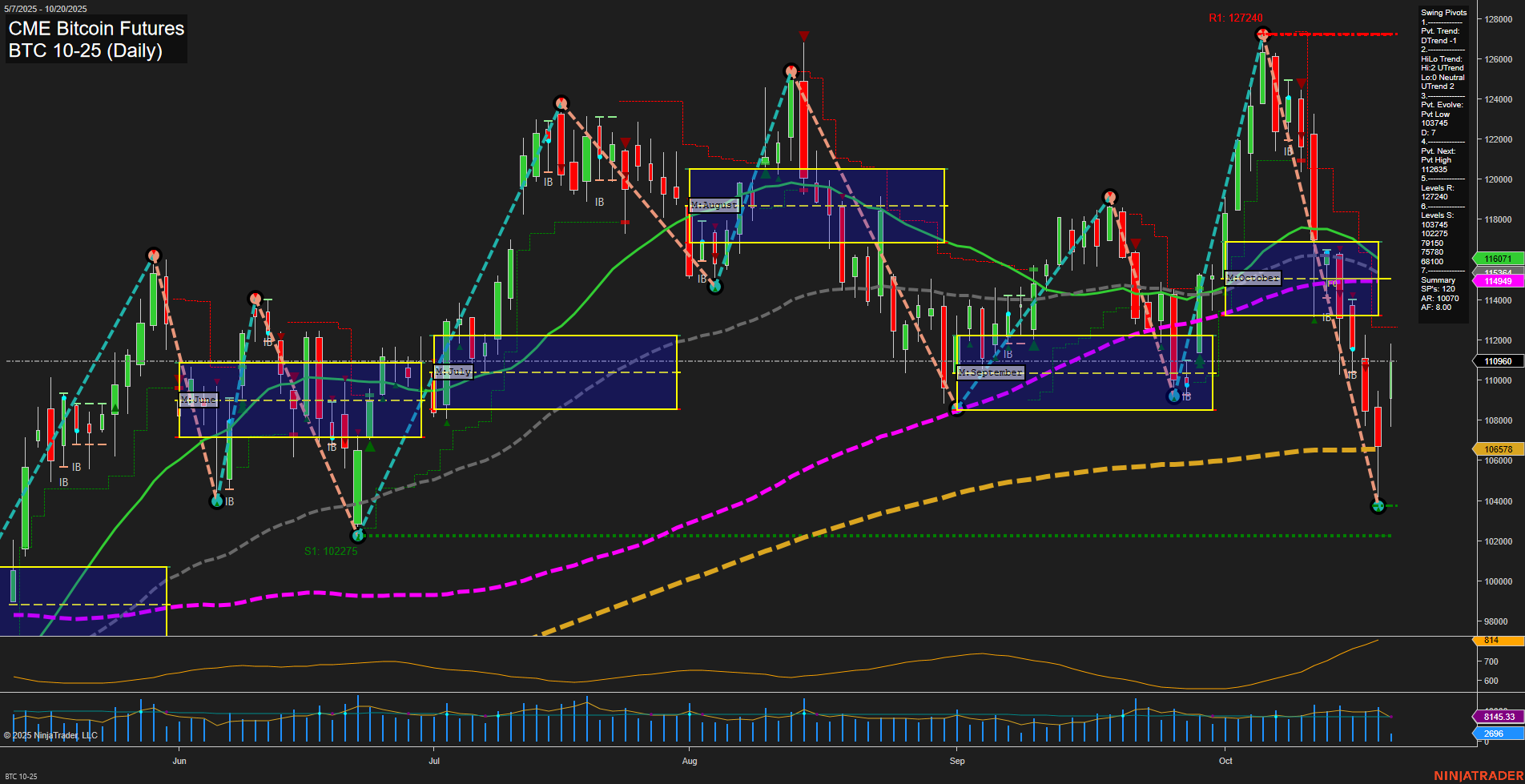

BTC CME futures have experienced a sharp and volatile move, with large bars and fast momentum indicating heightened activity and a potential inflection point. The short-term WSFG trend remains up, but the price is currently below the monthly MSFG NTZ, reflecting intermediate-term weakness and a downtrend bias for October. Both short-term and intermediate-term swing pivots are in a downtrend, with the most recent pivot low at 104745 and resistance levels stacked above, suggesting the market is in a corrective phase after a significant sell-off. Daily benchmarks across short and intermediate timeframes are trending down, reinforcing the current bearish pressure, while the 200-day moving average remains upward, supporting a longer-term bullish structure. Recent trade signals have triggered long entries, hinting at a possible attempt to establish a bottom or initiate a bounce. Volatility is elevated (ATR 1025), and volume remains robust, which could support further price swings. Overall, the market is in a transitional state: short-term is neutral as it seeks direction, intermediate-term is bearish due to prevailing downtrends, but the long-term outlook remains bullish as the broader uptrend is intact. The current environment is characterized by high volatility, potential for sharp retracements, and a watchful eye on whether the recent lows will hold or if a deeper correction unfolds.