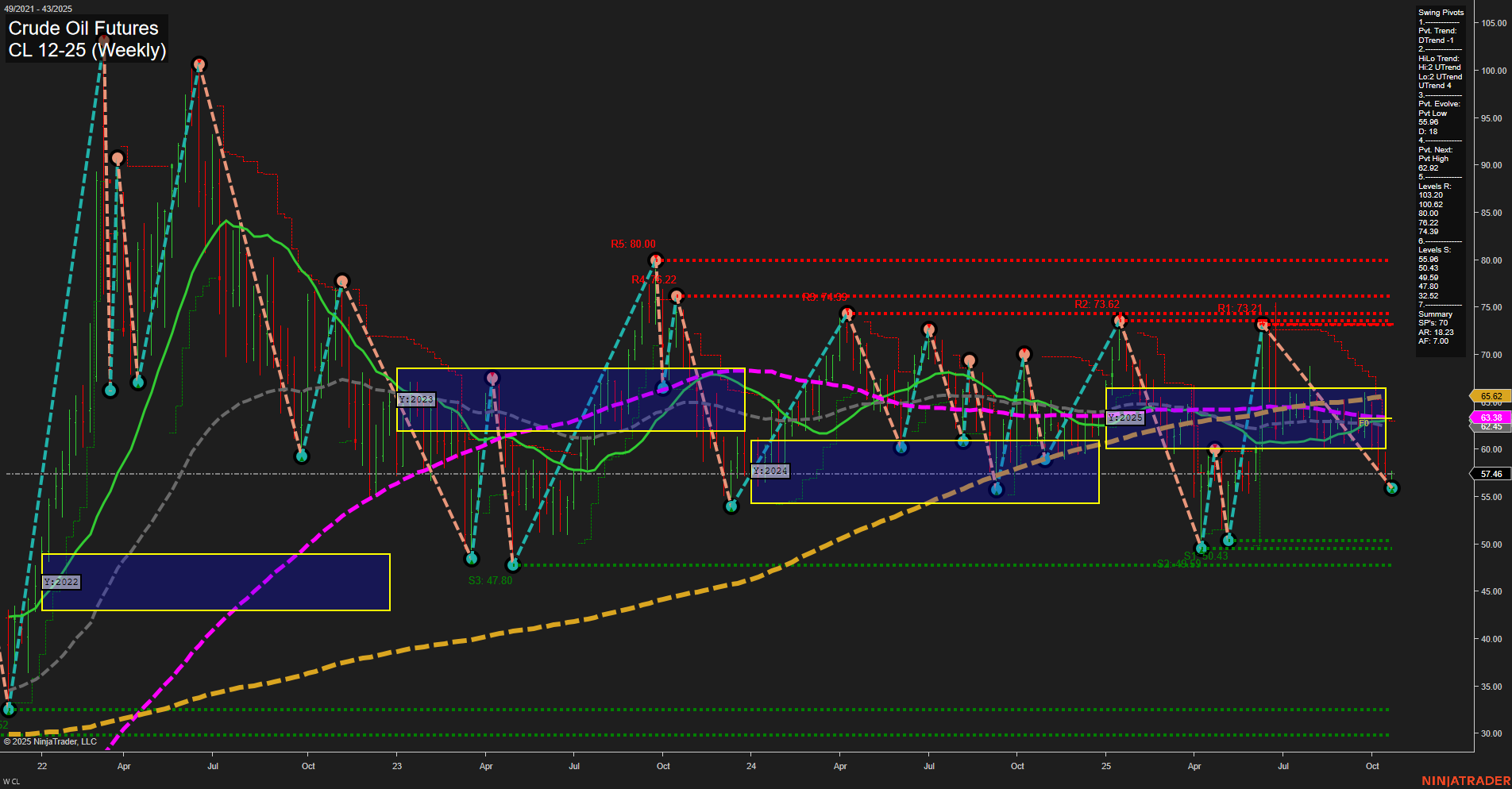

Crude oil futures are currently trading at 57.46, with medium-sized bars and slow momentum, indicating a lack of strong directional conviction. The short-term WSFG trend is up, but price has just recently moved below key intermediate and long-term Fib grid levels, suggesting a possible failed bounce or a shift in sentiment. The monthly and yearly session Fib grids both show a downtrend, with price below their respective NTZ/F0% levels, reinforcing a bearish bias for the intermediate and long-term outlooks. Swing pivot analysis shows a short-term downtrend (DTrend) with the most recent pivot low at 55.08 and the next potential resistance at 62.95. Intermediate-term HiLo trend remains up, but the overall structure is choppy, with multiple lower highs and lower lows visible. Resistance levels are stacked above, with significant barriers at 60.22 and higher, while support is clustered near recent lows. Long-term moving averages (20, 55, 100 week) are all trending down, confirming the broader bearish environment, while the 200-week MA remains in an uptrend but is well below current price, suggesting limited long-term support until much lower levels. The most recent trade signal is a short entry, aligning with the prevailing bearish technicals. Overall, the market is in a corrective or distribution phase, with failed rallies and persistent selling pressure dominating. The environment is characterized by volatility, failed recoveries, and a lack of sustained bullish momentum, with the risk of further downside if support at recent swing lows fails to hold.