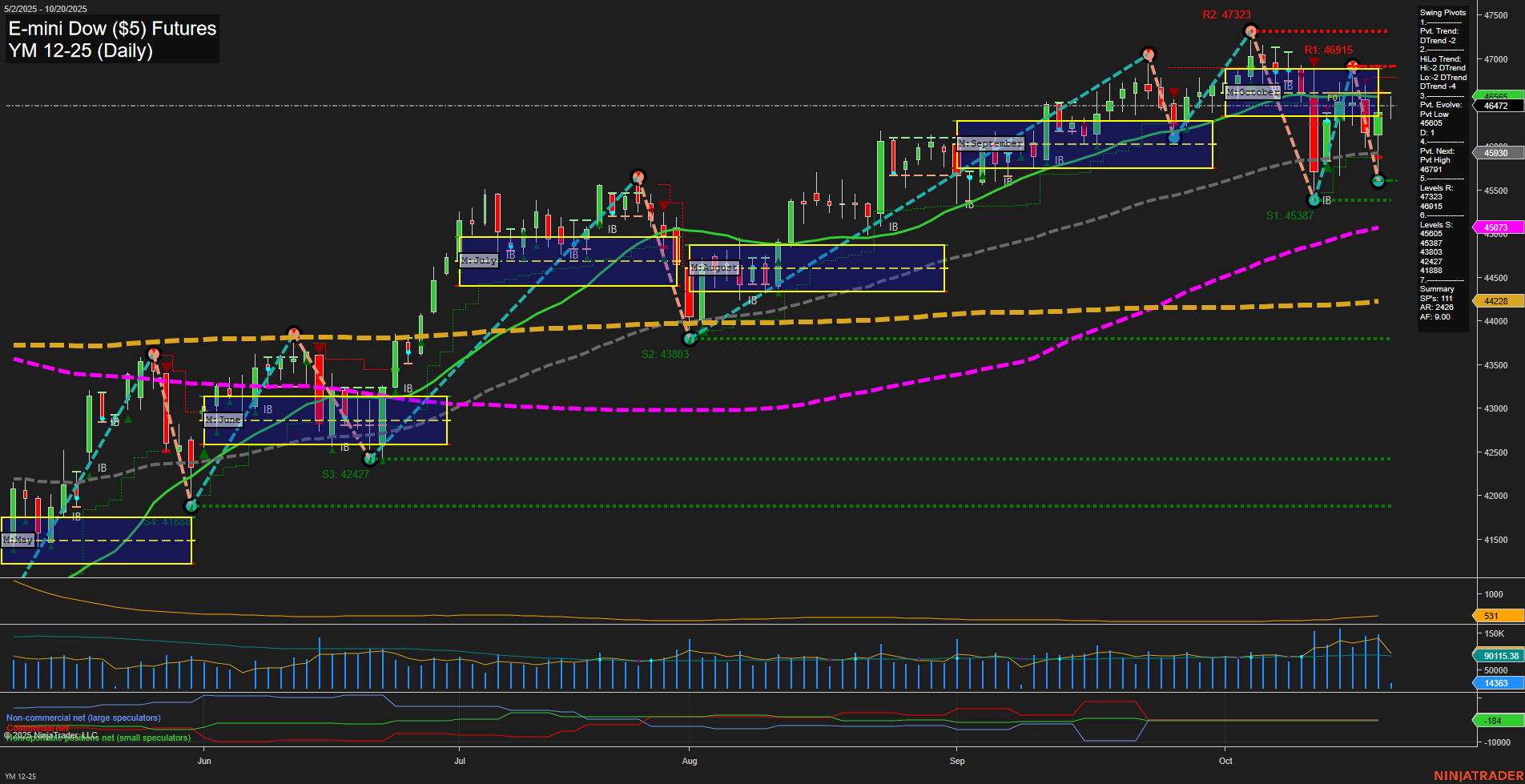

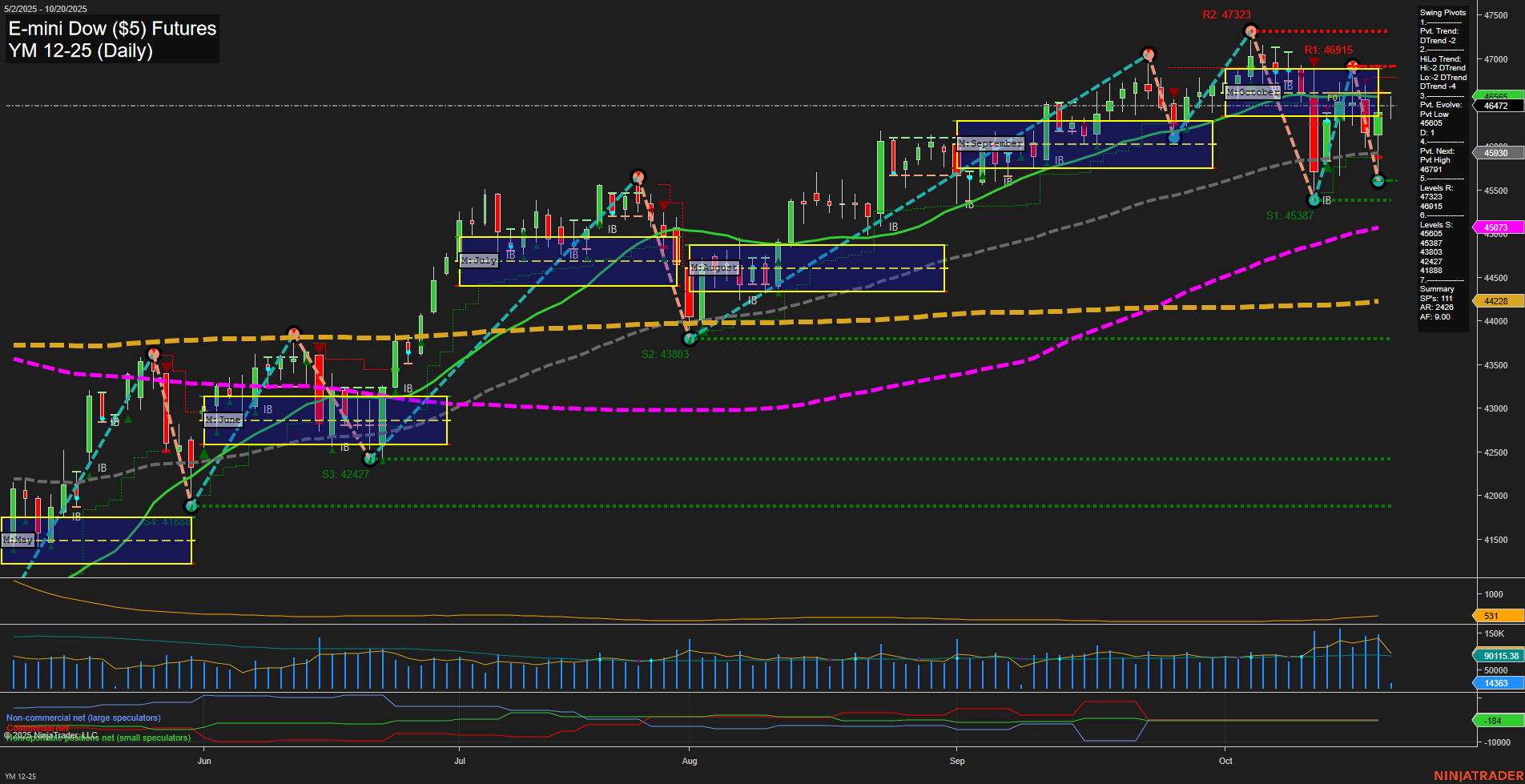

YM E-mini Dow ($5) Futures Daily Chart Analysis: 2025-Oct-20 07:21 CT

Price Action

- Last: 46472,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 0%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: -1%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 35%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt Low 45387,

- 4. Pvt. Next: Pvt High 46915,

- 5. Levels R: 47323, 46915,

- 6. Levels S: 45387, 43803, 42427.

Daily Benchmarks

- (Short-Term) 5 Day: 45930 Down Trend,

- (Short-Term) 10 Day: 46171 Down Trend,

- (Intermediate-Term) 20 Day: 46465 Down Trend,

- (Intermediate-Term) 55 Day: 45913 Up Trend,

- (Long-Term) 100 Day: 45073 Up Trend,

- (Long-Term) 200 Day: 44226 Up Trend.

Additional Metrics

Recent Trade Signals

- 20 Oct 2025: Long YM 12-25 @ 46543 Signals.USAR-WSFG

- 17 Oct 2025: Long YM 12-25 @ 46384 Signals.USAR.TR120

- 16 Oct 2025: Short YM 12-25 @ 46165 Signals.USAR-MSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bullish.

Key Insights Summary

The YM E-mini Dow is currently experiencing a short- and intermediate-term downtrend, as indicated by both the swing pivot trends and the direction of the 5, 10, and 20-day moving averages. Price action is consolidating near the lower end of the October MSFG, with momentum at an average pace and recent bars showing medium size, suggesting a period of digestion after recent volatility. The most recent swing pivot is a low at 45387, with resistance levels at 46915 and 47323, and support at 45387, 43803, and 42427. Despite the short-term bearishness, the long-term trend remains bullish, supported by the 100- and 200-day moving averages trending higher and the YSFG showing price above its yearly F0%. Recent trade signals show a mix of long and short entries, reflecting the choppy and reactive nature of the current market environment. Volatility remains elevated (ATR 531), and volume is robust, indicating active participation. The market is in a corrective phase within a broader uptrend, with potential for further downside tests before any sustained recovery.

Chart Analysis ATS AI Generated: 2025-10-20 07:22 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.