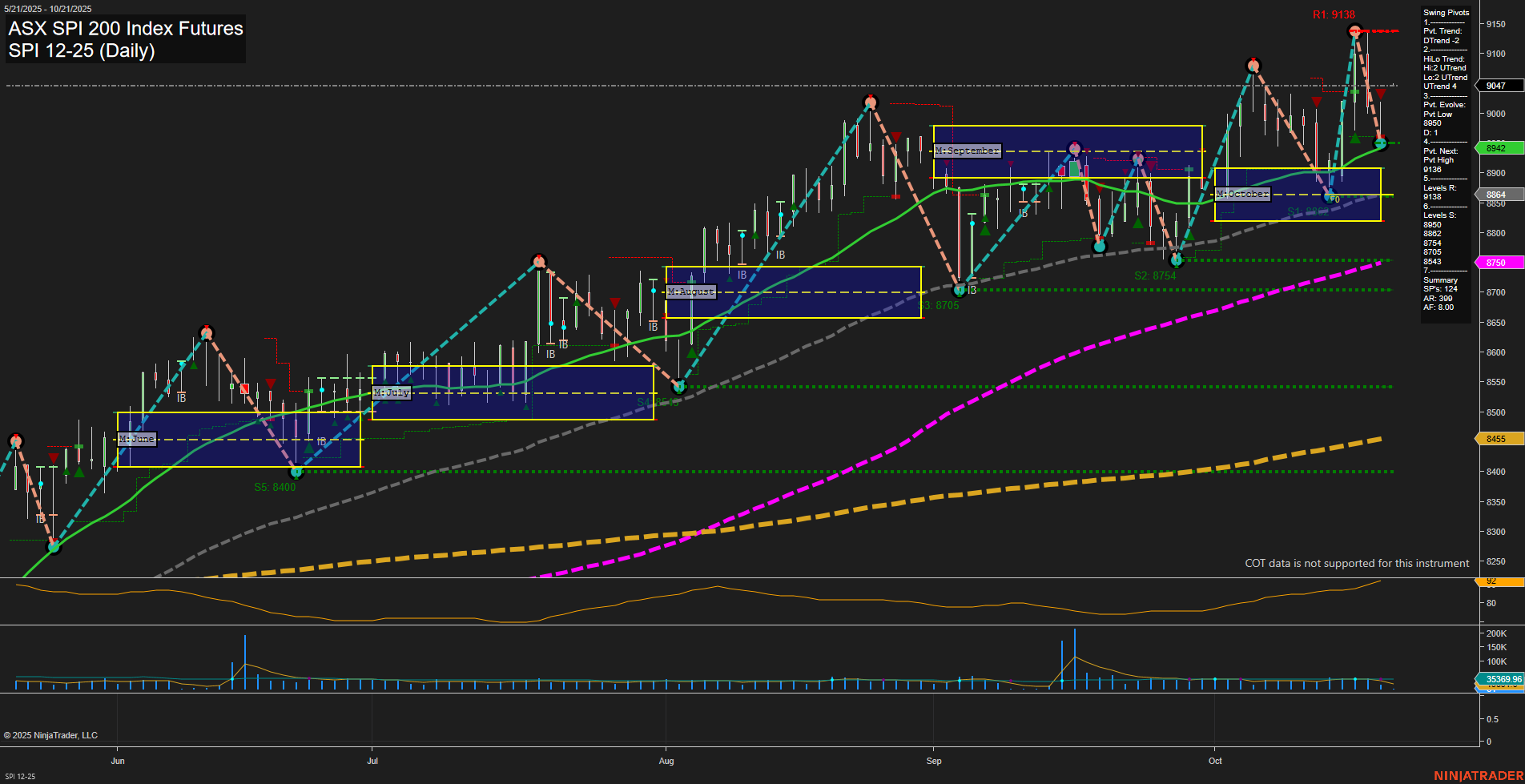

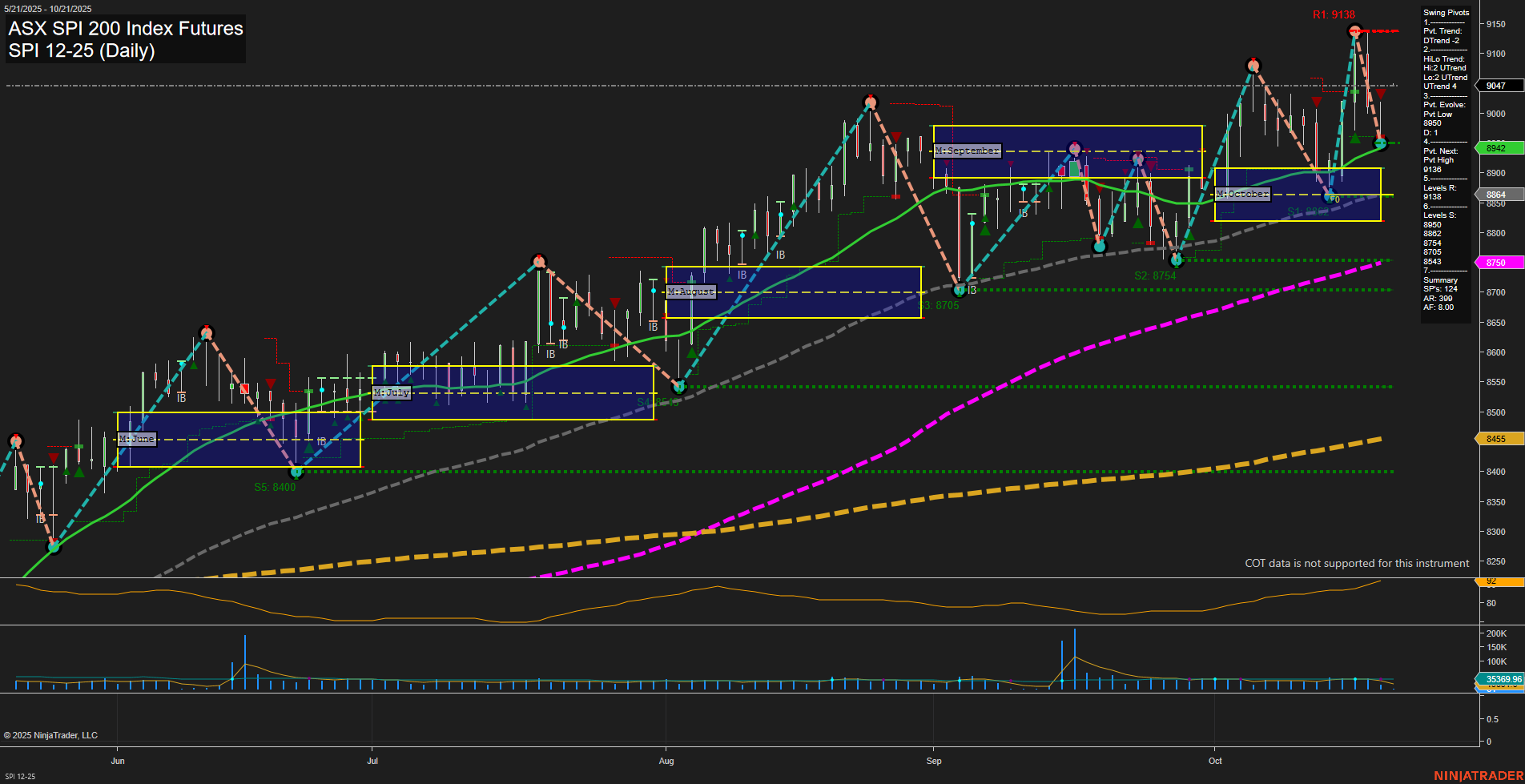

SPI ASX SPI 200 Index Futures Daily Chart Analysis: 2025-Oct-20 07:18 CT

Price Action

- Last: 9047,

- Bars: Medium,

- Mom: Average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt Low 8942,

- 4. Pvt. Next: Pvt High 9138,

- 5. Levels R: 9138, 9100, 9056, 9022,

- 6. Levels S: 8942, 8875, 8754, 8705, 8400.

Daily Benchmarks

- (Short-Term) 5 Day: 9049 Down Trend,

- (Short-Term) 10 Day: 9056 Down Trend,

- (Intermediate-Term) 20 Day: 8942 Up Trend,

- (Intermediate-Term) 55 Day: 8750 Up Trend,

- (Long-Term) 100 Day: 8759 Up Trend,

- (Long-Term) 200 Day: 8455 Up Trend.

Additional Metrics

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The SPI 200 Index Futures daily chart shows a recent pullback from the swing high at 9138, with the current price at 9047. Short-term momentum is average, and the bars are medium-sized, indicating a pause after a strong rally. The short-term swing pivot trend has shifted to a downtrend, but the intermediate-term HiLo trend remains up, supported by higher lows and a series of upward pivots since June. The 5-day and 10-day moving averages have turned down, reflecting the short-term pullback, while the 20-day, 55-day, 100-day, and 200-day moving averages all remain in uptrends, confirming the underlying bullish structure. Key resistance is clustered near recent highs (9138, 9100), while support is layered below at 8942 and 8875. Volatility (ATR) is moderate, and volume remains steady. The overall structure suggests a consolidation or corrective phase within a broader uptrend, with the market digesting gains after a multi-month rally. The technical backdrop remains constructive for the intermediate and long term, with the current pullback potentially setting up for a continuation move if support holds and momentum returns.

Chart Analysis ATS AI Generated: 2025-10-20 07:19 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.