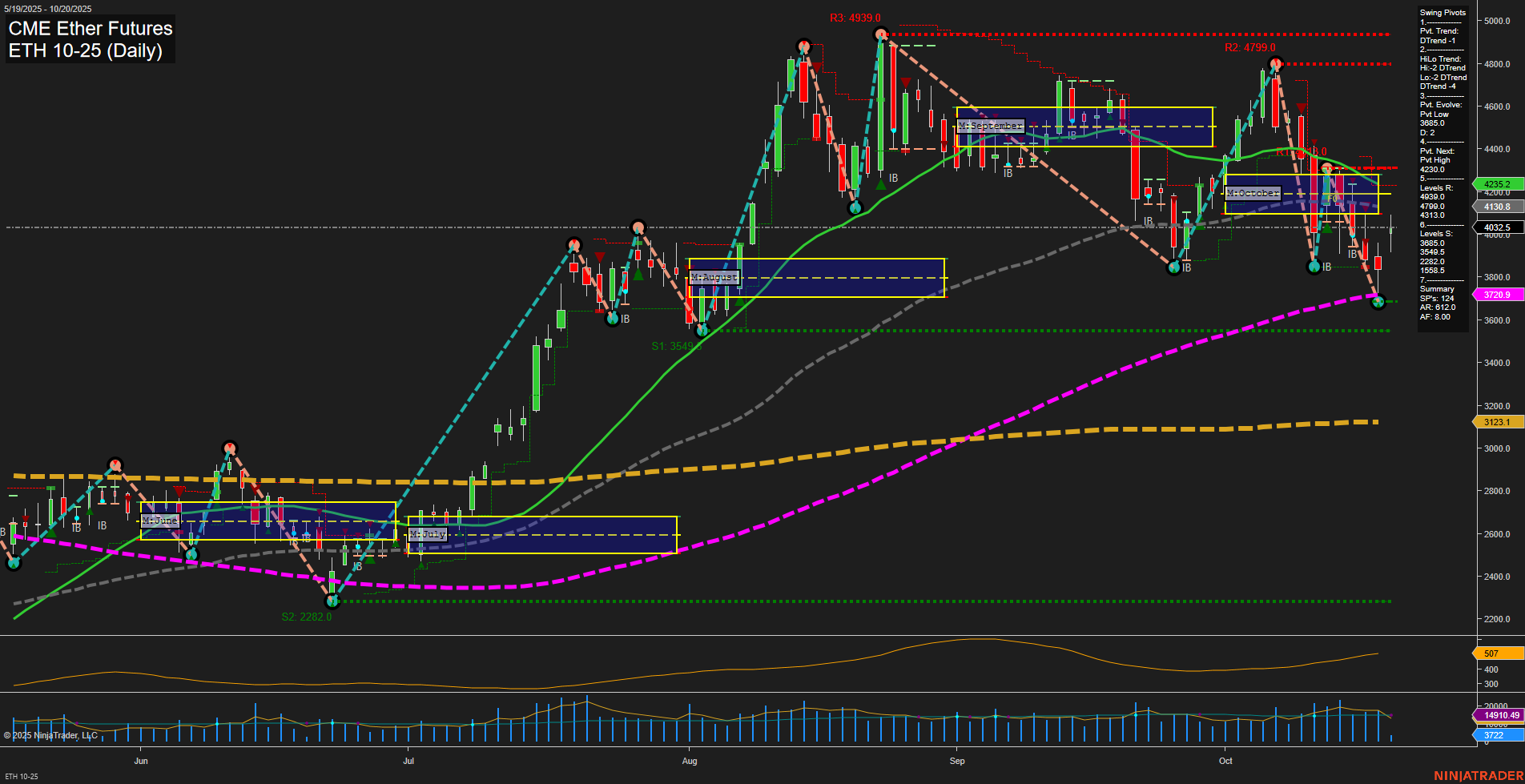

The ETH CME Ether Futures daily chart shows a market in transition. Short-term and intermediate-term trends are both bearish, as indicated by the downward direction of the 5, 10, 20, and 55-day moving averages, as well as the current swing pivot structure (DTrend) and price trading below the monthly session fib grid (MSFG). The most recent swing pivot is a low at 3722, with the next potential reversal at a swing high of 4230, suggesting the market is currently in a corrective or pullback phase within a broader uptrend. Despite the short-term weakness, the long-term outlook remains bullish, supported by the 100 and 200-day moving averages trending higher and price still above the yearly session fib grid (YSFG). Volatility is moderate (ATR 431), and volume remains healthy (VOLMA 8731), indicating active participation but not extreme conditions. Recent trade signals reflect this mixed environment, with both long and short entries triggered in close succession, highlighting the choppy and potentially range-bound nature of the current market. Key resistance levels are clustered between 4131 and 4799, while support is found at 3722 and below. The market appears to be testing support after a significant retracement, with the potential for either a further breakdown or a reversal if buyers step in at these levels. Overall, the chart suggests a cautious approach, with a focus on monitoring for signs of trend continuation or reversal as the market digests recent volatility.