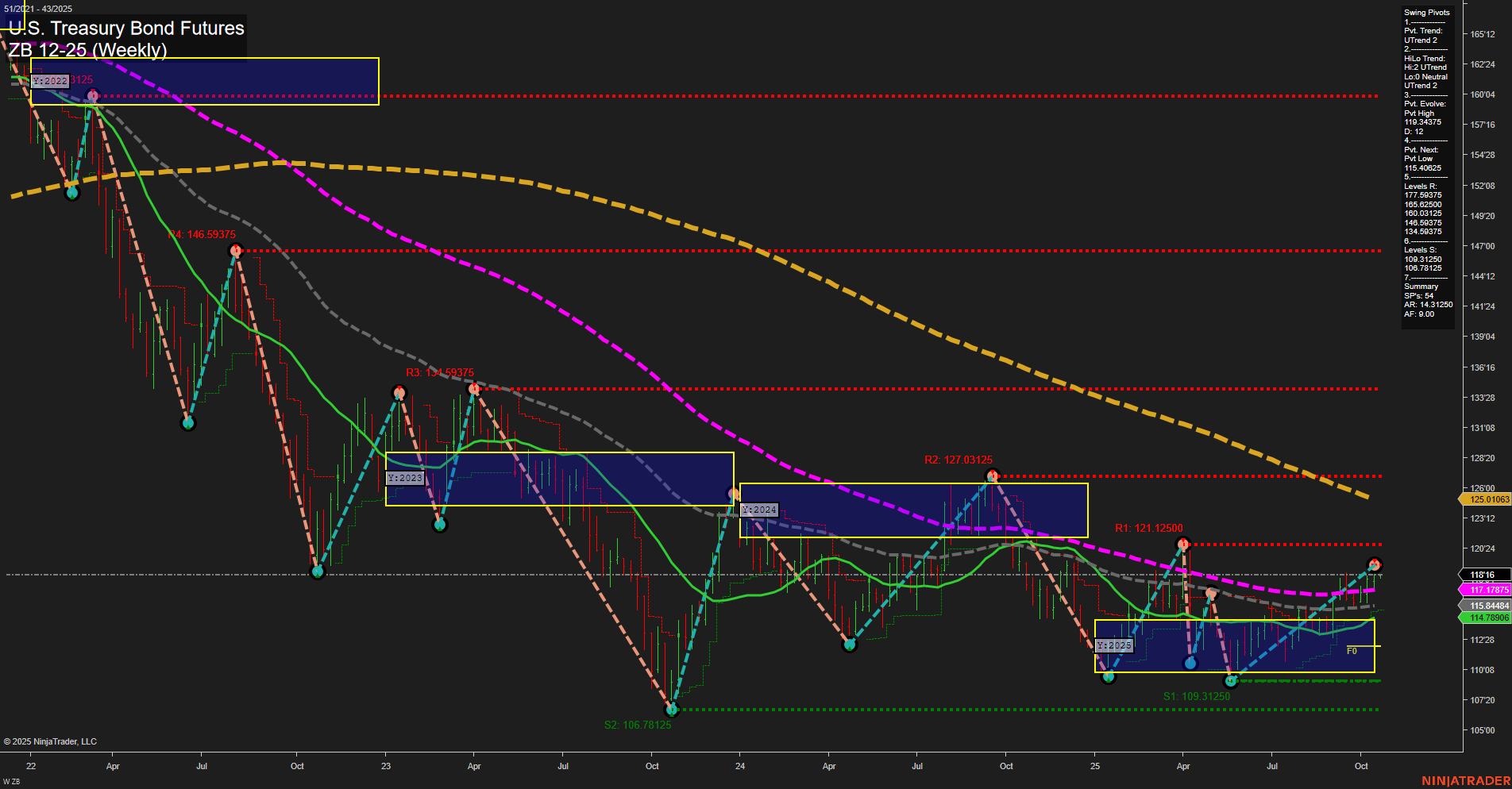

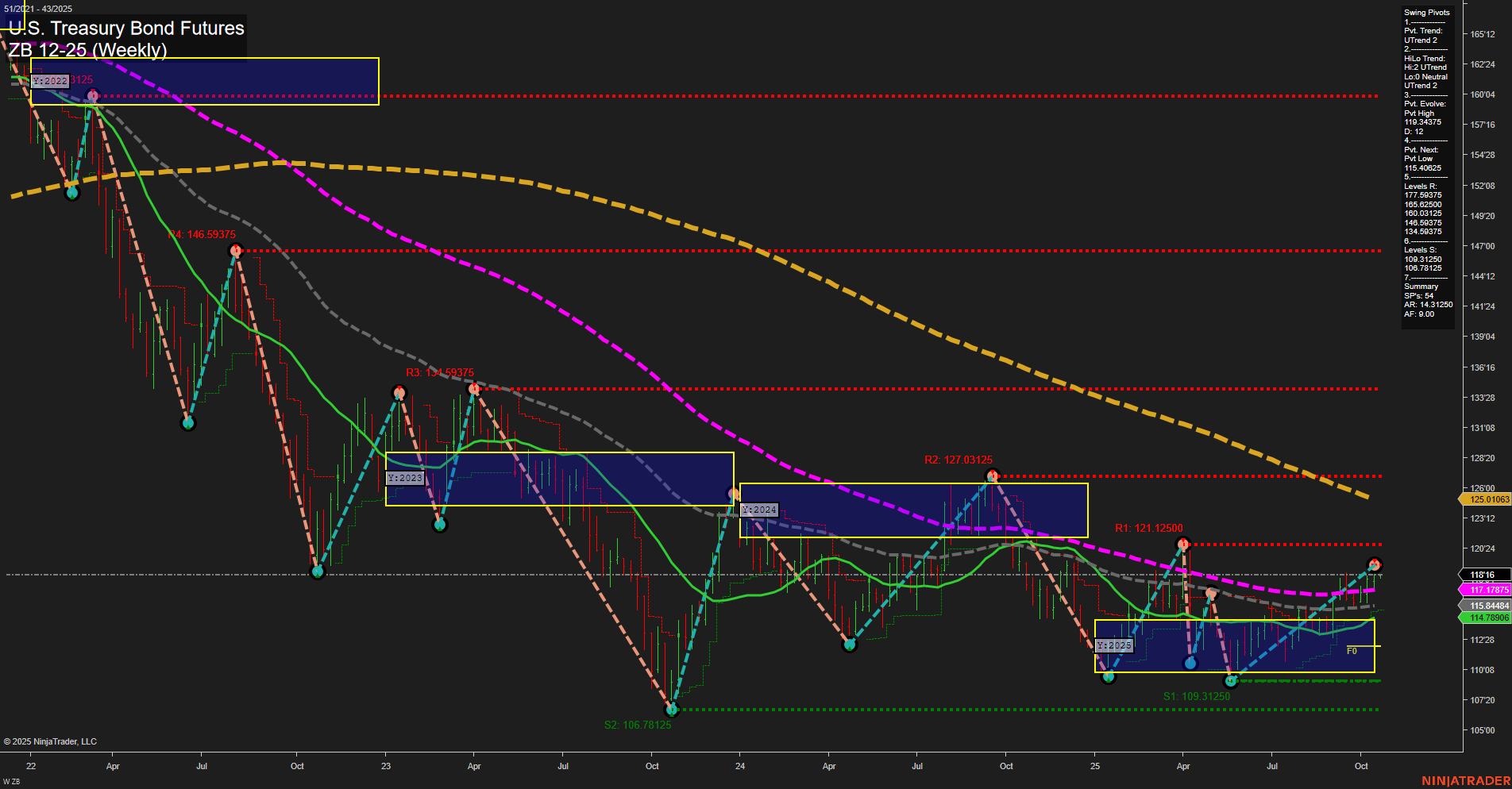

ZB U.S. Treasury Bond Futures Weekly Chart Analysis: 2025-Oct-20 07:22 CT

Price Action

- Last: 125'01.063,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt High 119.39437,

- 4. Pvt. Next: Pvt Low 115.60425,

- 5. Levels R: 146.59375, 127.03125, 121.12500, 119.39437,

- 6. Levels S: 109.31250, 106.78125, 100.78125.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 117.78775 Up Trend,

- (Intermediate-Term) 10 Week: 115.84484 Up Trend,

- (Long-Term) 20 Week: 114.78906 Up Trend,

- (Long-Term) 55 Week: 119.6116 Down Trend,

- (Long-Term) 100 Week: 125.01603 Down Trend,

- (Long-Term) 200 Week: 143.1250 Down Trend.

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bullish,

- Long-Term: Bearish.

Key Insights Summary

The ZB U.S. Treasury Bond Futures weekly chart shows a market in transition. Price action has stabilized with medium-sized bars and average momentum, reflecting a pause after previous volatility. The short-term trend is neutral, as indicated by the WSFG and the current price position within the NTZ zone, suggesting indecision and consolidation. Intermediate-term signals are more constructive, with both the 5- and 10-week moving averages trending up and the HiLo swing pivot trend showing an upward bias, hinting at a potential recovery or bounce from recent lows. However, the long-term outlook remains bearish, with the 55-, 100-, and 200-week moving averages all in downtrends and price still well below these key resistance levels. Major resistance is clustered above at 119.39, 121.12, 127.03, and 146.59, while support is found at 115.60, 109.31, and 106.78. The chart structure suggests the market is in a corrective phase within a broader downtrend, with the potential for further consolidation or a test of support before any sustained move higher. The overall environment is one of transition, with short-term neutrality, intermediate-term recovery potential, and long-term bearishness dominating the technical landscape.

Chart Analysis ATS AI Generated: 2025-10-20 07:23 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.