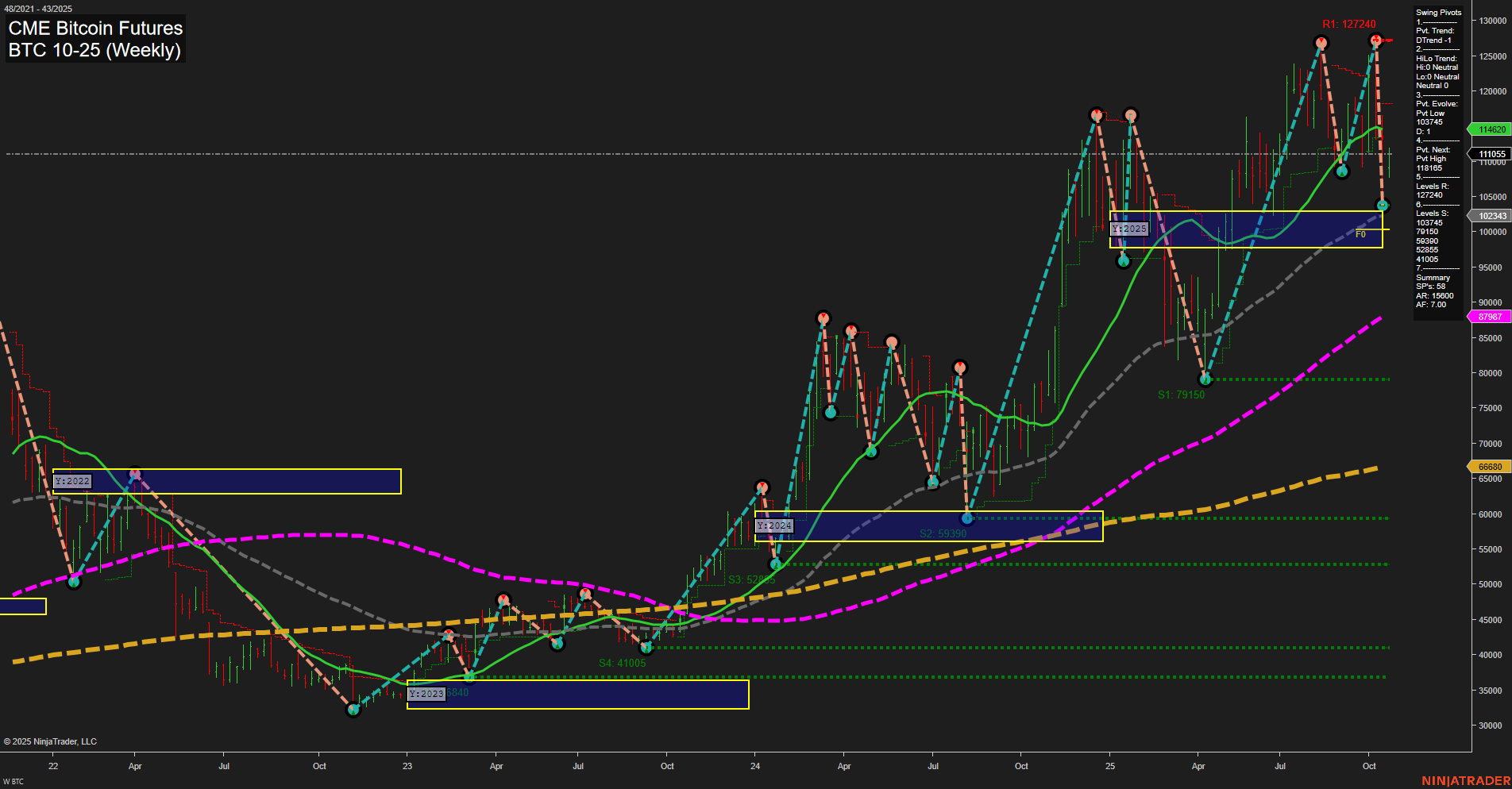

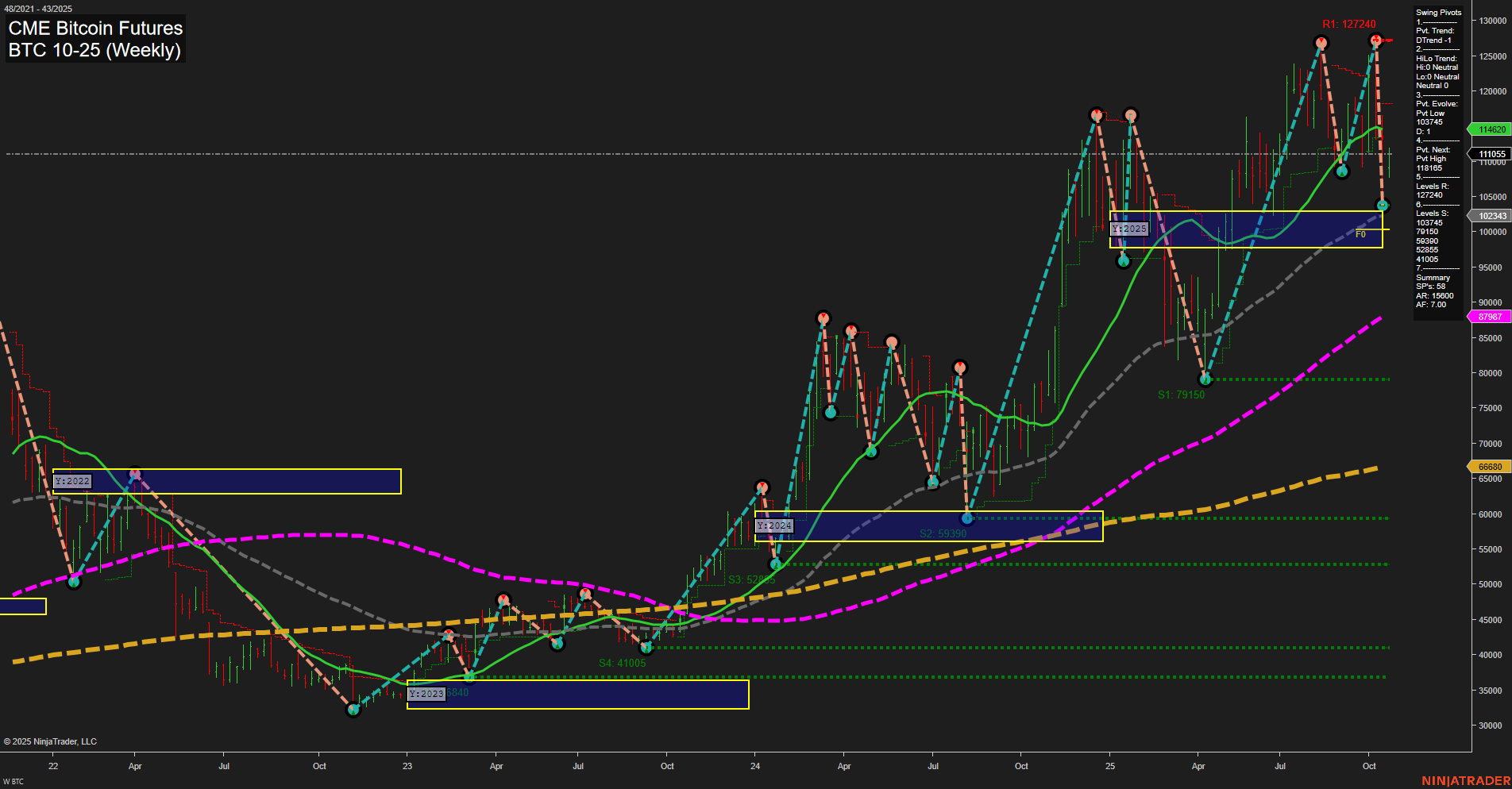

BTC CME Bitcoin Futures Weekly Chart Analysis: 2025-Oct-20 07:04 CT

Price Action

- Last: 111055,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: 18%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: -27%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 41%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: HiLo Neutral,

- 3. Pvt. Evolve: Pvt Low 103745,

- 4. Pvt. Next: Pvt High 118145,

- 5. Levels R: 127240, 118145,

- 6. Levels S: 103745, 79150, 59390, 52930, 41005.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 114620 Up Trend,

- (Intermediate-Term) 10 Week: 111055 Up Trend,

- (Long-Term) 20 Week: 102343 Up Trend,

- (Long-Term) 55 Week: 87967 Up Trend,

- (Long-Term) 100 Week: 66880 Up Trend,

- (Long-Term) 200 Week: 57967 Up Trend.

Recent Trade Signals

- 20 Oct 2025: Long BTC 10-25 @ 111145 Signals.USAR.TR120

- 19 Oct 2025: Long BTC 10-25 @ 109330 Signals.USAR-WSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Neutral,

- Long-Term: Bullish.

Key Insights Summary

The BTC CME Bitcoin Futures weekly chart shows a market in a strong long-term uptrend, with all major moving averages trending higher and price well above the yearly and 20/55/100/200 week benchmarks. Short-term price action has been volatile, with large bars and fast momentum, but the most recent swing pivot trend has shifted to a short-term downtrend (DTrend), indicating a pullback or correction phase within the broader uptrend. The intermediate-term trend is neutral, with the monthly session fib grid (MSFG) showing a downward bias and price below the monthly NTZ, suggesting some consolidation or digestion of recent gains. Key resistance levels are at 118145 and 127240, while support is found at 103745 and further below at 79150 and 59390. Recent trade signals have triggered new long entries, reflecting the underlying bullish structure, but the market is currently navigating a short-term retracement. Overall, the chart reflects a classic swing environment: a strong primary uptrend with active short-term corrections, offering both trend continuation and mean reversion opportunities for swing traders.

Chart Analysis ATS AI Generated: 2025-10-20 07:04 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.