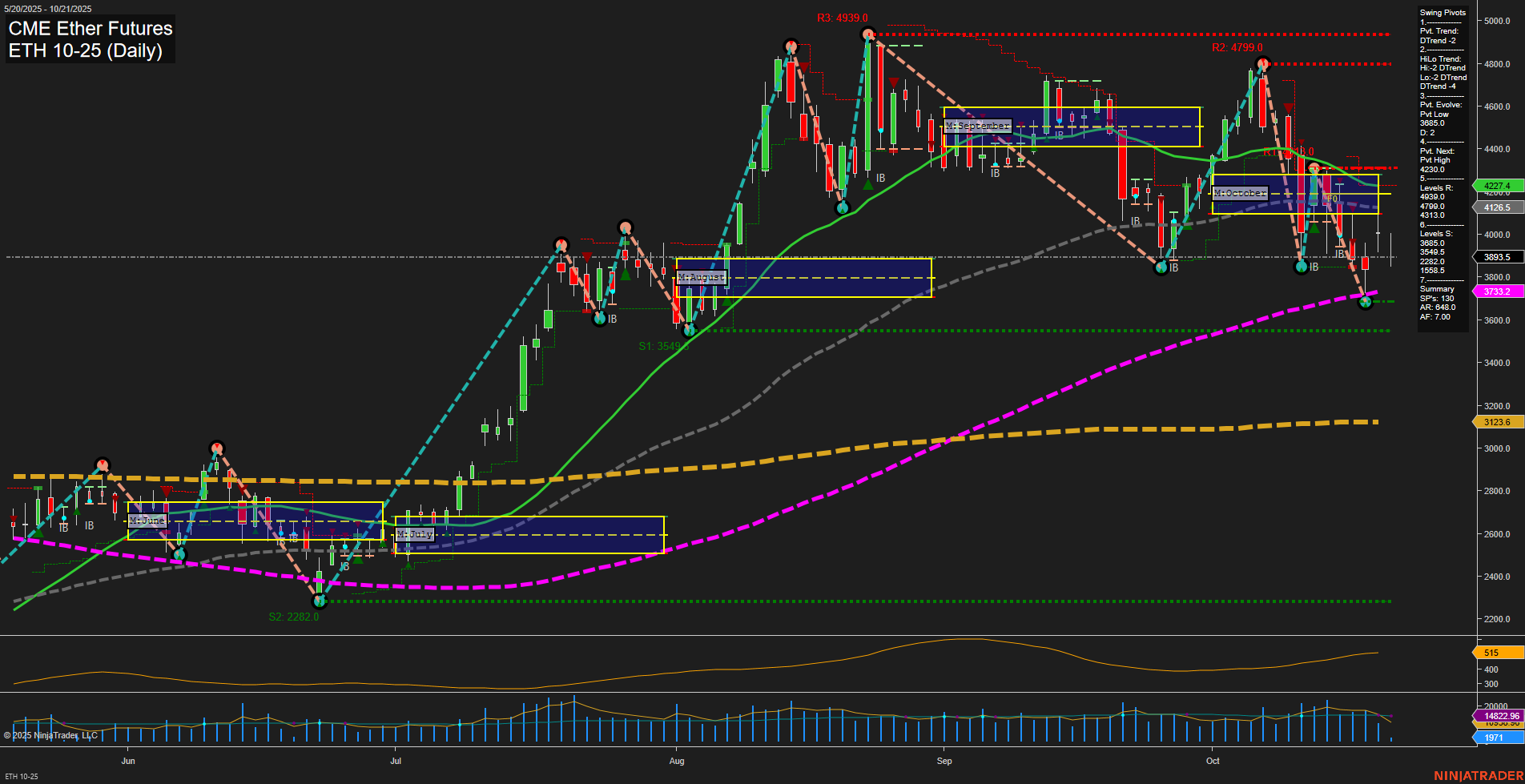

ETH CME Ether Futures Daily Chart Analysis: 2025-Oct-21 07:07 CT

Price Action

- Last: 3733.2,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: 4%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: -25%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 14%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 3733.2,

- 4. Pvt. Next: Pvt high 4230.0,

- 5. Levels R: 4939.0, 4799.0, 4230.0,

- 6. Levels S: 3549.0, 2282.0.

Daily Benchmarks

- (Short-Term) 5 Day: 3885.5 Down Trend,

- (Short-Term) 10 Day: 3988.5 Down Trend,

- (Intermediate-Term) 20 Day: 4126.5 Down Trend,

- (Intermediate-Term) 55 Day: 4277.4 Down Trend,

- (Long-Term) 100 Day: 3733.2 Down Trend,

- (Long-Term) 200 Day: 3123.6 Up Trend.

Additional Metrics

Recent Trade Signals

- 20 Oct 2025: Long ETH 10-25 @ 4039.5 Signals.USAR.TR120

- 20 Oct 2025: Short ETH 10-25 @ 3988.5 Signals.USAR-MSFG

- 14 Oct 2025: Short ETH 10-25 @ 4026 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bullish.

Key Insights Summary

ETH CME Ether Futures is currently experiencing strong downward momentum, with large daily bars and fast-moving price action. The short-term and intermediate-term trends, as indicated by both swing pivots and moving averages, are decisively bearish, with price breaking below key support levels and all major short and intermediate-term moving averages trending down. The monthly session fib grid (MSFG) also confirms a downward bias, with price trading below the NTZ and a negative trend for October. However, the long-term outlook remains bullish, as the yearly session fib grid (YSFG) and the 200-day moving average still point upward, suggesting that the broader uptrend is intact despite the current pullback. Recent trade signals reflect this volatility, with both long and short entries triggered in quick succession, highlighting a choppy and volatile environment. The market is in a corrective phase, testing lower support levels, and may be searching for a base before any potential recovery. Volatility remains elevated, as shown by the ATR and volume metrics, indicating that traders should expect continued large price swings in the near term.

Chart Analysis ATS AI Generated: 2025-10-21 07:08 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.