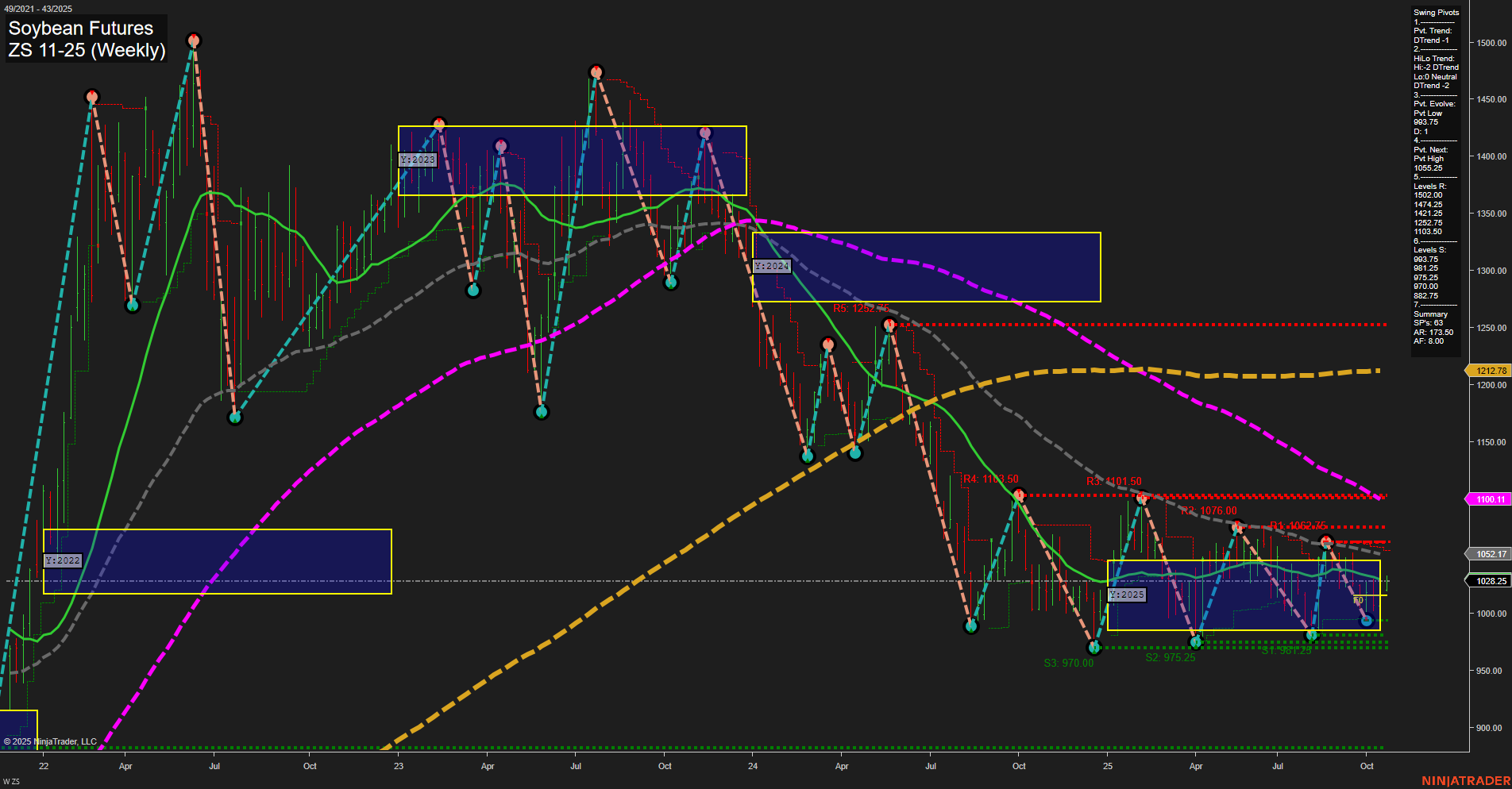

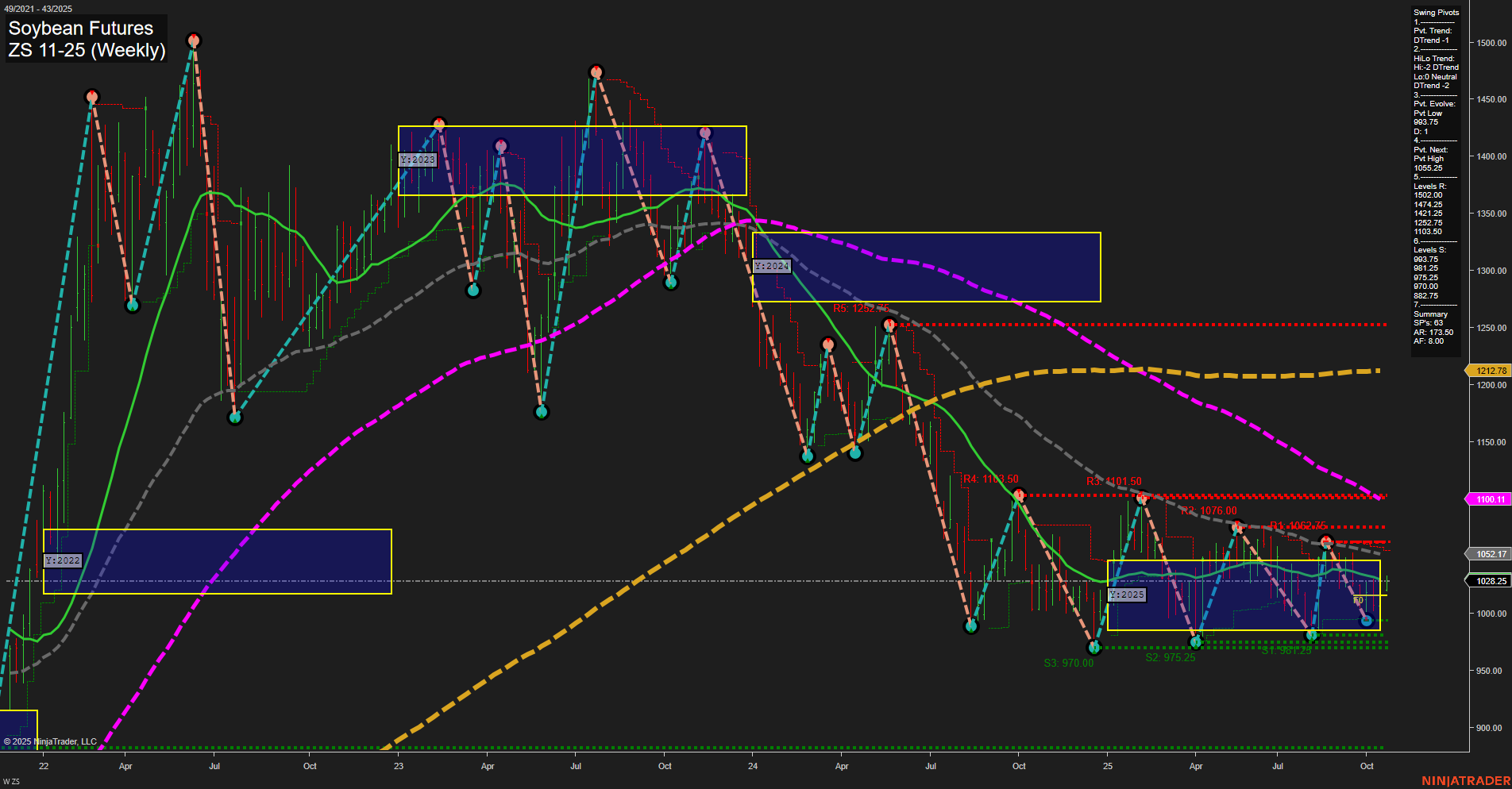

ZS Soybean Futures Weekly Chart Analysis: 2025-Oct-20 07:24 CT

Price Action

- Last: 1028.25,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: 31%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: 50%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 4%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 970.25,

- 4. Pvt. Next: Pvt high 1062.25,

- 5. Levels R: 1262.25, 1247.25, 1101.00, 1076.00, 1062.25,

- 6. Levels S: 981.25, 975.25, 970.25, 882.75.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 1052.17 Down Trend,

- (Intermediate-Term) 10 Week: 1100.11 Down Trend,

- (Long-Term) 20 Week: 1212.78 Down Trend,

- (Long-Term) 55 Week: 1100.11 Down Trend,

- (Long-Term) 100 Week: 1212.78 Down Trend,

- (Long-Term) 200 Week: 1212.78 Down Trend.

Recent Trade Signals

- 20 Oct 2025: Long ZS 11-25 @ 1023.5 Signals.USAR-WSFG

- 16 Oct 2025: Long ZS 11-25 @ 1013 Signals.USAR.TR120

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

Soybean futures are currently trading in a consolidation phase near the lower end of the yearly range, with price action showing slow momentum and medium-sized bars. Despite the recent short-term long signals, the prevailing swing pivot trends remain down for both short- and intermediate-term, and all major moving averages are trending lower, reinforcing a bearish bias for the intermediate and long-term outlooks. Price is holding above the NTZ center lines on all session fib grids, suggesting some underlying support, but repeated tests of support levels around 970–981 indicate a market struggling to gain upside traction. Resistance remains layered above at 1062, 1076, and 1101, with significant overhead supply from the 20, 55, 100, and 200 week moving averages. The market is in a choppy, range-bound environment, with no clear breakout or breakdown, and is likely to remain sensitive to seasonal factors and news flow as it approaches key support and resistance levels.

Chart Analysis ATS AI Generated: 2025-10-20 07:24 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.